This article was paid for by a contributing third party.More Information.

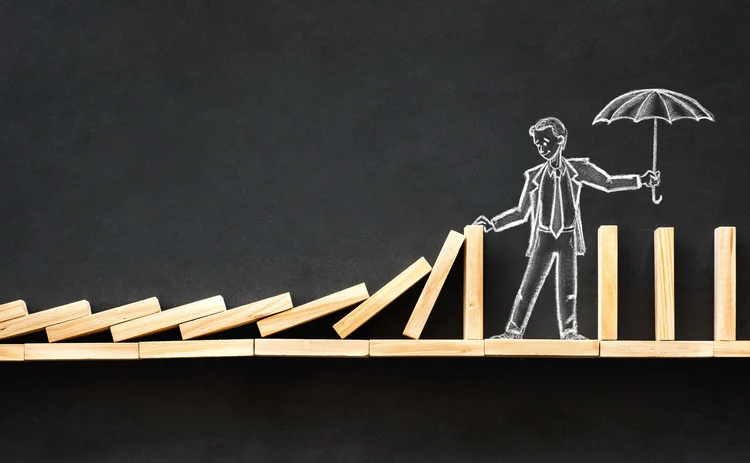

Solving the domino effect of delayed trade allocations

One year on from the pandemic-driven volatility of March 2020, Joanna Davies of Traiana looks at how buy-side firms can gain greater visibility and efficiency in exchange-traded derivatives (ETD) markets

Imagine this, the head of equity futures for one of the world’s largest asset managers is trying to navigate clients through the worst trading day since the global financial crisis of 2007–08. Dow Jones futures tumble more than 1,300 points and executing brokers are subsequently scrambling around trying to work out how to fairly allocate an order for over 1,000 Dow futures across multiple funds. Sound familiar?

It is hard to believe, but it is a year on from the Covid-19-induced global volatility that reinforced just how painful the give-up process is, and how great the impact on operational resources when things go wrong. This isn’t a new problem either – give-ups have been a thorn in the side of market participants for decades.

Buy-side allocation challenges

Typically, asset managers placing and managing large orders across multiple funds can only allocate across these funds once they know the final quantity and average price of the entire order. Sometimes it is the choice of the asset manager in terms of how long it takes to complete an order. This can be achieved through using algos, good ‘til cancelled orders or limit orders that sit at the edge of trading ranges – which can create a huge backlog of unallocated fills.

In addition, while an asset manager may be highly efficient in the allocation process during times of peak volatility, there could still be multiple allocations being communicated within minutes of the market closing. This creates an entire myriad of problems, which the industry continues to wrestle with.

Even if the asset manager allocates early in the day, the challenge for executing brokers is to identify the exchange fills (executions) associated with a single order. These executions at different price levels must be average priced before they are given up. To compound the challenge, in keeping with their mandates, asset managers are executing multiple orders during volatile periods to manage the risk within their portfolios.

The knock-on-effect on other market participants

Executing brokers play an important role by providing buy-side clients superior execution quality through strategies that reduce the market impact of buy-side activity, but often get hit with a hefty capital charge when the allocation of give-ups is not successful. They must clear these overnight and absorb the cost with no recourse to pass on the charge. This poses a risk to smaller executing brokers, in particular. In addition to average-pricing complexities, inconsistent data models and the lack of common symbology all contribute to complicating the allocation and matching process for all market participants.

Clearing brokers also are on the hook for clearing trades that are covered by a give-up agreement, but have limited visibility or control of the upstream process. The industry challenge is more than just inefficiency in the give-up workflow. Checking give-up agreements and commissions are dealt with at the clearing member’s end of the workflow, where timing and lack of quality data conspire to make trade acceptance hazardous and resource-hungry.

Moreover, issues can occur due to the sequential nature of the give-up workflow, where trades are still sitting with the executing broker before the clearing broker accepts them. Fills accumulate on the executing broker’s account at the clearing house until allocated. Once a client disseminates its allocation, the client remains in the dark until the clearing broker confirms the trade back to them. One hiccup in this workflow will delay or prevent the give-up from completing. During this process, the trade is cleared in the eyes of the clearing house but is not cleared from the perspective of the executing broker or asset manager – which leaves unallocated exposure. All the while, the client is oblivious to any issues.

Why the industry needs to work together

The goal of any process improvement should be to reduce the operational, financial and capital cost for executing brokers, and must give the buy-side client real-time transparency into the status of the executions and control over the allocation of the risk to the correct accounts at the clearing brokers.

For the clearing broker, the process must provide real-time visibility into give-ins so the members can assess the risk of the positions in a timely manner. Improved transparency and greater control of risk will ensure timely processing of give-ins. Several clearing counterparties provide standardised and real-time workflows for average pricing, give-ups and give-ins that serve as a good foundation to meet the goals of the buy side, executing broker and clearing broker. Each participant has a crucial role to play, and it may simply be a case of reassigning responsibilities to the corresponding change in the workflow.

The exchange view of the trade should remain the immutable record, but the buy side clearly groups and references it from a very different perspective. Relatable data points, such as common order IDs, from all sides, would allow the two perspectives of immutable record versus a client copy of the allocation to be matched.

The role of the vendor

Traiana has an extensive network of executing and clearing brokers that services over 100 buy-side clients. Our established ETD ClientLink service not only normalises client allocation messaging, but enriches it with fills from the executing broker. The service also manages the nuances between different broker requirements, helping to negate complexities that arise when dealing with multiple executing and clearing brokers.

Traiana has applied in-depth industry knowledge to encourage change from buy-side partners to help allocation processing. A key part of this is the work we are already doing to capture relatable data from all sides in order to unlock efficiencies. Traiana is extending existing ETD ClientLink functionality to meet many of the challenges under industry discussion, with a view to utilising new technology and services as they become proven. As illustrated above, buy-side clients need flexibility, and it is impractical to constrain their needs to achieve the operational efficiency of timely allocations and give-up processing. We at Traiana believe we can bring operational efficiency, transparency and timely processing while giving buy-side firms the necessary flexibility to meet their mandates.

Conversations with multiple industry participants indicate this approach as the most pragmatic and expedient way to solve the functional issues. Traiana’s experience in the reform of over-the-counter clearing workflows only adds to the support of our participation in this complex debate. Success in achieving these goals requires us to collaborate on designing the workflows with buy-side clients, executing brokers and clearing brokers, and leaves the door open for other service providers to join forces to solve. What is becoming increasingly clear, however, is that the transformation of the workflow should be the main goal for all parties. As an industry, we need to ensure that we let the workflow determine the technology, not the other way around.

Joanna Davies, global head Traiana, part of CME Group

Joanna Davies has served as global head of Traiana since June 2019. She is responsible for the strategic direction and the day-to-day management of Traiana’s global fintech portfolio, including trade processing, credit services and trade lifecycle. Prior to this, Joanna served as head of product for NEX Optimisation, where she focused on optimising revenue and maximising technology innovation for NEX Group’s six pre- and post-trade businesses. Before this, she was managing director and head of product for Traiana.

Joanna is an active member of the CME Group Optimization Services Executive Team. She has 30 years’ experience in investment banking, working predominantly in the ETD space, with prior roles including global head of client relationship management, head of operations and voice broker.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net