Energy trading

Hedging on the fly

Natural gas

Northwest in excess

Natural Gas

The cost of optimism

Petroleum engineers and financial regulators have never spoken the same language,as the recent Royal Dutch/Shell debacle has shown. And this has led to confusionover state oil reserves. By Maria Kielmas

Unlimited liability

Potential liabilities for European nuclear operators are set to rise sharply.Financial guarantees for nuclear operators will have to be restructured. Aregovernments and the insurance industry up to the task? MariaKielmas reports

Rethinking regulation

Market manipulation and inaccurate pricing led to the reregulation of Ontario’s electricity market. But at the right price, the Canadian province may see a revival of competition, reports CatherineLacoursière

Ex-Merrill Lynch energy trader pleads guilty to fraud

At 24, Daniel Gordon headed Merrill Lynch's energy trading business. He has now pleaded guilty to a $43 million fraud.

Storage strategies

Rankings 2004

Flying high

Rankings 2004

LNG drive gears up

Rankings 2004

The future of freight

The Baltic Exchange has recently shelved plans to offer freight derivatives,yet rising freight rates should aid the development of the embryonic forwardfreight agreement market. By Paul Lyon

Protection treaty

Matthew Saunders , of law firm DLA, introduces the bilateral investment treaty which, though often overlooked, can be an effective method of affording legal protection for energy investments and minimising energy project risk

In pursuit of the eurobarrel

The markets say they do not want oil prices in euros. But denominating internationalcrude prices in euros is a political ambition the European Union seems determinedto pursue – starting with Russia. MariaKielmas reports

Capital calculations

The latest Committee of Chief Risk Officers white paper offers capital adequacy guidelines for energy merchants. But why should energy firms perform these calculations? Glyn Holton asks whether the CCRO has missed the point

Contract killing

New frontiers

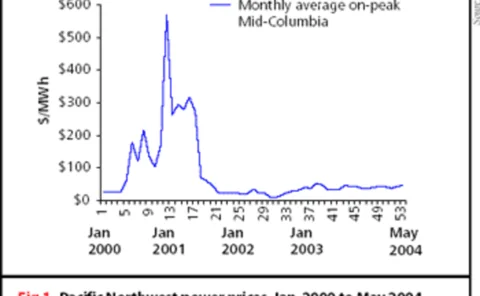

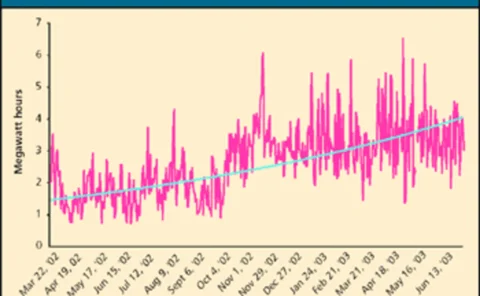

Operational and market risks of a regulated power utility

Victor Dvortsov and Ken Dragoon present an analytical method for including market and operational risks when estimating utility portfolio value-at-risk.

Breaking down the model

Brett Humphreys and Andy Dunn outline a method to help energy companies minimise potential model risk and thereby avoid costly errors in valuing deals.

Gas supply problems persist

Natural Gas

All talk, no action

Cancelled power plant auctions and the complexities of asset debt structures are bad news for the boutiques set up to acquire power assets. The boutiques talk a good business plan – but execution may prove troublesome, as Paul Lyon discovers

A capital adequacy primer

A summary of the Committee of Chief Risk Officers' (CCRO) emerging guidelines on capital adequacy, by Cinergy's Antonio Ligeralde, Kenneth Robinson of El Paso Merchant Energy and CCRO head Michael Smith.

Austrian rail firm on the risk management fast track

Austria’s largest electricity consumer, rail firm Österreichische Bundesbahnen, talks to EPRM about its energy risk management strategy. And, as Paul Lyon discovers, other end-users could learn from the innovative company

The search for spot

Strong demand for US liquefied natural gas is accelerating the development of an active global spot market and pricing benchmarks, as Catherine Lacoursière discovers

US coal trading picks up steam

While the coal market awaits pricing indexes to reinvigorate trading, emissions trading is getting a boost from increased coal burning. Catherine Lacoursière reports

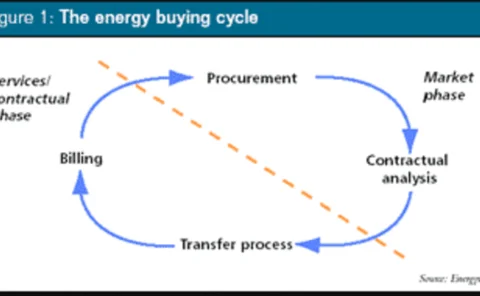

Buying your way out of trouble

UK high-street retailer Littlewoods has saved £1.5 million through an energy risk management and procurement programme. Utilyx’s Nigel Cornwall looks at how other companies can reduce energy costs through purchase programmes