Credit default swaps

DC to consider second request to trigger Credit Suisse CDS

Last-ditch effort hinges on whether the bank was, or said it was, unable to pay its debts

DC rejects attempt to trigger Credit Suisse CDSs

Committee dismisses claims Swiss bank’s AT1s were not subordinated to the CDS reference entity

Eurex clearing chief calls for active account carve-outs

Isda AGM: Müller says EU clearing thresholds should exempt market-making and US client trades

Citi becomes top single-name CDS dealer for US life insurers

Counterparty Radar: New York bank bests Barclays as sector contracts by $340 million at the end of 2022

Challenged single-name CDS market takes optimistic turn

Trading has boomed despite recent criticism, but can the market regain its former strength?

Ice and LCH declare victory as CDS migration nears end

Ice retains lion’s share of positions at shuttered European CDS service, but LCH gets more clients

BMR grows bought single-name CDS book as market slumps

Counterparty Radar: US retail funds cut $1.5 billion in sold swap positions in Q4

Capital Group, BMR double down on bought index CDSs

Counterparty Radar: Market for US mutual funds contracts in Q4 for the first time in eight quarters

CVA desks avoided re-hedging as Credit Suisse teetered

As credit spreads blew out, dealers opted not to adjust rates and FX risks

The carbon equivalence principle: methods for project finance

A method to price the environmental impact of financial products is proposed

SEC reporting rule threatens CDS liquidity, say traders

Market participants say proposals for identifiable position reporting will hamper bank lending

Credit Suisse CDSs offer no reprieve for AT1 losses

Legal experts pore over credit definitions after AT1 writedown

Vue CDS triggered, but payout showtime still in doubt

Lack of public debt information raises more questions about credit event determinations

DTCC’s blockchain for CDS trades finds no takers

Clients shun DLT connectivity to centralised swaps database in favour of the cloud

Esma still wants more tools to tackle clearing crises

Even after Emir 3 draft, EU regulator would like more powers over both foreign and domestic CCPs

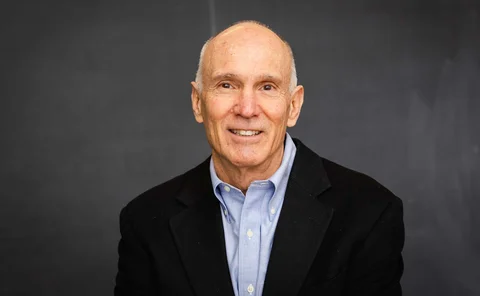

Lifetime achievement award: Stephen Kealhofer

Risk Awards 2023: KMV co-founder helped usher in a new era of credit risk analysis – at banks and investors

BofA’s DVA losses inflated to $193m in Q4

Latest hit is largest since 2020, but still leaves positive result for 2022

OTC trading platform of the year: Tradeweb

Risk Awards 2023: Traders prized the platform’s convenience and flexibility during last year’s market turbulence

Clearing house of the year: LCH

Risk Awards 2023: A member default and a spike in UK rates were handled with aplomb, while cleared volumes rose

Law firm of the year: Allen & Overy

Risk Awards 2023: A&O helps guide CDS market through multi-billion-dollar Russia default

Credit derivatives house of the year: Barclays

Risk Awards 2023: Attention to detail set bank apart from competition during volatile year

Uncleared, unrated CDS notionals boomed in H1 2022

Non-cleared trades up 21% in six months and 14% in twelve, BIS data shows

Ice Clear Credit may face Esma review as euro CDSs migrate to US

Upgrade in systemic status would depend on extent of migration from UK-based Ice Clear Europe

LCH scoops up Ice Clear Europe’s CDS clients

“A sizeable majority” of European CDS users are shifting their business to CDSClear in Paris