Clearing

Cleared portfolios surge at EU G-Sibs

Systemic banks post highest share of cleared trades in seven years, as IM phases five and six approach

CME pulls client default rule change after pushback

FCMs claim proposal gave clearing house too much power in customer defaults

Wells Fargo clearing and futures head departs

Veteran who oversaw bank’s swift rise to swaps clearing juggernaut retires

Client margin down 33% at Credit Suisse’s swaps unit in Q2

Drop in IM could signal clients jumping ship in the aftermath of Archegos blowout

Citi clearing head departs for crypto firm

Senior departure is latest among swaps giant’s clearing ranks

EU ‘unlikely’ to force swaps relocation – ex-MEP Swinburne

Multinational corporates would resist clearing move if CCP equivalence is lost, says former lawmaker

OCC quants tout anti-procyclical margin method

Technique aims to lower initial margin calls in times of stress without sacrificing risk sensitivity

It’s time to call time on leisurely disclosures by CCPs

When clearing houses falter, markets should not be kept in the dark for months on end

Eurex plans hedging contest in default auction revamp

New step in the default management process would enhance transparency in hedge provider selection

Ex-regulators back PTFs’ call to reform Treasuries clearing

G30 proposal comes just weeks after PTFs requested improvements to Ficc sponsored clearing

GameStop frenzy triggered $2 billion margin breach at OCC

Total initial margin held by the OCC's default fund stood at $114.4 billion in Q1

Swaptions get fallback safety net, but crave CCP fix

Isda’s Ice swap rate fallbacks calm fears, yet CCP action needed to protect physical settlement

UK aims to beat EU in Mifid swaps reporting stakes

UK follows up proposed EU solution to confusion over post-trade transparency with its own fix

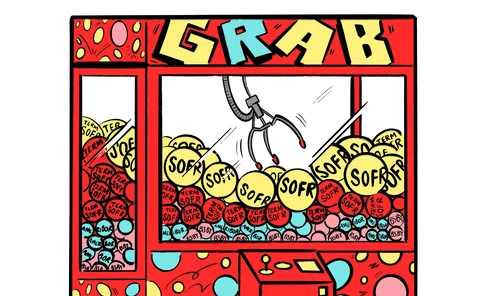

No mandate, no problem: SOFR swaps embrace clearing

Almost 70% of RFR derivatives cleared and half traded over Sefs in voluntary adoption of post-crisis norms

Euro RFR group calls for statutory Eonia fix

Legal designation for €STR as replacement rate would avert “confusion” in €9trn of legacy contracts

Sunil Cutinho on CME’s crisis performance

Maverick clearing house boss dismisses the need for anti-procyclicality tools imposed by regulators

Futures aim to put a dent in FX swaps supremacy

Advent of margin rules sharpens appeal of exchange-traded instruments for buy-siders

Pick a rate: pitfalls and prizes in the post-Libor world

SOFR set to win big in replacing Libor, but trillions could scatter across alternatives

BNP inks back-office clearing deal with FIS

Vendors jostle to offer collateral management services amid negative rates and shrinking returns for FCMs

NSCC caught $600m short during meme-stock frenzy

Worst-case losses would have wiped out the CCP’s available liquid resources on one day in Q1

JSCC issued $2.8bn VM call on a clearing member in Q1

The call was for a participant in the CCP’s clearing services that cover IRS, CDS and exchange-traded financial products

CFTC’s Stump: new talks needed on offshore client clearing

Libor demise should spur rethink on US customer access to foreign clearing providers, says commissioner

NSCC hit by $1.06bn margin breach

In total, the DTCC division reported 96 margin breaches at end-March 2021

Banks invest in futures utility to guard against tech snafus

FCMs, including Goldman and JP, stump up $44 million to fund FIA Tech push to standardise trade processing