Carbon dioxide

Voluntary carbon markets house of the year: SCB Environmental Markets

Energy Risk Awards 2025: Environmental specialist amplifies its commitment to the VCM

The role of a green factor in stock prices: when Fama and French go green

The authors propose a means to capture climate change risk exposure by combining a green factor with typical frameworks used for explaining stock returns.

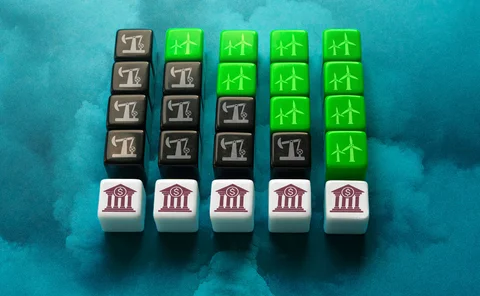

How to account for banks’ contribution to CO2 emissions

Price adjustments will depend on individual counterparties’ carbon footprints

Pricing the transition of Scope 3 emissions

A framework to measure banks’ costs associated with carbon emissions is proposed

Throwing green into the mix: how the EU Emissions Trading System impacted the energy mix of French manufacturing firms (2000–16)

This paper investigates links between environmental policy and production decisions, with a focus on firms' energy mixes.

Voluntary carbon markets go back to basics

Fledgling market is still debating fundamental concepts, but experts remain hopeful about its ultimate utility

Net-zero pledges bring big unknown for credit risk

Uncertainty on how governments plan to curb emissions adds political dimension to credit quality assessments

Revenues soar for SCB as interest in climate risk intensifies

Sponsored content

Emission impossible? Why voluntary offsets may not be scalable

As finance looks to shape decarbonisation in its own image, critics wonder if its efforts are misplaced

2021 brings big changes to the carbon market landscape

ZE PowerGroup Inc. explores how newly launched emissions trading systems, recently established task forces, upcoming initiatives and the new US President, Joe Biden, and his administration can further the drive towards tackling the climate crisis

US pension fund teams up with academics to cut through ESG fog

State fund and MIT’s business school look to improve ESG data and to reflect all investors’ views

Carbon pricing paths to a greener future, and potential roadblocks to public companies’ creditworthiness

In this paper, the authors introduce a valuation-based approach to estimate how energy transition risk may impact the creditworthiness of public companies globally within the next thirty years.

Count them in? Big US banks mull PCAF carbon standard

BofA, Citi and Wells Fargo looking to adopt emissions standard popular with EU lenders

Carbon tax spike could spur global recession – S&P

Higher carbon prices would trigger widespread industry defaults, says agency research unit

Ready or not – a low-carbon economy is coming

Government and business must avert disorderly move away from fossil fuels, says Geneva Association’s Maryam Golnaraghi

Calls to hike climate policy raise risk for oil firms

Increased climate policy will put more oil and gas assets under threat of stranding

Energy Risk Commodity Rankings: the return of geopolitical risk

Geopolitical tensions introduced extreme volatility to many commodity markets in 2018, while environmental markets began to take off

Climate risk rising up agenda for lenders

Reliable measures still some way off, banks admit

Speculators flock back into the EU carbon market

EU reforms trigger carbon rally set to last through 2018

Brexit roils UK electricity firms’ carbon hedging plans

Utilities may unwind hedges amid uncertainty over EU emissions market

Emissions house of the year: CF Partners

Specialist knowledge of carbon market is crucial to company's success