Buy side

Eurex members divided over liquidity risk charges

Banks say proposed charge too conservative, debate whether add-on should be charged directly to clients

The corporate bond revolution will be streamed

Dealers are piping feeds of live, executable prices direct to select clients

Non-EU hedge funds stage surprise escape from SFTR

European Commission clarifies scope of reporting obligation that confused many in the industry

Asia moves: Natixis hires Asia M&A chief, Deutsche Bank picks north Asia head, and more

Latest job news across the industry

Regulators urge buy-side action on Libor shift

ARRC set to release ‘checklist’ for buy-side firms, while FCA assesses exposures

OCC updates default auction rules to encourage buy-side bids

Clearer’s proposed changes follow client fears of being locked out

Ripping up the old asset class labels

Outmoded classifications of securities may be concealing market risk. AI has a better idea

Worth the cost? EU rethinks Mifid disclosure rules

Banks would gladly be rid of cost disclosures, but some clients want them improved, not scrapped

Neuberger Berman gets its Sherlock on

Asset manager deploys quant-cum-sleuth to sniff out portfolio risk

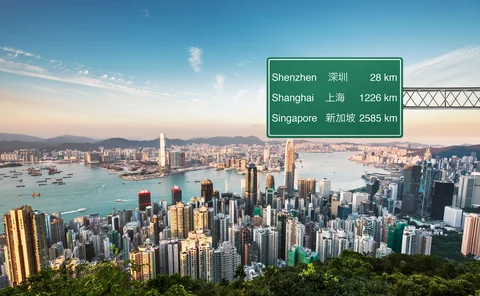

Fund managers look beyond Hong Kong as instability bites

Contingency planning for Hong Kong protests could turn into structural shift for asset management industry

CFTC urged to cement relief from a non-cleared margin rule

Industry seeks permanent right to specify two minimum transfer amounts: for initial and variation margin

Trading venues decry disruptors as MTF battle heats up

Unregulated tech vendors accused of operating as de facto venues; a claim dismissed as “entirely outrageous”

Private equity investors see savings in AI

Unigestion, Schroders using machine learning to avoid ‘obvious losers’ among private equity firms

Quant funds look to AI to master correlations

Machine learning shows promise in grouping assets better, predicting regime shifts

Dark materials: how one academic is delving into data

David Hand shines a light on dark data and the dangers of distortion by absence

US firms must rerun non-cleared margin test in March

Proposed CFTC calculation delay offers in-scope firms chance to trade out of phase five compliance

Smarter trading in a fragmented world

FX Week recently hosted a webinar in partnership with Refinitiv to ask foreign exchange industry leaders to discuss geopolitical challenges, market changes and developments, and evolving technologies, and how they have shaped forex markets in Asia

Coping with uncleared margin rules – the tricks, traps and tools

A unique insight on the evolving UMR strategies of 110 banks and buy‑side firms

Initial margin – A regulatory bottleneck

With the recent announcement of an extended preparation period for those smaller entities needing to post initial margin under the uncleared margin rules, the new timetable could cause a bottleneck for firms busy repapering derivatives contracts linked…

Will uncleared margin rules change the FX landscape?

As the next phases of uncleared margin rules come into force, there will be an economic driver for more clearing of FX. By Phil Hermon, Executive Director of FX Products at CME Group

Stock-picking finds unlikely champion in ex-Winton CIO

Matthew Beddall’s Havelock restyles value investing for the big data age

IM phase five – Smaller on bang, bigger on complexity

The initial margin ‘big bang’ may have been reined in by last-minute relief, but dealers aiming to get hundreds of buy-side firms over the documentation finish line by September 1, 2020 fear a compliance bottleneck

How pre-trade IM calculation can optimise and reduce collateral drag

With firms under pressure to make their systems compliant with uncleared margin rules (UMR), the increase in margin requirements has put further strain on the availability of high-quality liquid assets. Mohit Gupta, senior product specialist at Cassini…

OTC trading platform of the year: Tradeweb

Risk Awards 2020: To keep volumes growing, platform had to confront “incumbent’s dilemma”