This article was paid for by a contributing third party.More Information.

How pre-trade IM calculation can optimise and reduce collateral drag

With firms under pressure to make their systems compliant with uncleared margin rules (UMR), the increase in margin requirements has put further strain on the availability of high-quality liquid assets. Mohit Gupta, senior product specialist at Cassini Systems, explores how pre‑trade optimisation can help streamline margin requirements, impacting funding and collateral requirements

The advent of UMR has not only put pressure on firms to make their systems compliant with the regulations, but also put a drag on real returns as a result of the increased need to post margin on products that were previously not collateralised. The increase in margin requirements has begun to put a strain on the availability of high-quality liquid assets, which must be sourced to meet the margin needs.

Pension funds, asset managers and traditional long-only funds are those more severely impacted because, with directional books and growing notionals, the margin will continue to increase due to lack of any considerable offsets between positions.

This means trading derivatives in a world of regulation is not only about looking at returns, but also about reducing the cost of trading and reducing this collateral requirement and consequent funding costs.

Traditionally, traders and portfolio managers have only been concerned about the slippage or bid/offer as the dominant source of costs but, with regulations imposing stricter clearing and margin rules, the cost of funding the collateral for margin has to be taken into account as well.

This funding of collateral has a twofold impact on returns, typically known as collateral drag:

- The cost of funding this collateral at the firms’ funding rate

- Opportunity cost constrained to trade because of lower unencumbered cash levels.

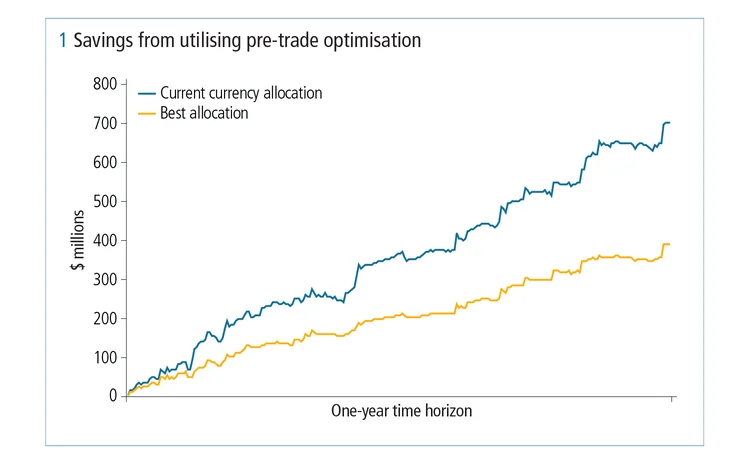

The good news is that there are solutions to optimise margin requirements, which reduce the associated costs. As with using bid/offers to determine the slippage before a trade, there are solutions that can help the least expensive clearing brokers or bilateral dealers understand taking the associated margin costs into account. The importance of pre-trade optimisation is illustrated in figure 1.

Cassini Systems simulated a relative-value hedge fund clients’ historical cleared book from the start of the year – with an empty book – to the end of the year. During this period, the client would regularly trade cleared swap trades in euro, US dollar and sterling. The client had three clearing brokers; however, instead of allocating the trades to the cheapest broker, the client used an operationally simple allocation rule of allocating all euro trades to one broker, all US dollar trades to another and all sterling trades to a third. Clearly, the fund gets offset between the trades of the same currency but loses out on offsets among currencies. Here, being a relative-value fund is one of the most common trading strategies.

Using pre-trade optimisation, the current currency allocation underperforms considerably as the trading activity builds over the course of the year. Utilising pre-trade optimisation helps save around 40% margin, on average, over the course of the year.

The savings are lower to start with, but grow significantly over the course of the year. The average margin requirement over the course of the year is roughly $150 million lower, which means $150 million less collateral to be funded. This saving has a twofold benefit:

- $150 million less collateral to be funded by the treasury – a direct reduction of the costs in the bottom line

- $150 million of collateral freed, which can be used to put more trades or size up on trades to generate higher returns if within the risk limits.

This is just one of many use cases in which pre-trade optimisation has proved helpful. Other use cases include:

- Liquidity add-ons – Clearing houses affix liquidity add-ons when a firm builds significant concentrated positions in certain risk buckets. Understanding this can help with optimising margin, as liquidity add-ons have been known, in extreme cases, to increase margin by as much as 50%.

- Futures cross-margining – Some exchanges offer cross-margining the futures against available over-the-counter positions. This cross-margining can lead to tremendous savings, especially in cases where a bond future is traded against a matched maturity swap or, more generally, short-term futures against matched swaps (convexity trades).

- Bilateral margining – The same optimisation techniques can be used for bilateral margining. Assuming execution price equivalency, margin optimisation can bring significant savings as the threshold available under bilateral agreements can optimally utilise.

- Strategic clearing and backloading – Bilateral and cleared trades have different liquidities and margins, and only new trades after the UMR phase-in dates are in scope for bilateral margin. This offers some firms the opportunity to choose between trading certain trades bilaterally or cleared depending on cost-benefit analysis. Assuming liquidity – and therefore execution price – is the same in the bilateral and cleared worlds, factors at play that might make one option better than the other include:

- Threshold available in bilateral agreements

- Cleared trades generally cheaper than bilateral trades in margin terms for standalone risk quantum

- Cross-margining with futures in cleared world

- Liquidity add-ons in cleared world.

As these factors highlight, pre-trade optimisation can help streamline margin requirements, with all the margin saved directly impacting funding and collateral requirements.

Contact

Jason Harris, EMEA Sales

T +44 (0)20 3709 1455

Initial margin – Special report 2019

Read more

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net