Bonds

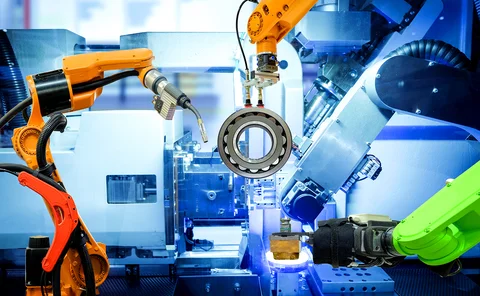

Asia embraces intelligent automation

Asia’s adoption of new tools and processes has gained significant momentum, with increased automation now a primary focus for many financial firms. Paul Worthy, head of Japan at Tradeweb, explores how this change has come about, and how firms can use the…

Term versions of RFRs will work – FCA official

Schooling-Latter backs plan to build curve from swaps and futures; others have doubts

World Bank completes first SOFR bond hedge

The largest SOFR swap trades to date were executed on August 13

Own goal: Mifid II reduces transparency in some EU markets

New rules replace voluntary arrangements in ETFs and Nordic bonds, fragmenting post-trade data

Poor Mifid data could condemn OTC market to the dark

Many derivatives likely to fail first full liquidity test and escape EU transparency obligations

Commerzbank VAR jumps on Italian turmoil

Sovereign bond yield spike hits public finance portfolio

Generali weathers Italian bond turbulence

Solvency II SCR ratio dips to a still lofty 201% in the first half

New frontiers

Innovative investment opportunities are helping to mitigate risk and satisfy Solvency II capital requirements as insurers face continued economic uncertainty. Frederic Morlaye, managing director, insurance and capital management solutions, Global Markets…

EU trading venues warn over looming end of LEI relief

Expelling issuers with no legal entity identifiers could hurt liquidity and investor strategies

UK bank funding costs spike in Q1 – BoE

Total term debt issuance is around 60% higher this year to date than at the same points in 2016 and 2017

CPI bonds set for growth, say dealers

Double issuance sparks hopes for inflation-linked swap market

Podcast: Richard Martin on EM debt, copulas, machine learning

Quant sceptical of machine learning algos and black boxes

Emerging market corporate bonds as first-to-default baskets

Modified Merton model offers insights on EM corporate debt

EIB shrugs off term RFR worries with Sonia bond plan

Issuer to use daily compounded, backward-looking rate with time lag for sterling benchmark

Modelling correlation: from zig-zag to zig-zig

Research is starting to show the stock-bond link in a new light

Buy-side modellers seek ‘Holy Grail’ of investing

When stocks and bonds fell in tandem this year, it sparked a debate about whether a lasting regime shift could be predicted

Citi largest counterparty for Templeton currency hedges

Citi accounted for 23% of outstanding forwards at end-March

European investment fund growth slows

Bond fund growth rate falls from 10.6% to 8.2% quarter-on-quarter

Duelling repack platforms find common ground

Standard documentation initiative mulls shared SPV model as founders seek to join rival

Dodge & Cox turns to MBS as Treasury yields rise

Income Fund grows securitised allocations from 36.1% to 39.7%

Reform fails to solve collateral woes in Korea

Korean swaps users wary of collateral reuse, leaving dealers with LCR burden

Libor death threatens to blow hole in hedges

Isda AGM: BlackRock, Fed stress need for fallbacks to marry up across rates universe

Rising rates hit Chubb's portfolio

US insurer posts $1 billion in realised and unrealised losses

Morgan Stanley expands long-term debt issuance

Outstanding long-term debt jumps 12% year-on-year