Basel II

Regulators concentrate on key op risk issues for QIS3

Global banking regulators working on the operational risk aspects of the controversial Basle II banking accord are concentrating their efforts on some key issues as they prepare their part of the so-called QIS3 survey.

Changes afoot at rating agencies

Rating agencies are under fire once again, this time for failing to anticipate Enron’s bankruptcy. But they are looking to improve their methodology. What do the changes mean for banks that will have to rely on their ratings under Basel II?

Credit risk reporting: Managing the exposure challenge

Mass financial shocks – including Enron and Argentina – are forcing banks to disclose more information, faster, about their credit exposures to satisfy skittish investors. How are banks' technology infrastructures coping with this challenge?

New disclosure rule boosts pension risks

New UK accounting rule FRS 17 will force companies to disclose pensions liabilities on corporate balance sheets. The risk management issues are wide-ranging, and experts have few easy answers. Furthermore, the new rule could soon be adopted in a number…

Basel II final paper delayed until 2003

Global banking regulators now expect to issue their final version of the complex and controversial Basel II bank capital adequacy accord “some time next year” rather than by the end of this year as previously hoped.

Survey delay puts Basel II timetable under further strain

Delays in issuing a crucial survey could again imperil the timetable of the Basel II bank capital adequacy Accord and further endanger the European Commission’s schedule for risk-based bank regulation.

Dealing with the flak

With the final Basel Accord proposals due to be published later this year, the Bank of International Settlements’ new Asian head, Shinichi Yoshikuni, does not have much time to settle into his new role, writes Nick Sawyer.

Weary recognition of gross income as Basel II op risk measure

LONDON - There was "weary recognition" among bankers that the use of gross income as a measure of operational risk was the least bad approach, said Richard Metcalfe, co-head of the European office of the International Swaps and Derivatives Association …

Retail banking accounts for two-thirds of op loss events, says Basel survey

BASEL, SWITZERLAND -- Operational losses in retail banking accounted for two-thirds of the number of operational losses suffered by banks, according to a survey by global banking regulators. The survey sought data about the impact on major banks of the…

The Basle II capital accord: op risk proposals in brief

This summary has been updated to include the revisions to the Basle II op risk proposals contained in the Working Paper on the Regulatory Treatment of Operational Risk issued in September, 2001 and available on the Bank for International Settlements’…

UK regulators ponder op risk charge for insurers

LONDON -- British regulators are deciding whether to impose a specific capital charge on insurance companies for operational risk under new risk-based rules aimed at making the UK insurance industry safer.

Loss survey supports arguments against capital charges, say fund managers

London - The results of a survey by global banking regulators of banks’ operational loss experience support arguments against using capital charges as the main protection against operational losses in fund management and broker activities. This is the…

Credit model evaluation

With the new Basel Capital Accord scheduled for implementation in 2005, banks are having to evaluate the credit scoring models that will enable them to meet the minimum standards for Basel’s internal ratings-based (IRB) approach. Selecting an appropriate…

IT and staff quality seen as key as India adopts Basel II

CALCUTTA, INDIA - The need to improve staff quality and use information technology (IT) effectively are among key targets for the Indian banking system as it prepares to meet intern ational standards of risk-based regulation, India’s central bank chief…

Risk financing might solve doubts over op risk insurance

LONDON - Combining risk transfer with risk financing might be one way of resolving regulator doubts about the use of insurance to mitigate operational risk under the proposed Basel II accord.

Basel II - Rules and Models

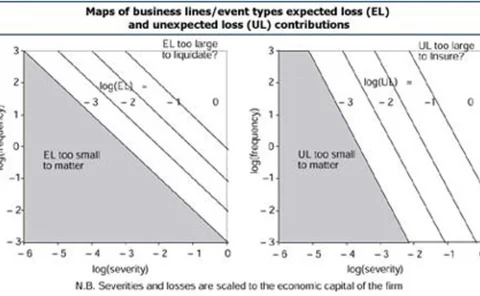

The proposed operational risk charge remains one of the most contentious areas of the new Basel Accord. Carol Alexander reviews the current proposals in the context of various simple models, and argues that practical implementation will require the use…

Linear, yet attractive, Contour

Banks’ Potential Future Exposure models are at the core of the advanced EAD (Exposure At Default) approach to capital requirements for credit risk considered in the New Basel Capital Accord. Juan Cárdenas, Emmanuel Fruchard and Jean-François Picron look…

Basel II may not suit emerging economies, says US central banker

Washington - Rules embodied in the Basel II banking accord may be inappropriate for banks in emerging-market economies because a country may have unique circumstances, a senior US central banker said in December.

In search of clarity and focus

Greater precision is needed in defining operational risk, but the Basle regulators' latest thoughts are lost in generalities, says Jacques Pézier, in the final article of a three-part series.

Basel shortcomings: Danger lurks on the rocky road to Basel II

The Basel Accord proposals to define operational risk contain many fatal flaws, says Jacques Pézier. He argues that it would be better to focus management time on managing key risks than on developing op risk databases and measurement procedures.

Regulators want active dialogue on op risk

BASEL - Active dialogue between banks and their supervisors is the key to the continued development of approaches to managing operational risk, global banking regulators said in a much-delayed paper on op risk sound practices issued in December.

SME debate delays next Basel II paper

The Basel Committee on Banking Supervision has delayed its next consultative paper for Basel II, the new rules that will determine the amount of regulatory capital internationally active banks put aside against risk.

Approach with caution

Indicators of operational risk are not for the faint of heart, nor are they necessarily bearers of good news. But used properly and effectively, they can help businesses identify potential losses before they happen.

The Basel II capital accord: op risk proposals in brief

This summary has been updated to include the revisions to the Basel II op risk proposals contained in the Working Paper on the Regulatory Treatment of Operational Risk issued in September, 2001 and available on the Bank for International Settlements'…