American options

Floating exercise boundaries for American options in time-inhomogeneous models

A pricing model is extended to account for negative interest rates or convenience yields

Pricing American options under irrational behavior in a Markov regime-switching model with a finite-element method

The authors investigate the problem of pricing American options under an irrational strategy, putting forward a method to negate this problem and demonstrate the performance of this model against alternatives.

Pricing share buy-backs: an alternative to optimal control

A new method applies optimised heuristic strategies to maximise share buy-back contracts’ value

A multidimensional transform for pricing American options under stochastic volatility models

The authors put forward a transform-based method for pricing American options which is computationally efficient and accurate under under low-dimensional stochastic volatility models.

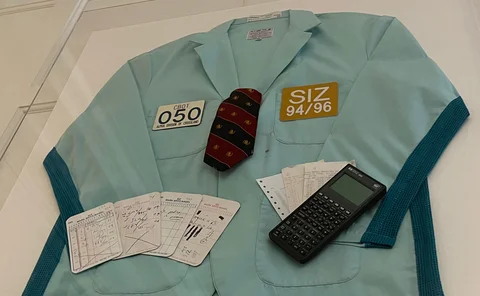

How HSBC got better at pricing share buy-backs

Monte Carlo approach generates faster, more reliable pricing for complex deals

Investors zero in on short-dated options to trade US inflation prints

But critics say 0DTE products are increasing volatility around CPI announcements

How to trade like the investor who made $1bn in a day

Mark Spitznagel won’t reveal how he made a 4,144% return, but he does discard plenty of rival trades

Pricing American options under negative rates

This paper derives a new integral equation for American options under negative rates and shows how to solve this new equation through modifications to the modern and efficient algorithm of Andersen and Lake.

OCC quants tout anti-procyclical margin method

Technique aims to lower initial margin calls in times of stress without sacrificing risk sensitivity

Fast pricing of American options under variance gamma

This research develops a new fast and accurate approximation method, inspired by the quadratic approximation, to get rid of the time steps required in finite-difference and simulation methods, while reducing error by making use of a machine learning…

The volatility paradigm that’s stirring up options pricing

‘Rough volatility’ models promise better pricing and hedging of options. But will they catch on?

FCMs fret over S&P 500 options settlement changes

Dealers say CME, Cboe settlement time shift for S&P 500-linked options causes risk management headache

On extensions of the Barone-Adesi and Whaley method to price American-type options

This paper provides an efficient and accurate hybrid method to price American standard options in certain jump-diffusion models and American barrier-type options under the Black–Scholes framework.

Danske quants discover speedier way to crunch XVAs

Differential machine learning produces results “thousands of times faster and with similar accuracy”

Pricing American call options using the Black–Scholes equation with a nonlinear volatility function

In this paper, the authors investigate a nonlinear generalization of the Black–Scholes equation for pricing American-style call options, where the volatility term may depend on both the underlying asset price and the Gamma of the option.

Fishing for collateral with neural nets

SocGen quant uses deep learning technique to optimise collateral substitution

Path-dependent American options

In this paper, the authors investigate a path-dependent American option problem and provide an efficient and implementable numerical scheme for the solution of its associated path-dependent variational inequality.

Complexity reduction for calibration to American options

In this paper, the authors propose and investigate a new method for the calibration to American option price data.

Efficient conservative second-order central-upwind schemes for option-pricing problems

In this paper, the authors propose improvements to the approach of Ramírez-Espinoza and Ehrhardt (2013) for option-pricing PDEs formulated in the conservative form.

Portfolio optimization for American options

In this paper, the authors construct strategies for an American option portfolio by exercising options at optimal timings with optimal weights determined concurrently.