Hedging

CaixaBank lifts structural deposit hedges to two-year high

Receiver swap notional climbs to €68bn as bank guards NII

Many banks see obstacles to options-based IRRBB hedging

Liquidity, accounting treatment and culture seen as impediments to wider use of swaptions, caps and floors

S&P bull run drives interest in reset and lookback hedges

Variable strike put options proved popular alternative hedging format of 2025

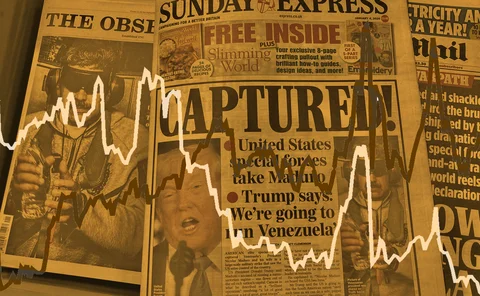

Trump’s LatAm gambit spurs FX hedging rush

Venezuela op boosts risk reversals as investors look to protect carry trades

Dealers warn of capital squeeze from increased FX hedging

Sharp rise in uncollateralised buy-side hedges could restrict banks’ ability to take on positions

Will Iosco’s guidance solve pre-hedging puzzle?

Buy-siders doubt consent requirement will remove long-standing concerns

Flow market-maker of the year: Citadel Securities

Risk Awards 2026: No financing; no long-dated swaps? “No distractions,” says Esposito

Currency derivatives house of the year: Bank of America

Risk Awards 2026: Early call on dollar weakness helped bank break vega records in April and quickly recycle 95% of risk

Hong Kong regulator exploring Southbound Swap Connect

Discussions on Southbound route for swaps trading follows surge in Northbound activity

Real money looks to dynamic hedges after tariff bout

Buy-siders are adopting more responsive FX hedging strategies after correlations broke down

Inside the 2025 BIS FX survey: dollar wobbles, trading shifts and settlement risks

BIS’s triennial survey shines a light on the forces shaping global FX markets

European exporters add flexibility to FX hedges

Corporates with USD exposures have been reducing hedging tenors and adding optionality

Korean autocalls to make comeback, with ‘smaller pie’ for banks

As equity-linked autocallable channels look set to reopen, new rules could limit market’s revival

The curious case of the missing volatility risk premium

Volatility investors will need to work harder and smarter to capture value, says Capstone

ANZ’s FX forwards surge with Pimco

Counterparty Radar: Australian bank becomes top counterparty to the asset manager after huge jumps in cable and EUR/USD

AI as pricing law

A neural network tailored to financial asset pricing principles is introduced

BIS 2025 FX survey: What the results mean for global markets

Key findings from the BIS triennial FX and OTC derivatives survey

EU banks fear tumbling rates will upset their IRRBB balance

As rates decline, hedging two separate tests of vulnerability becomes more difficult

Has US dollar hedging hype faded?

While the initial wave of real money USD hedging flows disappointed some dealers, many believe there is more to come

Some European banks still failing net interest income test

Swedbank joins seven other outliers after it updates methodology assumptions

How Amundi’s options strategy profited from dollar slump

French asset manager grabbed euro call options at low prices in tactical pivot for its FX absolute return fund