Structured Products - February 2014

Articles in this issue

Structured Products Americas Awards 2014: Call for entries

Structured Products Americas Awards 2014: Enter now!

Structured products can underperform a simple stock and bond portfolio, study finds

A group of PhDs churned through 18,000 structured products issued by 13 leading banks, including Barclays, Goldman Sachs and UBS, to find out what investors in the products earned. In November, they published their results. Yakob Peterseil talks to one…

Retail investors may be paying tax unnecessarily

A loophole in the UK's tax rules relating to financial advisers means investors can avoid paying VAT on certain transactions, but some advisers could be charging it nevertheless

SEC targets ‘protected’ and ‘guaranteed’ fund names

After criticising the use of the term “principal protected” in structured notes, the SEC turns to ETFs and mutual funds that promise protection from loss in their names

SEC's Amy Starr: we are scrutinising ETNs

ETNs pose many of the same disclosure risks as structured notes and may be the subject of future guidance, suggested the SEC’s top structured products regulator and author of last year’s letter to US banks

Focus Structured Solutions makes debut in UK structured products

Credit Suisse distributor launches three UK structured products with 60% European barriers

Biggest burden from Camp’s comprehensive tax review could fall on retail investors

After thinking they would be ignored in a broad reform of the US tax system led by David Camp, retail investors could find themselves in the firing line for phantom income tax, say bankers

UK's Tier One Capital seeks secondary structured products

Listed products are secondary nature at Tier One Capital

Structured deposits face uncertain future under UK ring-fence plans

Caught in the net

HVB note offers annual income on Deutsche Bank stock

HVB offers annual income

Riskier structured products with 60% barriers could be 'shockers' of the future, says insider

Capital-at-risk products with a 60% barrier have crept into the retail market and are becoming increasingly ubiquitous. But is the extra risk they pose appropriate for retail investors?

Gilliat offers three ways to play international markets

New internationalists

What’s next for FX structured products, ETFs and indexes?

Sponsored forum: Bloomberg Indexes

Finra bears down on complex structured products

Topping the regulator's list of priorities for 2014 is ensuring that US brokers make adequate enquiries before offering complex products to retail investors

How to capture growth in an autocallable world

Strategists are cautioning investors to look beyond autocallables and take advantage of low volatility to buy growth products. The banks have listened, engineering new solutions to capture upside. But will investors take the bait? Yakob Peterseil reports.

Morgan Stanley's 2013 maturity structured products deliver healthy returns

Six Morgan Stanley retail products maturing in 2013 produced annualised returns of 11–14%, while the bank's worst-performing growth products came in flat to the market

Trade of the month: Risk assessment

Trade of the month: Risk assessment

RBC reverse convertible taps 3D printing revolution

The next dimension

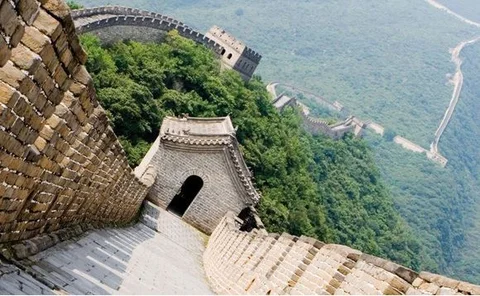

S&P Dow Jones Indices launches Total China series

Total China BMI series provides complete picture of China's equity market; MSCI licenses hedged indexes to UBS; FTSE launches UK digital sector benchmark

Closing the gap between structured products and funds

Rise of the chameleons

Risk premia: the end of the road for smart beta?

Editor's letter

People: SEC names head of complex investments unit

People: SEC names new head of complex products unit