Risk magazine

Reaping integration rewards

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…

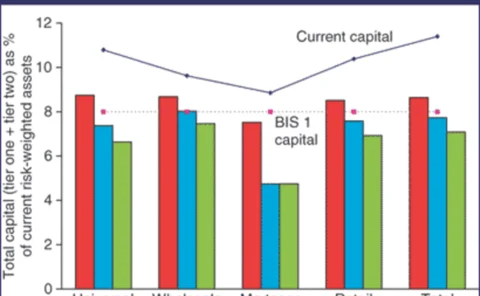

Letter to the editor: a response to Cosandey and Wolf’s Avoiding pro-cyclicality

From Thomas Garside, managing director, finance and risk management, and Christian Pedersen, senior manager, Oliver, Wyman & Company, London

Kiodex teams with Reuters in Asia and Latin America

Reuters is to market the Risk Workbench platform of New York-based technology company Kiodex to its commodities and energy customers in Asia, Latin America and the Caribbean.

New US online options exchange announces investors

The Boston Options Exchange (BOX), a venture of the Boston Stock Exchange, has announced investment stakes by Credit Suisse First Boston, JP Morgan Chase, Salomon Smith Barney and UBS Warburg. The size of the investments was undisclosed.

Deutsche Bank credit protection trades wider following Q3 losses

The cost of senior debt protection for Deutsche Bank has crept 5 basis points wider to 58bp-mid after the bank posted a third-quarter net loss of €299 million. In otherwise thin markets, credit derivatives traders in London said active buyers of…

Job moves

QUOTE OF THE MONTH “I believe that of all large German banks Commerzbank has the best risk management system” Wolfgang Hartmann, chief risk officer at Commerzbank Source: Risk, November

Fuelling doubts

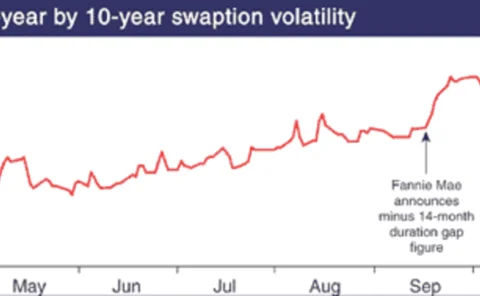

Violence and uncertainty in the Middle East have caused energy market volatility to soar, testing the mettle of even the most sophisticated corporate hedgers. Will it prove to be the last straw for the world’s ailing airlines? Navroz Patel reports

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net

Banding together for SME credit risk analytics

Germany’s banking associations are taking a leading role in getting the country’s fragmented banking sector ready to comply with the Basel II capital Accord. Germany’s savings banks association, in particular, says it has internal ratings-based systems…

The beta-blocker

Doug Dachille, chief operating officer at Zurich Capital Markets and formerly global head of proprietary trading at JP Morgan, believes the economic downturn has finally crystallised investor attention on beta. Christopher Jeffery reports

Basel II and pro-cyclicality

The main argument for making regulatory capital requirements more risk-sensitive is to improve allocational efficiency. But this may lead to intensified business cycles if regulators fail to take measures to prevent such an impact. In this first column…

Scor spreads widen 350bp after firm reveals €38m credit derivatives losses

The cost of senior debt protection on Scor ballooned to 850/1,000 basis points over Libor today, after the French reinsurer revealed, yesterday that it would make a net loss of €250 million this year, following major losses in credit derivatives and…

Currency overlay set to hit $500 billion

Currency overlay, the management of currency exposures in an investment portfolio separate from underlying asset exposures, is set to become a $500 billion dollar industry within the next three years, according to Piero Overmars, Dutch bank ABN Amro’s…

ING provides cross-currency swap for Samsung Card ABS

The Netherlands' ING Bank will provide the cross-currency swap for South Korean consumer finance company Samsung Card’s $400 million of cross-border asset-backed securities, said a spokeswoman for the Korean company.

RiskMetrics links fixed-income trading system to its risk management system

RiskMetrics Group, the New York-based risk analytics and technology firm, is integrating a pricing and portfolio analytics system into RiskManager, its flagship web-based application for the measurement and analysis of market-based value-at-risk.

JP Morgan signs up 18 CLS third-party customers

JP Morgan Treasury Services, a unit of JP Morgan Chase, has signed up 18 third-party service customers to allow them access to continuous linked settlement (CLS). The third-party service contracts allow counterparts to settle their foreign exchange…