Risk magazine

Italian unease

Italy

Carry on trading

Structured products

Single measures are not enough

Ashish Dev considers the contemporary relevance of three Risk articles from 2002-03

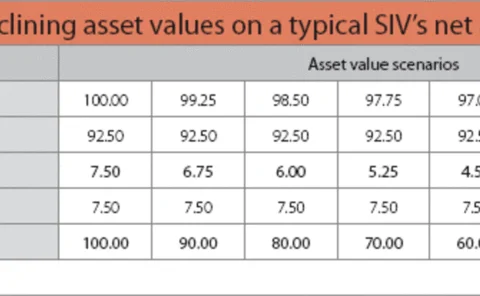

Leaking like a SIV

Structured Finance

No silver bullet

The emergence of contingent credit default swaps has presented banks with a new way to manage their counterparty credit exposures. However, they have important limitations, argues David Rowe

Lehman launches quant forex strategies platform

Lehman Brothers has become the latest bank to offer clients access to various algorithmic foreign exchange trading strategies through its new Macro Quantitative Currency Strategies Platform (MarQCuS).

Isda: 38% rise in credit derivatives notional in first half of 2007

The notional amount outstanding of over-the-counter credit derivatives grew by 32% in the first six months of the year, reaching $45.46 trillion in mid-2007, according to the International Swaps and Derivatives Association.

HSBC launches climate change indexes

HSBC's Corporate, Investment Banking and Markets division (CIBM) has launched an index to track the stock market performance of companies that stand to profit from the challenges posed by climate change, alongside four investable sub-indexes.

Range of 29 forward commodity ETFs to be listed on LSE

Twenty-nine new exchange-traded funds (ETFs) tracking the forward prices of a variety of commodities and commodity baskets are due to list on the London Stock Exchange (LSE) in the next four weeks.

Geen appointed general counsel for Isda

David Geen has been appointed general counsel for the International Swaps and Derivatives Association (Isda). He had previously served as Isda's European general counsel since November 2006, helping to develop the association's European loan credit…

Senior duo leaves Calyon after €250 million rogue trade

Two of Calyon’s most senior bankers have departed following the discovery of a rogue credit derivatives index trade earlier this month.

BarCap launches “new currency” for financing

Barclays Capital has unveiled a synthetic currency intended to reduce funding costs for corporate clients, banks and hedge funds.

Bear profits tumble by 61% as Goldman's rise 79%

Bear Stearns confirmed it was the US securities dealer with proportionally the most damaging exposure to the troubled US mortgage market when it unveiled a third-quarter net profit of $171.3 million, a year-on-year drop of 61%.

Rating agencies unmoved by Calyon’s rogue trade

Standard and Poor’s, Fitch Ratings and Moody’s Investors Service have all affirmed their ratings and ratings outlooks for Calyon and its parent company following the disclosure of a large rogue trade.

South Korea, Taiwan again fail to achieve developed market status

London-based index provider FTSE Group has again left officials in South Korea and Taiwan disappointed, after it decided to keep them classified as advanced emerging markets, as it did in 2005 and 2006. The supplier of the world’s most used index series…

Citi gets merchant banking licence in Bangladesh

Citi has become the first foreign bank to secure a merchant banking licence in Bangladesh, enabling the US dealer to act as an adviser, underwriter and lead manager in the country’s local capital markets.

Valuation reductions hit Lehman Brothers for $700m

Lehman Brothers yesterday unveiled it suffered a revenue decline of $700 million due to a reduction in its valuations for fixed-income assets. This reduction in valuation was felt most keenly by the US securities dealer's leveraged loan commitments and…

Calyon sets up Asian DCM team and names leveraged finance head

Calyon has named a new Hong Kong-based debt capital markets (DCM) team for Asia excluding Japan, headed by Antoine Gros. The French bank has also appointed a new head of acquisition & leveraged finance for Asia excluding Japan.

BGI hires Prooth as managing director for iShares

Barclays Global Investors (BGI) has hired Karen Prooth as managing director and European chief operating officer for iShares, the asset manager’s brand of exchange-traded funds.