Risk magazine

Risk Europe: Expanding the scope of Emir needs careful consideration, says Pearson

A Council of the European Union proposal to expand the scope of new European market infrastructure regulation to include exchange-traded derivatives should be carefully thought through, says the EC’s Patrick Pearson

Risk Europe: Roles of ESRB and ECB could conflict, says Belgium's Reynders

Europe's new systemic risk watchdog could clash with the ECB - but the ESRB's powers may need to be expanded, says Belgian finance minister, Didier Reynders

Risk Europe: Tweaks to Basel III will raise deadline pressure for banks

Changes to the detail of Basel III will make timely implementation a challenge, say attendees at Risk Europe

Risk Europe: no-go on CoCos, says panel

Traditional investors won't be won over by debt that converts into equity, says conference panel - and one CoCo issuer raises threat of feedback effects

Risk Europe: Dodd-Frank rating requirement has competitive implications under Basel III

The requirement under the Dodd-Frank Act to eliminate any reliance on external credit ratings could put US banks at a competitive disadvantage under Basel III, says the Basel Committee’s Stefan Walter

Risk Europe: 'Humble' Basel Committee open to liquidity rule changes

The Basel Committee's Stefan Walter says door is open to changing LCR and NSFR - but it's not open wide

Over a third of $1 billion-plus hedge funds not yet registered with SEC

Hedge funds in the US have until July 21 to register with the SEC but Citigroup says over a third of the larger funds have not yet done so.

EU Council questions Esma’s power to determine clearing eligibility

Legal precedent suggests European Commission might have to determine which contracts should be cleared under new derivatives rules, rather than Esma as originally planned

Sovereign debt managers criticise ban on naked CDSs

Sovereign debt managers criticise ban on naked credit default swaps

Regulators may keep it simple for Sifi selection

Regulators may keep the rules simple for Sifi selection process

CDO ratings arbitrage “reasonable and justifiable”, UK court finds

CDO ratings arbitrage ‘reasonable and justifiable’, finds UK court

LCH.Clearnet confirms FX options clearing for 2011

Annual results confirm significant investment in developing clearing services for FX options

People moves

Equities team reshuffle at Morgan Stanley

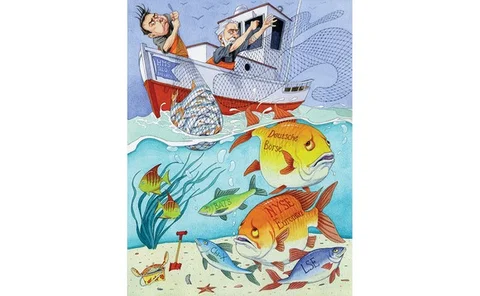

European politicians row over scope of Emir

Challenging Emir

European legislators squabble over Emir

The derivatives catch-all

Sovereign risk weights under threat

Weight gain

Portuguese deficit, Irish stress tests weigh on CDS spreads

Spreads are jolted following Portuguese deficit revision, and expectations of a new round of bank recapitalisation in Ireland

Unlevel playing field for CCP members concerns banks

Under the bar, over the top?

A practical challenge for collateral optimisation

Collateral conundrum

Dealers resigned to CCP competition in Asia

Gaining interest

Equity derivatives

Special report

New equity derivatives definitions imminent

Next step for equities

Preparing for Solvency II

Solvency II: insuring for change