Credit risk

Leo O’Neill

profile

Barra joins crowded market for Merton models

Credit Risk

Betting on principal finance

Cover story

CP3 comments: Any last words?

The comments elicited by the Basel Committee's third consultative paper (CP3) show just how little consensus exists between regulators and banks on the Basel II capital Accord. Dwight Cass highlights some of the telling comments.

iBoxx launches tradable CDO tranches

Bond and credit default swaps index company iBoxx has launched a series of tradable instruments linked to single tranches of one of its credit default swap (CDS) indexes.

Banks should standardise CDS indexes, says credit derivatives panel

Investment banks should be pushing for standardisation in credit default swaps (CDS) indexes, agreed a panel of credit derivatives experts at Risk ’s Credit Risk Summit Europe 2003 in London.

'A good deal for regulators and banks'

Paul Kupiec's article in the August issue of Risk – Does CP3 get it right? – raised a number of concerns about the application of Basel II to retail portfolios.

Corporate Statement > Alliance & Leicester Choose WhiteLight

After an extensive review of vendor solutions, Alliance & Leicester, one of the UK's major financial services groups, has chosen WhiteLight, a SymphonyRPM company, to provide their Basel II Retail Credit Risk solution.

Vital Statistics

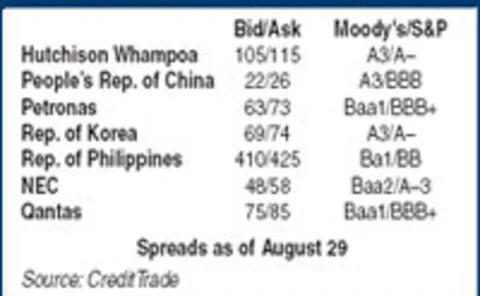

FIXED INCOME

Capital structure arbitrageurs build a following

Trading strategies

Any last words?

CP3 comments

Trac-x expands into Australia

New angles

Staking a claim

market trends

How to check your price

Systems

JP Morgan Chase and Morgan Stanley launch Trac-x Australia

JP Morgan Chase and Morgan Stanley launched the Trac-x Australia index today, the latest addition to the Trac-x global suite of credit default swap indexes created by both firms.

Sponsor's article > Reason for hope

One disappointing aspect of the Basel II deliberations has been the lack of any proposed change in the treatment of counterparty credit exposures. David Rowe argues that recent dialogue between the Basel Committee and industry representatives offers hope…

Counterparty credit concerns

Regulators are getting interested in derivatives counterparty credit risk. When Federal Reserve chairman Alan Greenspan noted in May that one dealer (and we understand this to be JP Morgan Chase) accounted for a third of the global dollar interest rate…

Protecting your own

Alstom

News in brief

New angles

Credit Crunch!

clive horwood

Credit due

commentary