Credit risk

Jon Schotz

Q&A

WInner: Eurocredit Opportunities I

Primary focus

PPF to refine levy

News

Putting energy into credit

Energy derivatives

RiskNews

RiskNews

Spain near to finalising CDS rules

New angles

New frontier for synthetics

Leveraged loans

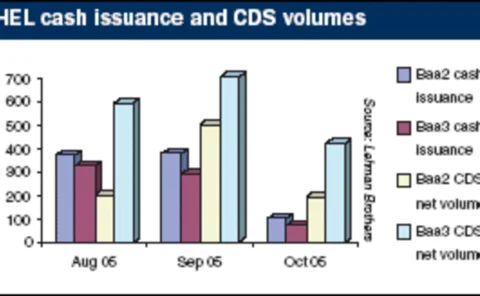

Home equity loan CDS surges

New angles

ABN Amro offers record €22bn securitisation to ease balance sheet

ABN Amro has launched a €22 billion securitisation, made up of mortgage-backed notes and credit default swaps (CDS).

A Cleaner Act for Credit Derivatives

As credit volumes have increased, firms must grapple with price transparency and operational risk.

Sponsor's article > Expected Positive Exposure: Achieving Basel II Compliance Strategically

Enhancements to Algo Capital provide robust and realistic EPE values for counterparties across the trading book, while taking into account complex forms of credit mitigation.

Leading the pack

Nordic banks are well ahead with their Basel II programmes compared with their international peers. But there are concerns about home regulator rules and advanced credit risk data requirements. Laurence Neville reports

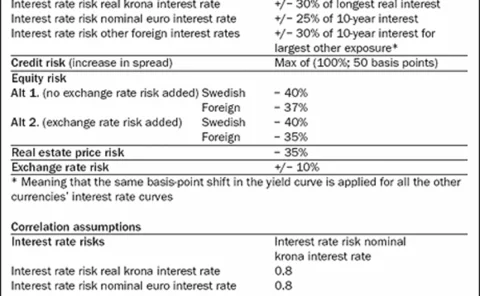

Mixed signals for derivatives

New solvency regulations in Sweden will force life insurers and occupational pension funds to mark their liabilities to market and stress test their positions under a new 'traffic light' regime. While the final result is unclear, the new rules look set…

Prime brokers - the real winners of hedge fund industry growth?

service provision: prime broking

Leading the pack

Basel II

Mixed signals for derivatives

Solvency reform

Credit news

News: Credit news

Leverage lift-off for new CDOs

Structured credit

Jim Toffey

Profile