Credit risk

Affari interni

Basilea 2

Low-default portfolios without simulation

Low-default portfolios are a key Basel II implementation challenge, and various statistical techniques have been proposed for use in PD estimation for such portfolios. To produce estimates using these techniques, typically Monte Carlo simulation is…

Credit DPCs are growing rapidly, says Fitch

Credit derivatives product companies (CDPCs), such as Primus Guaranty, are emerging as important participants in the burgeoning credit derivatives market, according to a new criteria report by Fitch Ratings.

Fed Governor: the US is not an outlier in regards to Basel II implementation

Governor of the Federal Reserve Susan Bies emphatically stated that the US is fully behind implementation of Basel II, dismissing criticisms that a delay in US implementation will give rise to global home-host issues and undermine the international Basel…

Markit to supply FSA with CDS pricing

The UK Financial Services Authority (FSA) has picked Markit to supply pricing information on credit derivatives.

Isda releases new CDS templates

Bankers welcome standard documentation for CDS on CDOs and on loans

Back to basics

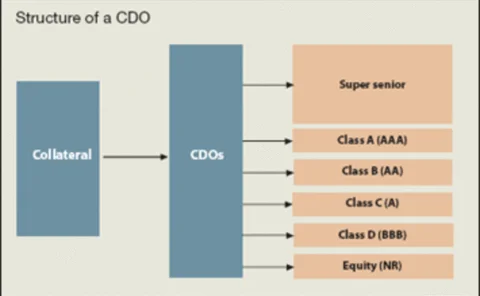

We take you back to the credit basics to review everything you thought you already knew but were too afraid to ask... Rob Pomphrett, head of structured product syndicate at RBC Capital Markets in London, explains how CDOs work

Correlation confusion

Retail Portfolio Risk

A saddle for complex credit portfolio models

Guido Giese applies the saddle-point approximation to analyse tail losses for very general credit portfolios, including correlated defaults, stochastic recovery rates, and dependency between default probabilities and recovery rates. The numerical…

Risk at the margin

Portfolio Margining

Laying the foundations

Credit Portfolio Management

Convergence on credit

Spurred on by Solvency II, insurance companies are refining their approach to managing credit risk. As a result, some insurers' credit risk management methods are beginning to converge with those favoured by banks. By Rachel Wolcott

New CDS documentation from Isda

The International Swaps and Derivatives Association has released standard documentation for three classes of credit default swap (CDS).

Dealers to launch standardised loan CDS documentation

A group consisting of 15 major dealers has announced that a standardised confirmation and settlement rider for the North American loan credit default swap (CDS) market will be finalised imminently.

Sponsor’s article > Pan-European Credit Data Consortium Case Study: Credit Data Pooling by Banks for Banks

Institutions seeking to apply the internal ratings-based (IRB) approach under Basel II are required to provide accurate estimates of their credit risks. However, most banks do not have enough internal data on default and recovery to calculate reliable…

Crossing the boundaries

trading technology

Looking before you leap

analysis: algorithmic trading and it

Industry gets energised

Attracting some 300 delegates, this year's Energy Risk USA conference was by far the biggest and most successful it's been since the fall of Enron, writes Stella Farrington