Credit risk

Guilty or not?

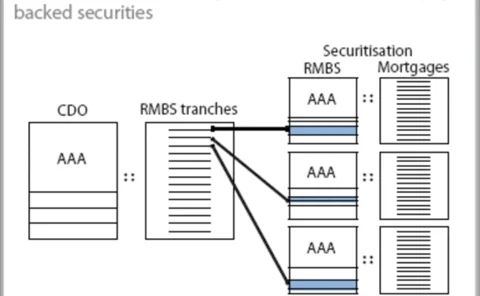

Rating agencies have been widely criticised for assigning AAA ratings to securitisations backed by subprime mortgages. Ashish Dev and Bo Qian argue that while the criticism is justified for some securitisation structures, there was a basis for assigning…

Revolving draws

As uncertainty cloaked the capital markets late last year, a number of corporates tapped committed revolving credit lines originally intended as backstop facilities. Could a potential surge in drawdowns affect banks already constrained by capital?…

US agriculture committee plans to ban naked CDSs

Daily news headlines

CDS: Mizuho tightens to 95bp as market slips wider

Credit default swaps 5-year mid-levels for structured products issuers (Thursday January 29)

CDS: US banks tighten again

Credit default swaps 5-year senior mid-levels for structured products issuers (Wednesday January 28)

US agriculture committee plans to ban naked CDSs

The US House of Representatives Committee on Agriculture has published a draft bill seeking to limit the holding of credit default swap (CDS) contracts to market participants owning the bonds of the reference entity in question.

CDS: European banks regain favour

Credit default swaps 5-year senior mid-levels for structured products issuers (Tuesday January 27)

CDS: Goldman Sachs, Morgan Stanley, BoA spreads tighten

Credit default swap 5-year senior mid-levels for structured products issuers (Monday January 26)

CDS: European banks widen

Credit default swap 5-year senior mid-levels for structured products issuers (Friday January 23)

CDS: Levels for Wednesday and Thursday flat ahead of the weekend

Credit Default Swap 5-year senior mid-levels for structured products issuers (Wednesday January 21 & Thursday January 22)

Cash-settlement auctions working, says Isda

The auction process for cash-settling credit derivatives trades has been tested recently but is working well, said Bob Pickel, chief executive of the International Swaps and Derivatives Association, at a symposium held by the organisation in New York on…

S&P unveils CDS indexes

Index provider Standard & Poor's Index Services (S&P) has launched three US credit default swap (CDS) indexes designed to evaluate the performance of the credit derivatives market.

S&P launches CDS indexes on US market

Index provider S&P has launched three S&P CDS US indexes, which are designed to provide exposure to the performance of the US credit default swap (CDS) market. The indexes can be used as underlyings for financial instruments such as structured products…

Buy-side firms scramble to meet novation deadline

Derivatives technology vendors have reported a significant upturn in activity among buy-side firms, looking to meet a February 28 deadline for processing all credit derivatives novation consents through electronic platforms.

CDS: RBS holds in at 124.3bp despite share sell-off

Credit Default Swap 5-year senior mid-levels for structured products issuers (Monday January 19)

CDS: Closing levels for January 16

Credit Default Swap 5-year senior mid-levels for structured products issuers (Friday January 16)

DTCC to publish more CDS data

The Depository Trust and Clearing Corporation (DTCC), the largest derivatives clearing house in the US, is to expand the data it publishes on the credit derivatives market.

Banks tighten conditions on revolving credit extensions

More stringent terms and conditions are being attached to revolving credit facilities (RCFs), although banks are still extending them to investment-grade corporates. Analysts and bankers agree that RCFs are becoming more expensive and smaller and will…

CDS: Citi tightens but remains wide at 346.2bp

Credit Default Swap 5-year senior mid-levels for structured products issuers (Thursday January 15 2009)

CDS: European banks stable; Citi levels overwhelmed by break-up plan

Credit Default Swap 5-year senior mid-levels for structured products issuers (Wednesday January 14 2009)

CDS: Santander leads widening

Credit Default Swap 5-year senior mid levels for structured products issuers (Tuesday January 13 2009)

Citi CDS blows wide on restructuring plans

Citigroup's credit default swap five-year senior mid level was at 370.1 minutes ago, marking a near 50% weakening from yesterday's New York close, when the paper was quoted by CMA DataVision at 262.9.

Ecuador recovery set at 31.375% in first sovereign CDS auction

The recovery rate for government bonds issued by the Republic of Ecuador was set at 31.375% today, in an auction to cash-settle sovereign credit default swap (CDS) contracts linked to the country's debt.

TriOptima CDS tear-ups cut risk by $30.2 trillion

Stockholm-headquartered technology company TriOptima has reported that its portfolio compression service, triReduce, eliminated $30.2 trillion in notional principal from the credit default swap (CDS) market in 2008.