Credit risk

Managing housing loan risk

Mortgage-backed securities

Internal risk rating systems for banks

Sponsored article

Trouble from above

Pension funds

JPM Merits CDOs

Credit tech

Commerzbank: kaput?

Credit of the month

Fuelling doubts

Violence and uncertainty in the Middle East have caused energy market volatility to soar, testing the mettle of even the most sophisticated corporate hedgers. Will it prove to be the last straw for the world’s ailing airlines? Navroz Patel reports

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net

Basel II and pro-cyclicality

The main argument for making regulatory capital requirements more risk-sensitive is to improve allocational efficiency. But this may lead to intensified business cycles if regulators fail to take measures to prevent such an impact. In this first column…

Super-senior risk buyer’s role seen as vital in managed synthetics

The future growth in managed synthetic collateralised debt obligation (CDO) deal-flow is dependent on the willingness of counterparties to sell super-senior risk protection to CDOs, said Jeff Huffman, a London-based executive director in Goldman Sachs’…

Read the small print

With prime brokers becoming an increasingly powerful force in the market, how closely should hedge fund managers examine the underlying agreements with their chosen provider?

Avoiding pro-cyclicality

David Cosandey and Urs Wolf argue that, for small to medium-sized enterprises, Basel II is pro-cyclical because of a double-counting of the risks. They present two main directions for possible capital rules that would circumvent the pro-cyclicality…

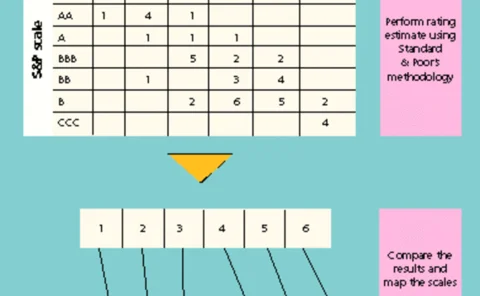

Credit risk systems: Getting the risk right

The requirements of the new Basel Accord are prompting some banks in Asia to begin implementing sophisticated credit systems, but there are still some obstacles to overcome.

Copula vulnerability

Counterparty credit risk

The credit risk time bomb

Insurers

PFE: ahead of its time

Modelling

Reinventing the market

Cashflow CDOs

CDS: the quest for neutral pricing data

Price data services

The credit risk time bomb

Insurers remain very keen to both guarantee and invest in credit derivatives products, but key regulators are about to release reports indicating that risk transfer between the insurance and banking sectors might not be such a good idea.

Credit’s secrets

Hedge funds