Risk magazine - Volume22/No2

Articles in this issue

Breath of Liffe

Amid fierce competition and regulatory scrutiny, the combined initiative by derivatives exchange Liffe and clearing house LCH.Clearnet for clearing credit default swaps was launched on December 22. Will the two companies have a first-mover advantage? By…

When hedge funds attack

The financial crisis has combined with catastrophic performances among hedge funds to decimate the fund derivatives industry, staunching new deal flow and causing many banks to pull out of the business. Mark Pengelly reports

The Rubik's cube of risk

The financial crisis has emphasised the need for integrated risk management and closer collaboration between trading desks and the middle office, covering market risk, collateral management, limits and counterparty risk exposure calculation. How well are…

Misery for municipals

A year on from the collapse of the auction rate securities market, short-term variable-rate financing in the US remains scarce. In 2009, municipal issuers face surging costs and low interest rates most can't access. By Peter Madigan

Perfect storm

The fall in equity prices, combined with a sharp drop in bond yields, has decimated the funding positions of pension schemes across the globe. With many companies tottering under the weight of ballooning pension deficits, could this be the spark for the…

Revolving draws

As uncertainty cloaked the capital markets late last year, a number of corporates tapped committed revolving credit lines originally intended as backstop facilities. Could a potential surge in drawdowns affect banks already constrained by capital?…

The danger of two cultures

A 50-year-old essay on the failure of communication between scientists and literary intellectuals might offer lessons for the future of modern finance, argues David Rowe

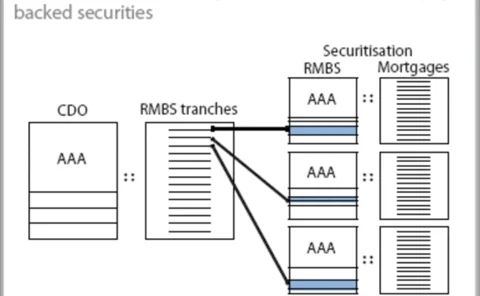

Guilty or not?

Rating agencies have been widely criticised for assigning AAA ratings to securitisations backed by subprime mortgages. Ashish Dev and Bo Qian argue that while the criticism is justified for some securitisation structures, there was a basis for assigning…

Credit solution

Many companies have used hedge accounting rules for interest rate hedges, but hedge accounting for credit risk is much less common. Dirk Schubert argues hedge accounting for this type of risk can be applied, and proposes a possible solution

All in Accord?

Klaas Knot, head of the Basel Committee's risk monitoring and management group, talks to Alexander Campbell

Being two-faced over counterparty credit risk

A recent trend in quantifying counterparty credit risk for over-the-counter derivatives has involved taking into account the bilateral nature of the risk so that an institution would consider their counterparty risk to be reduced in line with their own…

Robust asset allocation under model risk

Financial investors often develop a multitude of models to explain financial securities' dynamics, none of which they can fully trust. Model risk (also referred to as ambiguity) prevents investors from using the classical framework of expected utility…

Improving the risk governance process

Bill Schlich and Hank Prybylski expound on how and why an organisation-wide view of risk is still an aspiration for many banks

Shipping out

The shipping industry has suffered huge losses in recent months, with the Baltic Exchange Dry Index sinking 94% between May and December last year. What are the knock-on effects for the developing freight derivatives market? Christopher Whittall…

Fit for forex

A variety of online trading and analytics platforms are being offered by banks to their clients. Risk looks at the functionality and benefits of some of these systems. By Ryan Davidson

Hard times for metals markets

UBS topped the precious metals categories of this year's Risk commodity rankings, while Societe Generale won base metals, in a year dominated by volatile prices, illiquid markets and counterparty credit concerns. By Donna Haws, with research by Xiao-Long…

Hedge simple

Extreme shifts in foreign exchange rates have forced corporate treasurers to reconsider their hedging strategies. With currency volatility expected to remain high, many are shifting away from complex structures towards simpler approaches. By Ryan Davidson

All shook up

The financial crisis turned 2008 into an unforgettable year. The 2009 commodity rankings reveal those who triumphed despite adversity. By Roderick Bruce, with research by Xiao-Long Chen

Settlement settled?

The collapse of Lehman Brothers and other banks last year proved that settlement risk in the forex market has been greatly reduced. But while forex operational risk managers may be giving themselves a pat on the back, there are warnings that settlement…