Risk magazine - Volume20/No3

Articles in this issue

Mid-cap emerges

Equity derivatives

Data's destiny

Grid Computing

The stress-testing trident

While stress testing is a much discussed topic, an accepted definition of best practice remains elusive. David Rowe proposes a three-pronged approach

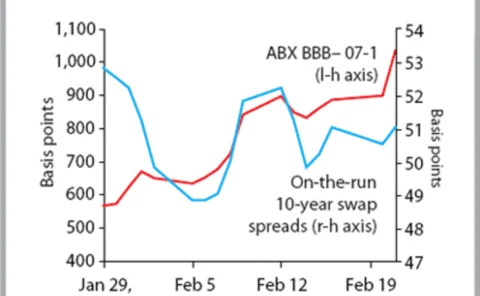

Under pressure

Interest rate swaps

The derivatives watchdog

Thomas Huertas, FSA director of wholesale firms, talks to Alexander Campbell

The power law

MasterClass

Sizing up skew

Structured products providers' methods for hedging skew are fairly homogeneous. Some banks, however, are searching for ways to refine their approach to hedging by transforming skew risk into an investment palatable to sophisticated investors. By Rachel…

Size constraints

Commercial real estate

The intrinsic currency valuation framework

Introducing the concept of the intrinsic value of a currency, Paul Doust shows how to use foreign exchange market volatilities to calculate the volatilities of intrinsic currency values and the correlations between them

Valuing inflation futures contracts

In recent years, futures contracts written on inflation (specifically, on the ratio of the consumer price index (CPI) level at two different times) have been introduced. Working within the Jarrow & Yildirim (2003) model, John Crosby derives formulas for…

Variance swaps under no conditions

Conditional variance swaps are claims on realised variance that is accumulated when the underlying asset price stays within a certain range. Being highly sensitive to movements in both asset price and its variance, they require a very reliable model for…

Ageing gracefully

Sponsor Statement

South Africa - The African frontier

Securitisation

Getting the balance right

Inflation

Regulators Comment

South Africa

South Africa - Looking to new heights

Inflation

In for the duration

Liability-driven investment

South Africa - Who's dropping the carry trade?

Foreign Exchange

A liability defined

Pension indexes

South Africa - Giving clarity

Hedge funds

Defending pensions

Profile

Pensions & life insurance

Introduction