Risk magazine - Volume 15 / No 11

Articles in this issue

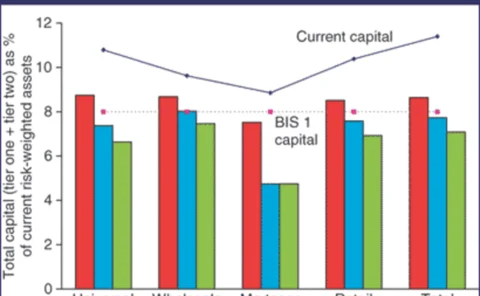

Basel II and pro-cyclicality

The main argument for making regulatory capital requirements more risk-sensitive is to improve allocational efficiency. But this may lead to intensified business cycles if regulators fail to take measures to prevent such an impact. In this first column…

The beta-blocker

Doug Dachille, chief operating officer at Zurich Capital Markets and formerly global head of proprietary trading at JP Morgan, believes the economic downturn has finally crystallised investor attention on beta. Christopher Jeffery reports

Banding together for SME credit risk analytics

Germany’s banking associations are taking a leading role in getting the country’s fragmented banking sector ready to comply with the Basel II capital Accord. Germany’s savings banks association, in particular, says it has internal ratings-based systems…

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net

Fuelling doubts

Violence and uncertainty in the Middle East have caused energy market volatility to soar, testing the mettle of even the most sophisticated corporate hedgers. Will it prove to be the last straw for the world’s ailing airlines? Navroz Patel reports

Job moves

QUOTE OF THE MONTH “I believe that of all large German banks Commerzbank has the best risk management system” Wolfgang Hartmann, chief risk officer at Commerzbank Source: Risk, November

Letter to the editor: a response to Cosandey and Wolf’s Avoiding pro-cyclicality

From Thomas Garside, managing director, finance and risk management, and Christian Pedersen, senior manager, Oliver, Wyman & Company, London

Reaping integration rewards

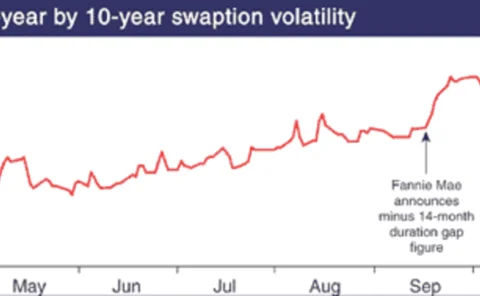

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…