Risk magazine - Oct 2022

In this collection: liability hedges hit by early collateral winter; our latest rates scenarios analysis; buy-side traders talking rates; and much more

Articles in this issue

Pension funds foresaw margin meltdown (a decade ago)

Years of warnings went largely unheeded. Questions may now spread to post-crisis clearing and margining project

UK pensions hit with £100m margin calls as gilts and sterling slide

At least three LDI managers request emergency capital as others consider unwinds to avoid default

CVA exposures to UK corporates jump ‘hundreds of millions’

Dash for credit protection triggered a doom loop in the CDSs of cross-currency swap counterparties

BoE intervention whipsaws pension funds that dumped hedges

Unhedged funds saw liabilities rise by up to 20% when rates pulled back

Pension funds brace for end of BoE intervention

Funds boost collateral buffers by as much as 300bp, as October 14 deadline looms

Markets mull UK pension clearing exemption

Treasury expected to extend regulation exempting retirement funds from having to clear OTC trades

UK pensions may struggle to capitalise on fully funded status

Bond yield spike reduced liabilities, but schemes need to sell illiquids at markdown to offload risk

Pensions with other LDI investments quicker to make margin calls

Columbia Threadneedle says funds invested in internal strategies moved collateral immediately, but outside transfers took time

Esma to meet with clearing industry over EU energy crisis

Widening eligible collateral on table; ECB intervention would need government indemnities

Banks face capital hit on broader energy market collateral

Non-standard clearing house margin for energy trades would increase RWAs unless relief granted

Margin costs leap on Simm rejig and rates hikes

Acadia finds roughly one-third jump in exposure following Simm recalibration, with higher funding costs adding to burden

Could a cold collateral winter be coming for pension plans?

UK LDIs passed an early test from rising rates, but margin call pressure is mounting

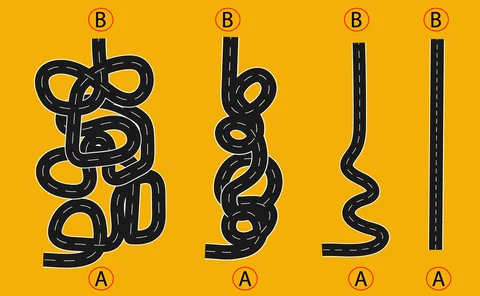

Interest rate scenarios: skinny-dipping with the Fed

As US rates march upwards, Risk.net readers offer deeply diverging forecasts on the impact for markets through to 2024

It’s amateur hour: how retail traders upended options market

Cutting-edge data shows non-professionals are driven by news events and desire to make a quick buck

Looming slowdown casts doubt on countercyclical capital

Confusion over use of buffers makes bankers wonder if concept will ever be successful

Lag in the SOFR-linked non-linear derivatives market: three barriers to transition

Risk.net explores three themes in SOFR non-linear derivatives discussed by experts in a webinar sponsored by Numerix

Talking Heads 2022: Rates market ruckus

Inaugural interview series looks at how sell-side traders are adapting to a world of surging inflation and rates

How Citi is handling topsy-turvy rates markets

Talking Heads 2022: Rate hikes and inflation have forced a rethink of the US bank’s hedging strategies

Goldman’s rates traders have been crowd-watching

Talking Heads 2022: Steepener unwinds in sterling were “canary in the coalmine”, says rates trading co-head

Barclays confronts ‘implausible’ macro risks

Talking Heads 2022: Bank is reaping rewards of sticking with its trading businesses, says macro head Lublinsky

A child of inflation: BNPP’s new macro trading unit

Talking Heads 2022: Currency and rates traders join forces at French bank as it plans to bring FX algos to US Treasury bonds

StanChart tackles US-China rates divergence

Talking Heads 2022: Policy changes have upended correlations in emerging markets, says rates head Lettich

EBA eyes top-down stress test for credit risk

European version of CCAR is off the table, but more projections are likely to be modelled by regulator

A chilly reception for climate risk capital

Bankers don’t believe climate-adjusted risk-weights will enter EU prudential framework – not for now, at least

Don’t fear the repack: why banks will retain inflation swaps role

Counterparties’ increasing use of direct trades does not spell end of intermediation

Keep risk parity simple, stupid

In times of volatility, simpler risk parity strategies may outperform more elaborate counterparts

CFTC backs banks in tussle over clearing house governance

CME and Ice will need to pay more attention to clearing members on risk committees

Europe’s regulators play ‘time the downturn’ with CCyB

Indicators justify hikes in countercyclical capital buffer, but shock-driven recession looms large

$899m margin breach at FICC’s mortgage unit

Three-day move in TBA prices on June 9 triggered second-highest backtesting deficiency to date

Europe’s countercyclical buffers buck recession trends

Almost half of EBU’s members have set out CCyB hikes; five plan two or more before mid-2023

Client margin at Credit Suisse shrinks to just $25m

Required funds for swaps meet same fate as F&O trades, as exit from prime services continues

Bailed-out Uniper suffered €14bn derivatives markdown in H1

Company cut value of gas forwards contracts due to risk of reduced deliveries from Russia

EU dealers’ IRC charges surge on debt market jitters

Santander and Natixis among hardest hit, with charges up 117% over first six months of the year

European banks set for 17.5% capital hike under Basel III

Output floor could account for almost half the increase in Tier 1 capital requirements by 2028

Data-driven wrong-way risk

A calculation method for regulatory CVA wrong-way risk based on credit and exposure is introduced

Automatic implicit function theorem

New technique can improve use of adjoint algorithmic differentiation in calibration problems

Deep calibration of rough volatility models

Rough vol models are calibrated and fitted to SPX and Vix smiles

Terrance Odean on the $2.8bn catch in zero-commission trading

Berkeley professor’s research on the true cost of retail trading has caught the eye of regulators