Europe

Germany tells EU to PFOF

Proposed ban might need to be dropped to prove practice is harmful

EU banks decry threat of capital hit to UK CCP exposures

EBA says supervisors could apply charges to “excessive exposures” of euro derivatives at all non-EU clearing houses

Ice Clear Europe hit by $1.03bn margin breach

The CCP’s futures and options division reported its second largest IM breach ever in Q4, as energy prices skyrocketed

Offshore waves: how the ruble is becoming a painful trade

As liquidity dries up in markets affected by sanctions, trading is shifting from electronic venues

In roiling markets, fraud rises. Banks want to understand why

Disruption from Ukraine and Covid puts managers on alert for misconduct, as risk controls are stretched to the max

Germany fights for neobrokers’ PFOF rights

Leaked document shows Germany wants to protect ‘anti-competitive’ practice

EU banks kept building Russian exposures as sanctions loomed

Latest EBA data shows the bloc’s lenders cut holdings of government debt securities, but increased commitments to private sector

This is going to hurt: EU-prescribed OTC tape is no cure-all

Market participants sharply divided on utility of a consolidated tape to record OTC derivatives trades

LCH turns to central banks in rejig of liquidity pools

Central bank balances hit all-time high, despite aggregate fall in liquidity buffer in Q4

EU banks racked up VAR breaches in 2021

Crédit Agricole and ING Bank hit with higher multipliers after exception count rises

Funds forced to estimate value of Russian securities

Western asset managers can sell Russian shares from April 1. But they have to value them by March 31

Ucits’ clash with IM rules could cause collateral damage

Strict collateral reuse guidelines may restrict popular investment vehicles’ hedging capabilities

Climate is changing for derivatives valuation adjustments

Banks back increased use of global warming criteria when calculating XVAs

EC looks to force market’s hand in euro clearing battle

Industry exasperated as commission proposes new mandates and capital penalties for banks clearing in London

EU trading venue definition could crush innovation, fear bank execs

Widening scope of regulated firms could undo progress in fixed income electronification and increase costs

ETF issuers face dilemma with frozen Russian funds

To liquidate or not to liquidate? BlackRock, VanEck and Lyxor risk lawsuits if they wind down ETFs

Op risk data: Allianz dealt a $4bn blow for not-so-Alpha Funds

Also: Credit Suisse cops two cartel shops; banks get slapped in gender pay gap. Data by ORX News

Banks: sanctions evasion driving rise in money laundering risk

Attempts by oligarchs to siphon cash out of Russia sparks heightened scrutiny of AML alerts

Goldman exec: rogue algos could spark ‘systemic’ crashes

Device proliferation and digital assets also altering risk environment, says Europe op risk head

Net zero banks playing catch-up in ECB climate review

Banks that aim to align to Paris Agreement still fall short on climate disclosures

On Russia, finance needs to find its moral compass

The looming risk of big write-offs should prompt investor rethink

Energy firms call for central bank support to cover margin spikes

EFET warns energy market participants risk being unable to meet “unprecedented margin requirements”

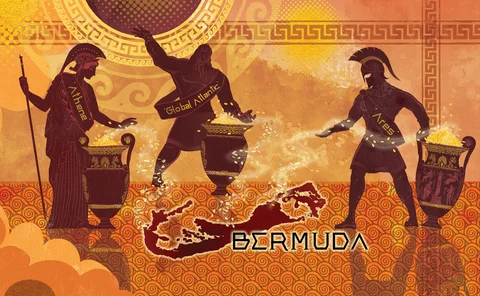

Apollo, KKR, Ares and the Bermudan CLO arbitrage

‘Capital efficiency’ may explain a 1,100% surge in life assets reinsured on the Atlantic island

How Russian stocks still meet EU rules for ‘good governance’

Loose SFDR definitions leave room for Russian state-owned firms to remain in article 8 funds