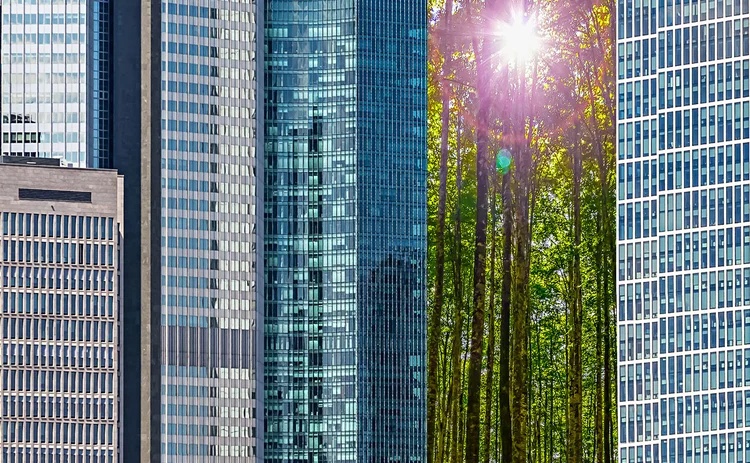

Climate is changing for derivatives valuation adjustments

Banks back increased use of global warming criteria when calculating XVAs

When pricing new long-dated derivatives contracts, dealers are increasingly factoring in how climate change will affect their counterparties’ underlying business. To incorporate this additional risk, firms are developing new valuation adjustment methods.

The trend follows the publication last year of a paper by Chris Kenyon, head of quantitative innovation and valuation adjustment quant modelling

Only users who have a paid subscription or are part of a corporate subscription are able to print or copy content.

To access these options, along with all other subscription benefits, please contact info@risk.net or view our subscription options here: http://subscriptions.risk.net/subscribe

You are currently unable to print this content. Please contact info@risk.net to find out more.

You are currently unable to copy this content. Please contact info@risk.net to find out more.

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net

More on Markets

CME outage sparks FX soul search

How November’s halt exposed fragile wiring of new futures-led market structure

CME outage exposed FX market’s futures dependency, says SNB

Study finds EUR/USD spreads widened eightfold as non-bank PTFs blew out by nearly 30 times in November halt

CME rankles market data users with licensing changes

Exchange began charging for historically free end-of-day data in 2025

Gap risk fears push FX traders into Sunday-night Asia hours

Volumes surge at Singapore open as Trump’s weekend announcements force early risk management

BBVA joins growing Spire repack platform

Spanish bank becomes 19th dealer on multi-bank SPV issuer amid rising investor interest

ISITC’s Paul Fullam on the ‘anxiety’ over T+1 in Europe

Trade processing chair blames budget constraints, testing and unease over operational risk ahead of settlement move

Integration strengthens e-trading in persistently volatile markets

Survey reveals that traders are grappling with daily volatility, while technology outranks liquidity as the top market structure concern

How Optimal aims to shake up US retail options trading

New wholesaler has assembled a team of market-makers to compete with Citadel, IMC/Dash and Jane Street