The Americas

Repo stress drove 2025 SOFR-to-fed funds swap pivot

SOFR OIS volumes slipped to almost half of fed funds activity during September repo spikes

Real money investors cash in as dispersion nears record levels

Implied spreads were elevated to start 2026. Realised levels have been “almost unprecedented”

JP Morgan gives corporates an FX blockchain boost

Kinexys digital platform speeds cross-currency, cross-entity client payments

Fannie, Freddie mortgage buying unlikely to drive rates

Adding $200 billion of MBSs in a $9 trillion market won’t revive old hedging footprint

How US shutdown set off long-awaited basis bet

Hedge funds dust off a years-in-the-making relative value trade to profit from fallback mismatch

FXSpotStream expands into US Treasuries trading

Bank-owned streaming venue targets mid-year launch, offering “all you can eat” subscription fees

Non-cleared derivatives margining jumps after framework rollout

Margin-to-notional ratio trails early regulatory estimates

Deutsche Bank returns to US swaps client clearing

Re-entry comes after Basel III endgame proposals sparked capacity concerns among global clients

Collateral velocity is disappearing behind a digital curtain

Dealers may welcome digital-era rewiring to free up collateral movement, but tokenisation will obscure metrics

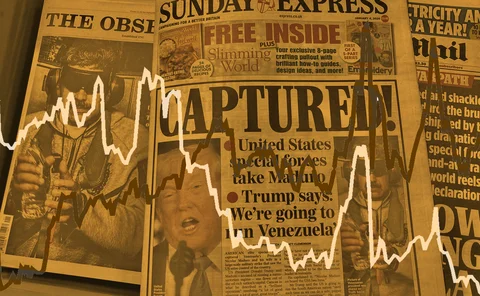

Trump’s LatAm gambit spurs FX hedging rush

Venezuela op boosts risk reversals as investors look to protect carry trades

US insurers turn to short-dated FX forwards as notionals rise

Counterparty Radar: Trades under three months make up nearly 60% of total positions, up from just a third in 2022

Who is Selig? CFTC pick is smart and social, but some say too green

Colleagues praise crypto smarts and collegial style, but views on prediction markets and funding trouble Senate

Equity derivatives house of the year: JP Morgan

Risk Awards 2026: Volatility strategies and technology investment help realise hyper scale-up

LSEG adds market risk optimisation for FX options

Tool attracts eight dealers and could be expanded to rates and equity options

Tomorrow’s Quants: what it takes to be a next-gen modeller

Employers increasingly prize mix of hard and soft skills, Risk.net survey reveals

Dealers prep for year-end equity financing surge

Cost of funding equity derivatives bets blew out to 227bp in 2024 and is ticking higher again

Pimco piled into euro put options in Q2

Counterparty Radar: EUR/USD buying spree takes Pimco’s FX options book to $7 billion

Banks grapple with Fed’s double deadline on stress-test plans

Supervisor consulting simultaneously on next year’s test scenario and broader model changes

Crypto ETFs gatecrash the US Treasury repo market

Counterparty Radar: Volatility Shares tapped $13 billion in repo funding in Q2

Row breaks out over cause of FX settlement fails

One European bank blames T+1 for a 50% jump in FX fails, but industry groups dispute the claims

XTX alleges Currenex entered own trades ahead of users

Market-maker claims venue used triangular arb tool to trade before users