Standard & Poor’s

Large banks safer for CCPs than they get credit for

Plentiful pre-positioned liquidity softens the blow of resolution, new research argues

Risk Technology Awards 2022: No oil painting

After years of relative peace, the risk landscape has turned ugly. This year’s winners of the Risk Technology Awards weigh the challenges facing their clients

Good citizenship can signal better creditworthiness – study

Environmental and social behaviour predicts credit ratings in North America – less so in Europe

Scared of fallen angels? So are the rating agencies

Data shows rating agencies more reluctant to downgrade firms at the investment-grade boundary

Banks join forces on model development utility

Crisil is working with HSBC and three other banks on platform to share model-building tools

S&P resists mapping new China onshore ratings to global scale

Uncertainty over state support and accounting prompts agency to keep Chinese ratings separate

Sovereign risk weights cannot wait

Why reform of Basel rules is urgent – and how to improve on December 2017 proposals

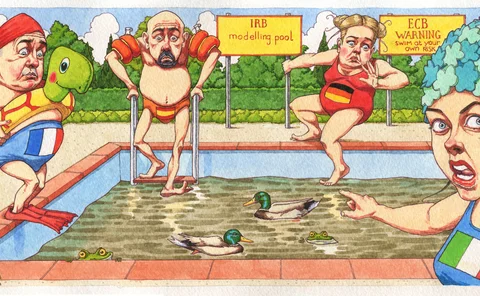

Pooled resources offer way to keep credit models afloat

Supervisors drive banks to seek more corporate default data and cost-effective model improvements

Brexit, EU regulation and a new benchmark

The week on Risk.net, July 28-August 3, 2018

Investors cheer debut Fannie SOFR note launch

Healthy demand could have been higher if S&P had approved benchmark

The DIY approach to China bond investing

Lack of international ratings means foreign investors will need research resources of their own

China TLAC uncertainty frustrates capital planning

Banks face $1 trillion issuance crunch if regulators take too long to define bail-in debt

Esma's Mifir endorsement of ISIN identifiers questioned

Markit and Bloomberg claim Red codes and Figis should be used for trade reporting

DBRS and Fitch consider bail-in boost for swap ratings

If agencies follow Moody's lead, S&P would be isolated

Granger-causal nonlinear financial networks

This paper aims to quantify cascades of price movements in financial markets. It considers nonlinear lead-lag effects with stocks in the S&P 100 as nodes, and it also looks at directed links between the stocks identified through Granger causality. The…

Questions remain about China banks' TLAC exemption

China is one of only two Asian countries with G-Sibs – but unlike Japan its banks can sidestep TLAC

'Santa Claus' equity market rally given credence by S&P

December is roughly four times more profitable than the average month, finds research

S&P court loss in Australia unlikely to spark rival claims

Standard & Poor's found to owe duty of care with CDO ratings

Credit fears hold back US solar securitisation deals

SolarCity deals show potential and pitfalls of new asset class