Scotiabank

Stressed liquidity flows swell at Canadian banks

Derivative and repo activity push up LCR cash flows at RBC, TD and Scotiabank

FRTB may bite harder for Europe’s CVA modellers

Farther reach of advanced approach and lighter load on total requirements mean limited takeaways from Canada and Japan’s implementation

A peek under the hood of Canadian banks’ new CVA machine

Disclosures from the country’s top dealers offer first glimpse of how FRTB reforms can reshape capital gauge for potential losses on derivatives

Impaired loans surge at Canadian banks

RBC leads increase with soured C$1.5bn utility loan

Default and credit spread risks drive Canadian banks’ FRTB charges

New Basel III disclosures give first glimpse into market risk mix after internal models retirement

RBC’s CVA risk charges swell 42% in first year under FRTB

Bloating RWAs contrast with declines at peers employing new standardised approach

Scotiabank pivots to standardised approach for securitisation exposures

Risk-weighted assets under SEC-SA jump 450% in three months to end-July

Canada’s top dealers boost derivatives clearing as FRTB kicks in

BMO, RBC and TD Bank cleared record C$45.1 trillion in notionals in Q1

Canadian banks’ market RWAs spike on FRTB switch

CIBC, TD Bank and Scotia saw end-January charges jump amid overall ditching of internal models at Canada’s Big Five

No Canadian banks using internal models as FRTB kicks in

One bank still plans to adopt IMA after delays prevented it going live in January

At Canada’s Big Five, impairments keep creeping up

BMO leads the group with bad loans up 39% quarter on quarter

Impaired loans surpass pandemic peaks at CIBC, Scotiabank

At five Canadian banks, troubled loans up 40% year-on-year

Danske, Deutsche and PNC pin SVAR to Covid-19

Most global banks continue to use the global financial crisis to stress-test their portfolios

RBC lifts CET1 ratio by 80bp with model parameter update

Reclassification of small business clients carves out C$26 billion of credit risk

End of SVAR relief hikes market risk at Canada’s ‘Big Five’

Market RWAs increased by C$13.9 billion over the three months to end-July

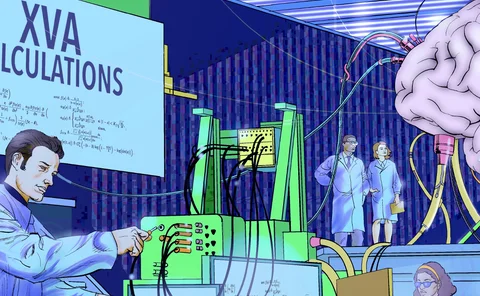

Deep XVAs and the promise of super-fast pricing

Intelligent robots can value complex derivatives in minutes rather than hours

At TD and RBC, higher deposits weigh on LCR

Higher net cash outflows in Q2 keep liquidity coverage pressures up

Canada’s top banks cut loan-loss provisions by $1.2bn

The decrease in set-asides represents a 92% fall quarter on quarter

At Canada’s ‘Big Five’, counterparty and op RWAs grew in 2020

Credit, market RWAs ebbed over the year

Big Five Canadian banks’ provisions doubled in pandemic year

However, over three months to end-January, set-asides dropped dramatically

Technology innovation of the year: Scotiabank

Risk Awards 2021: New risk engine can run nearly a billion XVA calculations per second