JP Morgan

Amid Covid crisis, top US banks give $32bn away to shareholders

Buybacks exceeded Q1 2019 total, despite voluntary suspension on March 15

Systemic US banks put aside $25bn for credit losses in Q1

JP Morgan took a $8.3 billion provision, the most of the eight G-Sibs

Top US banks issue $35bn of SOFR-linked debt in 2020 to date

Citi leads on notes placed year-to-date

FVA losses back in spotlight after coronavirus stress

Three US banks suffer combined loss of almost $2bn after rates and funding double whammy

JP Morgan takes $951m XVA hit

Funding spread widening blamed for majority of Q1 hit

Fed missed chance to curb dividends, say ex-supervisors

Instead, changes to stress capital buffer and TLAC rules would allow larger payouts

Fed action fails to dampen spreads for riskier credits

Borrowing costs for some issuers are still two to three times the historical average

US banks stand apart as top lenders cancel dividends

Capital savings would equal 3% of end-2019 aggregate total if payouts suspended

CECL delay grants mid-sized US banks a capital windfall

Synchrony, Huntingdon and Citizens among those to reap most CET1 relief

Wells Fargo led top US banks on CMBS risk in 2019

Commercial mortgage-backed securitisations are struggling amid Covid-19 crisis

Energy Risk Commodity Rankings: Uncertain times

The winners of Energy Risk’s Commodity Rankings overcame some tumultuous times in 2019, learning lessons that are certainly required in today’s volatile environment

Bankers say discount window is imperfect fix for UST woes

Further changes advocated to ensure Treasuries are used in US bank liquidity buffers

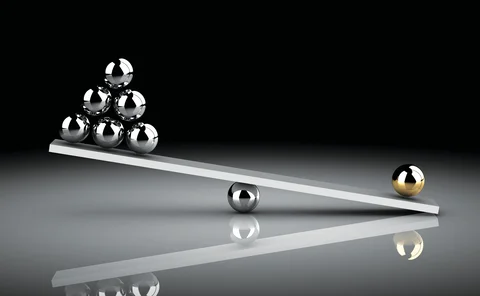

Top US banks’ buyback freeze to bolster capital above $30bn

Suspension will save the equivalent of 4% of aggregate CET1

Banks rail against China CCPs’ loss-sharing policy

Controversial loss allocation technique remains unused during recent market routs, but banks want it banned

Systemic US banks shed more than $7trn of non-cleared swaps in 2019

Cleared notionals stay flat on the year

US G-Sibs urged to release surplus liquidity to fight virus sell-off

Top banks have about $378 billion of extra HQLA that could be released

Systemic banks could free $156bn of capital after Fed plea

Banks asked to use management buffers to support economy in combating coronavirus

US banks’ systemic footprints grew in 2019

Balance sheet growth lifts systemic risk scores

Aggregate LCR of systemic US banks edged lower in 2019

Net cash outflows increased at a faster pace than HQLA last year

Leverage is underestimated

Off-balance sheet funding is large, rising and not fully accounted for in leverage metrics

Over two years, top US banks’ capital fell 5%

Stress capital buffer could reduce CET1 a further $40 billion

Apac CCPs: we’ve come a long, long way together

Members still gripe about arcane policies, but risk management fundamentals are strong

Citi shed over $32bn of counterparty exposures in Q4

Risk-weighted assets for CCR exposures dropped -12%

E-trading takes hold for FX swaps – sort of

Bulk of trades are being executed over screen, but bolder changes have stalled