European Commission (EC)

EU banks decry threat of capital hit to UK CCP exposures

EBA says supervisors could apply charges to “excessive exposures” of euro derivatives at all non-EU clearing houses

Germany fights for neobrokers’ PFOF rights

Leaked document shows Germany wants to protect ‘anti-competitive’ practice

This is going to hurt: EU-prescribed OTC tape is no cure-all

Market participants sharply divided on utility of a consolidated tape to record OTC derivatives trades

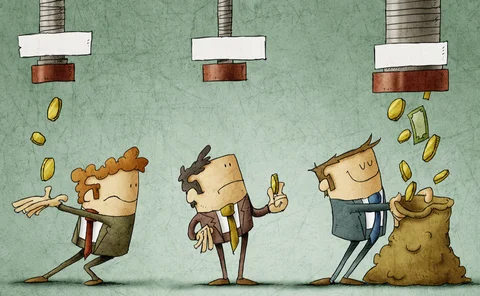

EC looks to force market’s hand in euro clearing battle

Industry exasperated as commission proposes new mandates and capital penalties for banks clearing in London

How Russian stocks still meet EU rules for ‘good governance’

Loose SFDR definitions leave room for Russian state-owned firms to remain in article 8 funds

Banks, CCPs protest Esma’s ‘prescriptive’ procyclicality rules

Dealers welcome model transparency push, but call for greater say on methods to combat spikes

Smaller EU nations stare down giants in capital floor standoff

EU member states clash over severity of internally modelled output floors for cross-border bank groups

Leaked EU doc shows pushback on cross-border trading ban

Member states propose loosening European Commission’s CRD draft to varying degrees

In U-turn, EC extends euro clearing consultation deadline

Responses to over 200 questions on the future of euro clearing must now be submitted by March 22

EC ignores pleas to extend clearing consultation deadline

Despite industry appeals for more time on EU-wide clearing consultation, EC refuses an extension

EU lawmakers’ demand for local capital floors alarms banks

Multiple output floors applied to each entity raises fears of capital increase for large groups

FRTB capital quirk for sovereign bonds bewilders banks

EU treatment of govvies under internal models is worse than standardised approaches

Market begs EC for more time to mull euro clearing proposals

Firms given one month to respond on wide-ranging consultation around relocation of euro swaps

Rabobank sees 5–10% RWA inflation from Basel III

Dutch mortgage floor and other model curbs set to accelerate reforms’ impact

SSA risk manager of the year: European Commission

Risk Awards 2022: EC debt programme skyrockets to fund recovery package of up to €800 billion

RWA increase puts ABN’s core ratio closer to Basel III estimate

Higher RWAs shrink gap between actual and pro forma ratios

EU regulators warn Basel III deviations could last forever

CRR III allows European Commission to extend transitional rules for SA-CCR

Market halts clearing shift to Eurex ahead of EU consultation

Participants hit ‘pause’ after proposed three-year equivalence extension for UK clearing houses

Blockade or blunder? Enigma of EU cross-border trading ban

Drafting errors and lawmaker’s comments leave industry perplexed about controversial new rules

Planned EU cross-border trading ban to hit most large markets

Most major jurisdictions currently provide either interdealer or client exemptions

EU looks to close Brexit escape route from ECB supervision

Changes to capital regulation would stop national rulebook arbitrage deployed post-Brexit

New branch rules threaten Japanese banks’ EU plans

Draft CRR III may cause foreign banks to think twice before expanding in the EU

Spanish regional bank’s CVA charge up 30-fold on SA-CCR

Banco de Crédito Cooperativo saw end-June charges balloon the most year-on-year across a sample of 120 European banks

Europe swap dealers eye London return post-Brexit

Proposed Mifid exemption paves way for BNP Paribas, SocGen and Deutsche to trade swaps on UK venues