European Commission (EC)

EU’s Brexit clearing grab slow to lift off

Clearing members say clients aren’t transferring material volumes from LCH to Eurex rapidly

Why a European bad bank may not be the right answer

Types of loans most likely to become distressed due to coronavirus don’t suit EU-wide solution

Synthetics sweetener teases European banks

As structural woes resolve, regulators remain split on preferential capital treatment for STS deals

EU banks expect further margin reprieve for equity options

Exemptions for intra-group and equity options from non-cleared margin rules expire by January 2021

EU urged to pass permanent market risk capital relief

Council agrees temporary changes, but ECB’s Enria wants legislators to trust supervisors

EU Parliament ‘likely’ to allow market risk capital relief

MEPs propose allowing supervisors to temporarily exclude Covid-related backtesting exceptions

ECB’s Enria unsure banks will dip into capital buffers

Anxiety over investor and rating agency reaction may limit banks’ use of Covid relief measures

ECB lays foundations for climate risk capital charge

New guide will influence capital management, but pillar two charges likely to await EBA report

Spot FX shies away from regulatory yoke

As Europe weighs Aussie-style rules for spot trading, some see benefits – but many fear the burden

Leverage ratio squeeze hits options trades

With clearing banks constrained by leverage limits, prop traders fear options market lockdown

EU ‘non-paper’ reveals new effort to delay CCP open access

Negotiations on CCP recovery and resolution could provide a route to postpone Mifid rule

Leaked EU document casts doubt on leverage ratio relief

Several MEPs oppose leverage exemption for sovereign bonds, but some want SA-CCR fast-tracked

Regulatory lenience over Covid-19 must be carefully judged

Former ECB supervisory board member says unwinding regulatory relief later will take courage

Debelle: regulation could be ‘helpful’ to FX code

As EU weighs regulation of spot market, GFXC chair dismisses key industry argument

EC: No plans to delay IM phase five

EC official says Europe will go ahead with phase five initial margin requirements set to come into effect in September

Spot FX could be dragged into Mifid II

EC tells Risk.net it is studying Australian-style approach to regulating currency trading

Of rats and men: would member compensation imperil CCPs?

CCPs and members split over whether compensation after default losses is moral hazard or fair

Why bankers should embrace the Brexit political theatre

Treating equivalence as purely technical might not have the outcome that financial firms want

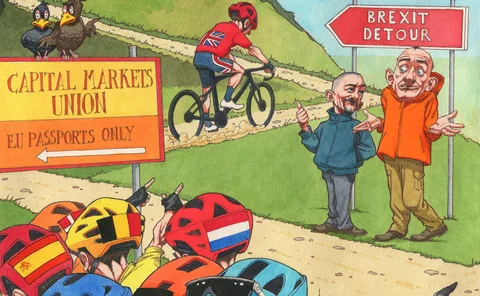

The UK’s path to EU equivalence: détente or detour?

Race to meet post-Brexit cross-border trading requirements will go down to the wire

CME, Eurex rebuff calls to compensate members for losses

BlackRock and BNP want CCPs that recover from a default to reimburse members and clients

Synthetic Libor faces legal obstacles

EU benchmark rules may thwart ‘tough legacy’ fix, reviving calls for blanket legislation

New Mifid equivalence rules leave UK firms in limbo

Revised market access rules won’t kick in until six months after UK leaves single market

EBA: end ‘tick box’ approach to money laundering in EU

First EBA report on national supervisors’ AML/CFT approach finds many agencies failing to co-operate

Non-EU hedge funds stage surprise escape from SFTR

European Commission clarifies scope of reporting obligation that confused many in the industry