Eurex Exchange

Industry to make 11th hour plea over Emir scope

The EU council text of Emir could be voted through next week, but a group of industry associations will plead for a late - and controversial - change

Mifid draft resuscitates CCP open access battle

CCP open access debate rears its head once again in draft rules spun out of Mifid

SFOA conference: Eurex supports central bank access for CCPs

Derivatives clearing houses should be able to rely on central bank liquidity support, says Eurex exec at SFOA annual conference

On the move

On the move

Derivatives users face tough choices on CCPs

A clear path?

Deconstructing Emir

Deconstructing Emir

European politicians row over scope of Emir

Challenging Emir

European legislators squabble over Emir

The derivatives catch-all

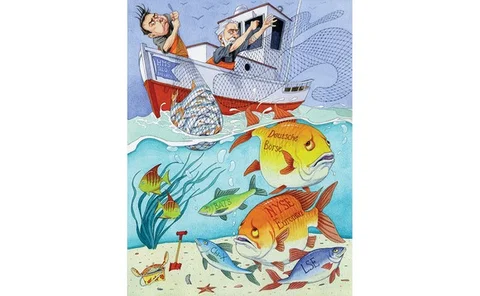

Draft European clearing rules threaten Eurex business model

Analysts warn Council of the European Union proposals could hurt trading revenues at Eurex, as its owner, Deutsche Börse, pursues merger talks with NYSE Euronext

Best ETF provider

Structured Products Europe Awards 2010

Eurex move ignites multiple CCP debate

Eurex move ignites multiple CCP debate

MTS recruits new head of markets

MTS recruits new head of markets

Eurex freezes marketing of CDS clearing

Eurex has halted the marketing of its credit default swap (CDS) clearing operation after failing to attract sufficient business, Risk understands.

Dealer-led market may be disrupted by Dodd-Frank

Banks could lose margins and competitive edge as a result of derivatives reforms in Dodd-Frank Act

Dividend rout blamed on hedge fund short positions

Some bankers say hedge funds are behind the dramatic fall in dividends on May 7

Buy side steers clear of CCPs

Regulators have pushed hard to ensure buy-side firms are able to access central counterparties since the crisis began. But despite the launch of several new services, very few buy-side participants are actually using them. By Mark Pengelly

Dealers warn of risks of forced allocation in OTC clearing

Clearing houses could cause large losses for their members if they don't put limits on portfolio allocation, dealers think.

Dividend growth

Dealers and hedge funds were hammered by sharp falls in dividends during late 2008 and early 2009. Since then, liquidity has recovered as a wider range of market participants take advantage of the dislocation. Mark Pengelly reports

Commodity focus: Eurex is Entering the Commodities Space

Ralf Huesmann, Product Strategy, discusses Eurex’s increased activity in alternative asset classes as market trends change and appetites increase

Eurex cuts no Ice

The July 31 deadline for central clearing of credit default swaps in Europe was successfully met by dealers and clearing platforms. Both Eurex and IntercontinentalExchange have launched clearing services in Europe, but take-up for Eurex’s has so far been…