Basel Committee on Banking Supervision (BCBS)

FRTB: ECB postpones model approval deadline

Postponement follows Basel’s decision to revise key elements of new market risk framework

Fed’s Curti: SMA will smooth capital mismatches

OpRisk North America: non-US banks holding less capital under own-models approach was “a big problem”, says regulator

Basel to scrap automatic fails for P&L test

“Amber zone” will protect near-miss desks, but regulators not convinced by NMRF complaints

Global fragmentation looms in FRTB data pooling stand-off

Smaller banks unwilling to hand over localised trade information to data utilities

European FRTB capital charges hang by a thread

EU Council mulls introducing only reporting requirements in CRR II, or a very low scalar

Not waiving but drowning: EU banks face capital traps

Council and some MEPs try to kill cross-border capital and liquidity waivers in CRR II

Banks make new push on FRTB’s P&L test

Industry calls for series of changes as regulators prepare new consultation, says Nomura’s Epperlein

Basel liquidity rules block Fed’s QE exit

LCR and NSFR could produce $1 trillion shortfall in plans for balance-sheet ‘normalisation’

US clearing banks still push for leverage ratio IM offset

Potential cut in ratio and adoption of SA-CCR not enough to stop shake-out, FCMs warn

Pillar 2 moves to centre stage for op risk capital

US banks set for sharp falls in Pillar 1 requirements, but regulator-set add-ons cloud SMA’s impact

Three ways to improve stress testing

Better scenario choice, iterative testing and top-down approaches could improve performance, says Ahraz Sheikh

FRTB: banks grapple with hard-to-model risks

Swiss, UK bank efforts to comply with regulators’ risks-not-in-VAR rules may be undone by transition to FRTB

Op risk modelling to survive move to SMA

Models will still be needed to measure forward-looking risks under Pillar 2

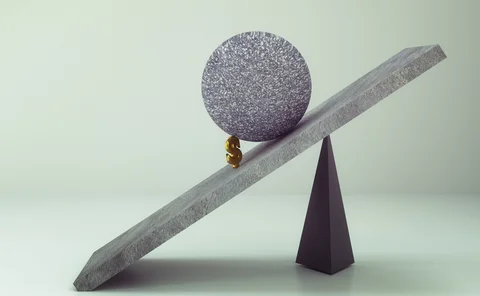

Tranche warfare: uphill struggle for euro safe bonds

Junior tranche and regulatory impasse are key challenges for pan-eurozone sovereign bond-backed securities

No carve-outs in Fed’s revised leverage ratio proposal

Holdco leverage ratio will fall, but initial margin and custody funds still in scope

JP, Citi may not see capital benefit from new op risk rules

Collins floor may also prevent Morgan Stanley, State Street and Wells Fargo from realising SMA savings

Revised Basel output floor could hit US banks after all

Fall in operational risk weights could push up capital requirements for market and credit risk

Basel set to hammer Japanese megabank capital ratios

Sharp increase in risk weights for unrated corporates could lead to 30% jump in RWAs

CVA dismay: final Basel rules disappoint dealers

Minor tweaks don’t make up for removal of internal modelling, say banks

‘Catching the outliers’ does not always make sense for Basel

The capital impact of Basel III on Nordic banks is disproportionate to the risks they face

FRTB, CCAR and bonus caps for prop traders

The week on Risk.net, December 16-22, 2017

Apac banks dodge op risk capital hit from new rules

Chinese lenders have largest capital requirements in region; banks expect muted increase on average