News

FSB exec says reduction of NBFI leverage not a target

Isda AGM: Martin Moloney says the body isn’t seeking wholesale cut in leverage across markets

APG upbeat on sustainability derivatives despite setbacks

Isda AGM: Dutch pension fund manager’s chief executive believes instruments have room to grow

BoE to consult on promoting clearing for gilt repo market

Isda AGM: Deputy governor also takes aim at bilateral repo haircuts and cross-CCP netting

Isda proposes oversight group for CDS process

New governance committee the “first step” in credit determinations revamp

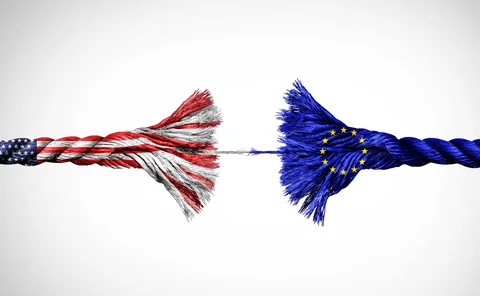

US has got what it wanted from Basel, say former regulators

Calls to stay at the table come after US Treasury Secretary condemned “outsourcing” of regulation

Vendor oversight splinters across FMIs

Op Risk Benchmarking: firms grapple with “chaos” of third-party rule changes, amid growing recognition of cyber and resilience threats

Emir 3.0 could complicate Eurex cross-margining for repo

Clearing house targets November 2025 to launch repo on Prisma, but new EU rules are imminent

After tariff rout, hedge funds revive euro rate steepeners

Dutch pension overhaul drives bets on euro rates curve steepening

Hedge funds burned as Hong Kong dollar bets implode

Carry trades and call spreads unwound after Trump tariffs pushed spot to edge of currency peg

Novel risk-off CTA strategy passes tariff test

Ai for Alpha’s defensive approach to trend following worked as planned in April turmoil

European investors ramp up FX hedging as ‘dollar smile’ fades

Analysts at one bank expect average hedge ratios to jump from 39% to 70% within six months

CLO market shakes off ETF outflows

Despite record redemptions, exchange mechanics and relatively small volumes cushioned impact

ECB removes need for governing council to approve CCP facility

New “automatic” facility will require safeguards that are “still being implemented”, bank says

Pension funds hesitate over BoE’s buy-side repo facility

Reduced leveraged and documentation ‘faff’ curb appetite for central bank’s gilt liquidity lifeline

Wells Fargo’s FX strategy wins over buy-side clients

Counterparty Radar: Life insurers looked west for liquidity after November’s US presidential election

How BrokerTec, MarketAxess fared during Treasury rout

Electronic bond trading platforms see spike in volumes and small growth in market share, Risk.net analysis shows

Tariff volatility pushes banks to tighten close-outs

Lawyers say dealers are looking to update playbooks for terminating derivatives trades

BoE plans to link system-wide and individual stress tests

Meanwhile, ECB wants to broaden system-wide stress models to include central counterparties

People: Balaÿ is new broom at CA CIB, Ungari swaps QIS roles at SG

Latest job changes across the industry

Cyber insurance costs expected to rise as loss ratios worsen

Recent ransomware and tech failure events could feed through into higher premiums this year

SG’s Ungari swaps research for structuring in new QIS role

Veteran researcher and strategist ‘putting things into action’ with new remit

Yen rates losses from tariff volatility top $1 billion

Pay fixed, curve flattener and vol steepener positions were hit hard as yields swung wildly

Markets are mispricing tariff uncertainty, say academics

Johns Hopkins economists warn of risk from changes to the ‘rules of the game’

Repo clearing rule could raise SOFR volatility – OFR analysts

Analysis of 2022 data finds large divergence in tail rates but no change in median