News

Icap shuts London weather desk

Inter-dealer broker Icap exited the European weather and environmental derivatives market last month. It thereby joined the growing ranks of other market participants – including BNP Paribas, Aquila and Italian bank Intesa BCI – that have fled the…

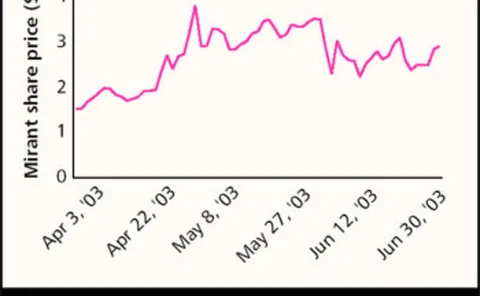

Mirant raises prospect of bankruptcy

Energy company Mirant asked its bank lenders to approve a pre-packaged bankruptcy plan in June, suggesting the Atlanta-based company could be forced to file for Chapter 11 bankruptcy.

Credit risk models enhance link between credit and equity prices, say BIS

The growing use of credit risk models is helping to strengthen the link between credit and equity prices, said the Bank for International Settlements (BIS).

Cantor subsidiary files patent infringement suit

Interdealer-broker Cantor Fitzgerald’s trading technology subsidiary eSpeed has filed a patent infringement suit against electronic fixed-income trading platform BrokerTec, while separately a court case pertaining to alleged constructive dismissal…

Bear Stearns adds CDO evaluator to Pacre

Bear Stearns has added a high-yield collateralised debt obligation (CDO) pricing model to its price-adjusted credit risk evaluator (Pacre) product. The model is designed to calculate credit-adjusted spreads on individual CDO tranches.

Old Mutual Asset Management appoints head of risk management

Old Mutual Asset Management, the US asset management arm of financial services company Old Mutual, has hired Jeffery Howkins from Mellon Institutional Asset Management as its head of risk management and audit.

Sector roundup

sectors

Credit risk models enhance link between credit and equity prices, say BIS

The growing use of credit risk models is helping to strengthen the link between credit and equity prices, said the Bank for International Settlements (BIS).

EU finally publishes third CAD draft

After nearly a month of delays, the EU Commission finally published the fourth consultation on its capital adequacy directive (CAD) this afternoon.

Rolfe & Nolan names new chairman

UK derivatives back-office vendor, Rolfe & Nolan, has appointed John Hamer as its new chairman.

Deutsche Börse adds more fixed-income ETFs

Deutsche Börse has added three more bond exchange-traded funds (ETFs) as part of its XTF segment.

GASB issues new derivatives guidelines

The US Governmental Accounting Standards Board (GASB), a not-for-profit organisation that seeks to establish standards of financial accounting and reporting for state and local governmental entities, has issued new derivatives accounting guidelines for…

MSCI and Lyxor launch tradable hedge fund index

Morgan Stanley Capital International (MSCI), a provider of indexes for financial institutions, has teamed up with Lyxor Asset Management (Lyxor), a subsidiary of Société Générale specialising in structured funds and alternative investments activities, to…

AIG forex under merger threat

AIG Trading’s foreign exchange group faces an uncertain future, as parent company Connecticut-based American Insurance Group (AIG) prepares to merge its AIG Trading and AIG Financial Products subsidiaries, sources close to the firm told RiskNews ’ sister…

Polaris and State Street launch first ETF on Taiwan exchange

Taiwan’s Polaris International Securities Investment Trust and Boston-based State Street Global Advisors have launched Polaris Taiwan Top 50 Tracker Fund (TTT), the first exchange-traded fund (ETF) to be listed on the Taiwan Stock Exchange. Trading on…

EDX London to start trading on Monday

A new equity derivatives exchange, EDX London, will start trading Scandinavian equity derivatives on Monday.

Nasdaq pulls out of single-stock futures business

US electronic stock exchange Nasdaq has pulled out of its joint venture with Euronext.Liffe to create a market for single-stock futures.

SunGard upgrades ALM tool

SunGard Trading and Risk Systems, an operating group of US technology company SunGard, has released a new version of its asset and liability management (ALM) software, BancWare Convergence.

Reuters and GFI strike credit derivatives data partnership

Global information company Reuters has signed an exclusive deal with New York-based inter-broker GFI to provide GFI's credit derivatives data and Fenics credit pricing tools through Reuters 3000 Xtra, Reuters Bridgestation and Reuters Trader terminals.

Wachovia bolsters credit derivatives team

In the latest of a raft of recent hires, Wachovia Securities has hired Christopher Shin and Kathleen O’Halloran Harris to its structured credit products group.

Central bank reports more leverage in swaps market

The second half of 2002 saw a sharp rise in leverage in the interest rate swap market, according to the June issue of the Bank of England's Financial Stability Review.

GASB issues new derivatives guidelines

The US Governmental Accounting Standards Board (GASB), a not-for-profit organisation that seeks to establish standards of financial accounting and reporting for state and local governmental entities, has issued new derivatives accounting guidelines for…

Risk ALM USA: mortgage investors’ extension risk balloons

The combination of a concentration of mortgage assets in ever-fewer hands and a dearth of hedging tools for short-duration mortgage portfolios has dramatically increased banks’ extension risk, according to Kamal Abdullah, senior vice president – fixed…

Long-only fund managers will adopt hedge fund techniques, says DB researcher

Many arbitrage techniques currently used by hedge fund managers will move into the long fund community, according to Leigh Baxandall, global head of equity derivatives strategy at Deutsche Bank in London.