News

India allows foreign currency rupee options

Foreign currency rupee options have finally become reality in India, with the Reserve Bank of India (RBI) allowing plain vanilla currency options trading to commence today.

Deutsche names new structured products head

Marc Badrichani has joined Deutsche Bank in London as head of the corporate structuring group for Europe.

HVB’s US operations upgrade with Front Arena

HVB Americas, the US arm of Germany’s HVB Group, is upgrading to SunGard’s Front Capital Arena version 2.0, to ensure the smooth start-up of a new business in Bermuda. HVB Americas said it needed the latest product since older Arena versions were…

Jacobs joins Chicago Fed's new economic capital group

Former managing director and head of analytics for Bank of America's loan portfolio management, Thomas Jacobs, has joined the Federal Reserve Bank of Chicago as an economic capital specialist in the watchdog's risk specialist division.

Energy firms turn to credit derivatives market

More energy companies are likely to start purchasing credit derivatives as a way of mitigating counterparty credit risk, analysts said at a conference in New York this week. This is partly because spreads on single-name credit default swaps (CDS) of…

Moody's claims documentation affects recovery values

Recovery values assigned to a single reference entity in credit derivatives contracts are inconsistent, partly due to a lack of standardised valuation documents, according to Moody’s Investors Service.

Jacobs joins Chicago Fed's new economic capital group

Former managing director and head of analytics for Bank of America’s loan portfolio management, Thomas Jacobs, has joined the Federal Reserve Bank of Chicago as an economic capital specialist in the watchdog's risk specialist division.

Citi contemplating US credit derivatives index

Citigroup is contemplating launching a US credit derivatives index product, according to Doug Warren, managing director for North American credit derivatives, and intends to make a decision on this within the next two to three weeks.

Dutch debt office opts for Trema

The Dutch State Treasury Agency (DSTA) has licensed a debt financing software system, Finance Kit, from France-headquartered financial software provider Trema.

Algorithmics to launch Linux version of Algo Suite

Algorithmics of Canada, an enterprise risk management solutions provider, said today it will launch a fully supported Linux version of Algo Suite by the end of the third quarter of this year.

CA-Legend to distribute DSTi’s HiRisk product in China

Investment management software solutions provider DST International (DSTi) has selected Computer Associates-Legend Software (CA-Legend) of China to distribute its HiRisk product in that country.

GlobeOp grabs JP Morgan/Cygnifi fixed-income software

GlobeOp Financial Services, a risk management, operations and administration service provider to the global funds management community, has bought a risk reporting and valuation analytics library, developed by JP Morgan and its now-defunct technology…

US pushes agreement on carbon storage research

The US government has launched an international research and development programme to reduce power plant emissions by pumping carbon dioxide (CO2) into deep storage.

LNG may not fix gas supply problem

Despite its long-term promise, liquified natural gas (LNG) will only have a minimal impact on a significant US gas storage shortfall in the winter of 2003/2004, says Energy Security Analysis Inc (Esai), a Boston-based research firm.

Icap shuts London weather desk

Inter-dealer broker Icap exited the European weather and environmental derivatives market last month. It thereby joined the growing ranks of other market participants – including BNP Paribas, Aquila and Italian bank Intesa BCI – that have fled the…

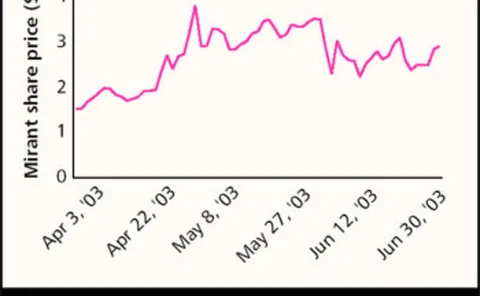

Mirant raises prospect of bankruptcy

Energy company Mirant asked its bank lenders to approve a pre-packaged bankruptcy plan in June, suggesting the Atlanta-based company could be forced to file for Chapter 11 bankruptcy.

Credit risk models enhance link between credit and equity prices, say BIS

The growing use of credit risk models is helping to strengthen the link between credit and equity prices, said the Bank for International Settlements (BIS).

Cantor subsidiary files patent infringement suit

Interdealer-broker Cantor Fitzgerald’s trading technology subsidiary eSpeed has filed a patent infringement suit against electronic fixed-income trading platform BrokerTec, while separately a court case pertaining to alleged constructive dismissal…

Bear Stearns adds CDO evaluator to Pacre

Bear Stearns has added a high-yield collateralised debt obligation (CDO) pricing model to its price-adjusted credit risk evaluator (Pacre) product. The model is designed to calculate credit-adjusted spreads on individual CDO tranches.

Old Mutual Asset Management appoints head of risk management

Old Mutual Asset Management, the US asset management arm of financial services company Old Mutual, has hired Jeffery Howkins from Mellon Institutional Asset Management as its head of risk management and audit.

Sector roundup

sectors

Credit risk models enhance link between credit and equity prices, say BIS

The growing use of credit risk models is helping to strengthen the link between credit and equity prices, said the Bank for International Settlements (BIS).

EU finally publishes third CAD draft

After nearly a month of delays, the EU Commission finally published the fourth consultation on its capital adequacy directive (CAD) this afternoon.

Rolfe & Nolan names new chairman

UK derivatives back-office vendor, Rolfe & Nolan, has appointed John Hamer as its new chairman.