News

Rates Markets Update: Swap flows increase on economic news

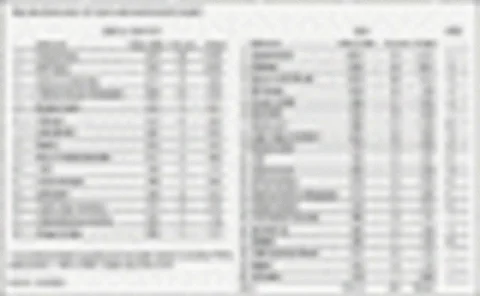

Dollar-swaps saw big flows this week following a US Treasury announcement on Monday that it plans to borrow $120 billion to cover its budget shortfall. Ten-year swap spreads had come in from 57.5 basis points at the start of the week to 52bp midweek,…

Hedge funds of funds may offer CDO opportunity, says S&P

Standard & Poor’s (S&P) today predicted that collateralised debt obligations (CDOs) of hedge fund of funds will be the next sector to fuel growth in alternative investments.

Hedge funds open to retail investors in HK

A new ruling by Hong Kong's Securities and Futures Commission (SFC) today will allow retail investors in the Special Administrative Region to buy hedge funds from the third quarter of this year.

Moody’s highlights swap risks within European securitisations

Using fixed amortisation schedule swaps to hedge securitisations can actually increase, rather than reduce the market risk, claims Moody’s Investors Service.

FASB redefines derivatives

The Financial Accounting Standards Board (FASB) yesterday amended the definition of derivatives within its mark-to-market accounting regulation FASB 133.

iBoxx launches Xavex

News

XBRL promotes transparency

Credit tech

UK's FSA to tackle operational risk

The UK’s Financial Services Authority (FSA) today launched its whistle-blowing initiative, designed to encourage financial industry workers to make disclosures about malpractice in the workplace.

AFP warns against hasty derivatives regulation

Bill Miller, chairman of the Association of Financial Professionals’ (AFP) End-Users of Derivatives Council (EUDC), is calling for restraint when considering amending US derivatives regulation following the collapse of Enron.

Swiss Re executes $40 million catastrophe risk CDO

Swiss Re Capital Markets Corporation (SRCMC) has executed what is believed to be the first ever synthetic CDO based on natural catastrophe risks. The underlying risk exposures were accessed through industry loss warranties (ILWs), for which Judith…

San Paolo plans to launch first Italian single-manager hedge fund

Obiettivo SGR, a subsidiary of Italian banking organisation San Paolo IMI, plans to become the first single-manager hedge fund launched in Italy.

Credit Markets Update: Spreads widen on US telecoms woes

The cost of credit derivatives protection rose on a number of telecoms today following the resignation yesterday of WorldCom chief executive Bernard Ebbers and a wider than expected $698 million loss in the first quarter reported by Qwest.

Nordea snares Andreasen and Bangert to boost exotics

Nordea Markets, the investment banking arm of pan-Nordic bank Nordea, has made two key hires as part of its bid to boost complex derivatives activities.

BNP boosts Asia-Pacific fixed-income derivatives team

French bank BNP Paribas has made three new hires to its Asia-Pacific interest rate derivatives trading team in Singapore.