Structured products

BOTCC strikes metals derivatives deal with CMXchange

Chicago's Board of Trade Clearing Corporation (BOTCC) has entered an agreement to process and guarantee the forward and over-the-counter derivatives transactions of internet-based metals exchange, CMXchange, located in Northfield, Illinois.

Algo includes S&P for Basel II

Algorithmics is strengthening its credit risk management offering as demand grows for more comprehensive credit solutions. It is integrating a number of Standard & Poor’s credit data products with its analytical tools and developing a new module to help…

Will Germany scupper Basel II?

How real is Germany’s threat to veto the proposed Basel II bank capital accord if the country fails to get the concessions it wants on the accord’s treatment of bank lending to small to medium-sized companies (SMEs)?

Regulators looking at possible changes to Basel II credit risk plans

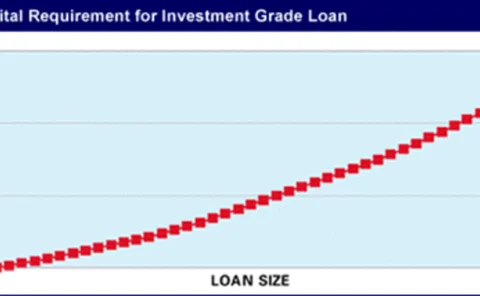

Basel - Global banking regulators are studying possible changes to the credit risk proposals of the complex Basel II bank capital accord, after seeing evidence that banks face higher capital charges under Basel II than they do under the current Basel I…

Could the Basel II op risk charge be cut again?

BASEL - Might banking regulators agree again to lower the capital charge for operational risk proposed under the controversial Basel II bank capital accord as part of horse-trading over the credit risk charge?

Building for Basel

The 2005 implementation date for the new Basel II Accord – already postponed by a year – is looming large. Whilst the banking sector is steadily gearing up for the proposed changes, there are fears that some institutions may be left behind.

Is there hope in the advanced measurement approaches?

Basel II is mistaken in assuming a stable relationship between expected and unexpected losses, argues Jacques Pézier in his second article on the Basel Committee’s recent operational risk working paper.

Building for Basel

The 2005 implementation date for the new Basel II Accord – already postponed by a year – is looming large. Whilst the banking sector is steadily gearing up for the proposed changes, there are fears that some institutions may be left behind.

A spanner in the works

The US and Germany are in a standoff over Basel II’s capital charge calculation for SME lending. Without a compromise this month, the issue threatens to derail implementation of the Accord and the European Directive.

A perfect rating

Profile

Mezz funds facing supply scramble

Mezzanine

Down but not out

High yield poll

Building for Basel

Basel implementation

ICI prospects looking bleak

Limited upside potential

Risk measurement under the spotlight

Portfolio management

Asia’s ASP quandary

ASPs

The technology dilemma

Comment

Preparing for the worst

Systems

A wider view of risk

Enterprise-wide risk