Structured products

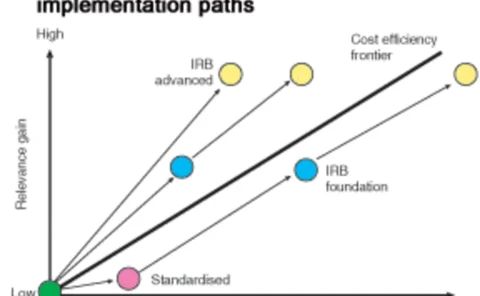

A cost/benefit approach to Basel II

The cost of implementing Basel II could put banks at a competitive disadvantage compared with non-banks, and spur them to ‘de-bank’ to avoid this regulatory burden. Harry Stordel and Andrew Cross say regulators must look at the provisions from a cost…

The active manager

SG Asset Management’s Stéphane Farouze provides tailor-made capital guarantees for investment managers. After closing some of the biggest deals in Europe, now he is eyeing the US

Nine billion ways to be snowed

Emanuel Derman separates real tools from passing trends in the risk management vocabulary. This article is adapted from his talk on Future Innovations in Risk Management, presented at the April Risk 2002 Conference in Paris

Job moves

QUOTE OF THE MONTH: - “It is likely that doubt and a lack of market confidence will affect all energy trading for some time to come” Francis Hervé, chief executive of EDF Trading, the London-based trading subsidiary of Electricité de France (EDF),…

The benefits of Enron

Many corporations are keeping a low profile when it comes to their derivatives use. But when the Enron-related witch-hunts are over, companies may find that insurers and shareholders now view corporate hedging as a fiduciary duty

End-user rankings 2002

Survey

A slow evolution

Credit risk

Hedge funds open in HK

New Angles

Looking for value

Convertible bonds

Another step forward

Comment

SG to offer 'mountain range' funds in Asia

SG, the securities division of French bank Société Générale, has begun rolling out its ‘mountain range’ series of capital guaranteed funds in Hong Kong, four years after they made their first appearance in the European market.

Barclays Global Investors gets SEC approval for fixed-income ETFs

Barclays Global Investors (BGI) has been approved to launch the first US fixed-income exchange-traded funds (ETFs), following approval at an open meeting of the US Securities and Exchange Commission on May 29. Seven BGI fixed-income US Treasury and…

Credit Markets Update: Spreads widen on weak earnings and equity news

Most of the activity in the credit derivatives markets was again seen in the volatile telecoms sector, with five-year spreads on UK telco mm02 widening by around 20 basis points to 440bp/460bp following weak earnings results on Tuesday, which caused its…

Japan Credit Markets Update: New convertible issues push spreads wider

Convertible bond issues by Japan’s largest leasing company, Orix, and its biggest trading house, Mitsubishi, drove Japanese credit default swap spreads wider this week in an otherwise quiet market.

Crédit Lyonnais set to offer prime brokerage in Asia-Pacific

CLSA, the emerging markets arm of French bank Crédit Lyonnais, plans to offer prime brokerage services in the Asia-Pacific region to cater for an anticipated growth of the hedge fund market in the region, according to Sheldon Lee, CLSA head of hedge fund…