Structured products

Reaping integration rewards

In the October issue of Risk, Clive Davidson discussed the integration of ALM and ERM technology. Here, in a second article, he profiles the firms that have tackled this project and reviews the challenges, advantages and pitfalls of the integration…

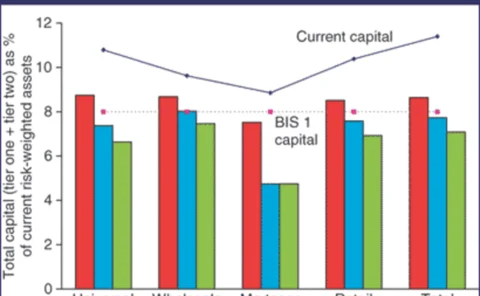

Letter to the editor: a response to Cosandey and Wolf’s Avoiding pro-cyclicality

From Thomas Garside, managing director, finance and risk management, and Christian Pedersen, senior manager, Oliver, Wyman & Company, London

Job moves

QUOTE OF THE MONTH “I believe that of all large German banks Commerzbank has the best risk management system” Wolfgang Hartmann, chief risk officer at Commerzbank Source: Risk, November

Fuelling doubts

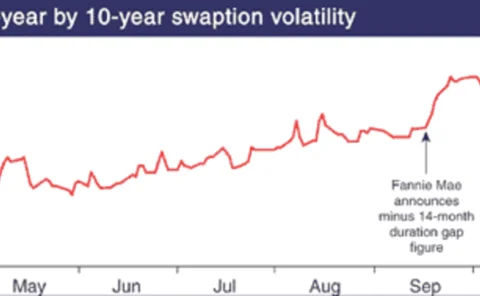

Violence and uncertainty in the Middle East have caused energy market volatility to soar, testing the mettle of even the most sophisticated corporate hedgers. Will it prove to be the last straw for the world’s ailing airlines? Navroz Patel reports

RiskNews review

October’s leading stories from RiskNews. Breaking news on derivatives and risk management, see RiskNews – www.RiskNews.net

Banding together for SME credit risk analytics

Germany’s banking associations are taking a leading role in getting the country’s fragmented banking sector ready to comply with the Basel II capital Accord. Germany’s savings banks association, in particular, says it has internal ratings-based systems…

The beta-blocker

Doug Dachille, chief operating officer at Zurich Capital Markets and formerly global head of proprietary trading at JP Morgan, believes the economic downturn has finally crystallised investor attention on beta. Christopher Jeffery reports

Basel II and pro-cyclicality

The main argument for making regulatory capital requirements more risk-sensitive is to improve allocational efficiency. But this may lead to intensified business cycles if regulators fail to take measures to prevent such an impact. In this first column…

Scor spreads widen 350bp after firm reveals €38m credit derivatives losses

The cost of senior debt protection on Scor ballooned to 850/1,000 basis points over Libor today, after the French reinsurer revealed, yesterday that it would make a net loss of €250 million this year, following major losses in credit derivatives and…

Currency overlay set to hit $500 billion

Currency overlay, the management of currency exposures in an investment portfolio separate from underlying asset exposures, is set to become a $500 billion dollar industry within the next three years, according to Piero Overmars, Dutch bank ABN Amro’s…

ING provides cross-currency swap for Samsung Card ABS

The Netherlands' ING Bank will provide the cross-currency swap for South Korean consumer finance company Samsung Card’s $400 million of cross-border asset-backed securities, said a spokeswoman for the Korean company.

Airline exposures cast shadow over CDOs and derivatives trading

Collateralised debt obligation (CDO) investors assessing their credit risk exposure should be aware that recovery prospects among airlines bonds vary dramatically from company to company, according to Goldman Sachs.

Defaults by EU companies outpace global and US counterparts, says S&P

The default rate in the European Union (EU) continued to outpace its global and US counterparts during the third quarter, according to rating agency Standard & Poor's (S&P). A total of 20 rated EU entities have defaulted on rated debt worth $8.7 billion…

JP Morgan Chase markets CDO with equity puts in Asia

JP Morgan Chase has begun marketing synthetic collateralised debt obligations (CDOs) with embedded equity put options to a small number of investors in Asia-Pacific. This type of structure is aimed at sidestepping the sometimes-thorny issue of…

Taiwan rule change should help local interest rate derivatives market

The Taiwanese authorities’ decision to allow short selling of government bonds in mid-October is opening the door to new derivatives products on the Taiwan dollar market.