Credit markets

Job moves

QUOTE OF THE MONTH: - “An infectious greed seemed to grip much of our business community” Alan Greenspan, on the corporate governance scandals hitting the US Source: Reuters, July 16

Strategic shortcomings

A survey of 13 private banks’ risk management practices reveals some dangerous shortcomings. Lisa Kastigar of Sherwood Alliance, a Switzerland-based financial consulting firm, examines the challenges for risk managers at these institutions

Serving the credit funds

Hedge funds initially used default swaps for simple hedging. Now, credit arbitrage is de rigueur, and it is inspiring dealers to reassess and restructure their own businesses in response

Equity hedge funds’ appetite for credit derivatives grows

Hedge funds are increasingly willing to buy and sell credit protection, either as part of a more complex strategy, or outright, according to dealers.

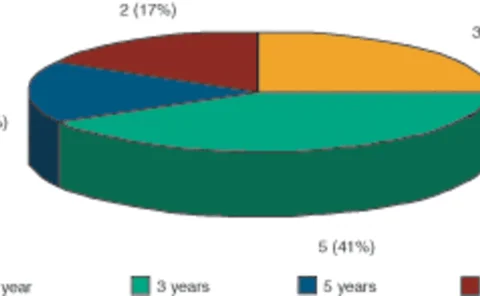

Moody's report confirms European CDO growth

Ratings agency Moody’s Investors Service said the European collateralised debt obligation (CDO) market grew by 46% in the first half of 2002, compared with the corresponding period of last year. Moody’s rated 72 CDO transactions in the first half of the…

Isda requires CDS reference obligation specification at trade date

The International Swaps and Derivatives Association has decided that confirmations should specify reference obligations as of the trade date for credit default swap (CDS) transactions.

Further surge in investment grade synthetic CDO issuance expected, says BofA

A further surge in static and managed corporate synthetic collateralised debt obligation (CDO) issuance is expected this year, according to new research by Bank of America.

French securitisation ruling likely to be delayed further

The French banking regulator ruling to change the capital risk weighting system on securitisations continues to cause confusion, with market commentators stating that a final decision may be delayed until September.

French securitisation ruling likely to be delayed further

The French banking regulator ruling to change the capital risk weighting system on securitisations continues to cause confusion, with market commentators stating that a final decision may be delayed until September.

Credit Markets Update: High correlation to equity markets continues

The credit default swap market continued to see significant volatility and trading activity in Europe this week, as the high degree of correlation to the equity markets persisted, according to traders in London today.

Credit Markets Update: Negative equity sentiment transmutes into wider spreads

European credit default swap spreads were wider this week, with investors buying protection as credit concerns and accounting scandals in the US contributed to negative investor sentiment that led to a further battering of stocks.

Credit Markets Update: France Telecom fluctuates in thin markets

The cost of credit protection on troubled telco France Telecom fluctuated this week within a 100 basis point range, causing knock-on effects on the spreads of other European telecoms in jittery markets that saw little trading activity. But positive…

RiskAdvisory Software

Technology

S&P rates hedge fund of funds CDO

Ratings agency Standard & Poor’s (S&P) said it has rated a hedge fund-backed collateralised debt obligation (CDO) issued last week by Diversified Strategies, a special-purpose vehicle. Cayman Islands-based Investcorp Management Services is the investment…

Long-awaited exposure draft on SPV consolidation released in US

The US Financial Accounting Standards Board (FASB) has released a long-awaited exposure draft on the consolidation of special purpose entities, or special purpose vehicles (SPVs). New rules for accounting for SPVs, a class that includes all CDOs, was…

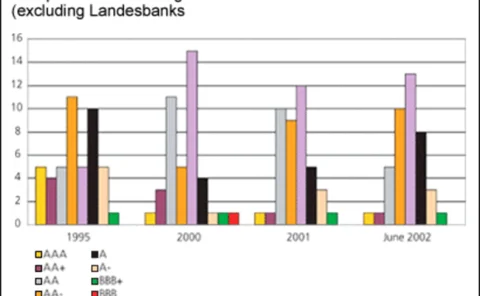

Regulators grow confident about Basel II calendar

Global banking regulators were expected to issue an upbeat statement in mid-July on progress with the controversial Basel II bank accord after several months of uncertainty in which some bankers doubted the accord would ever see the light of day.

Capital charges not enough to protect banks against op risk, says Moody’s

Protective capital is an incomplete line of defence against operational risk and effective op risk measurement and management should amount to more than just a capital allocation exercise enforced by regulators, a leading credit rating agency said in…

IMF seeks scrutiny of insurers' credit risk

The International Monetary Fund (IMF) says greater information about insurers' financial markets activities – including credit risk transfers – is needed before their implications for financial stability can be clearly ascertained.

CLNs come of age

Technical

Bondholders versus shareholders

Sponsored article

Japan credit upbeat

News

Equity poses the big questions

Roundtable