Monthly swaps data review: credit volumes peak in June

Global cleared credit derivatives volumes reached $1 trillion before ebbing in July

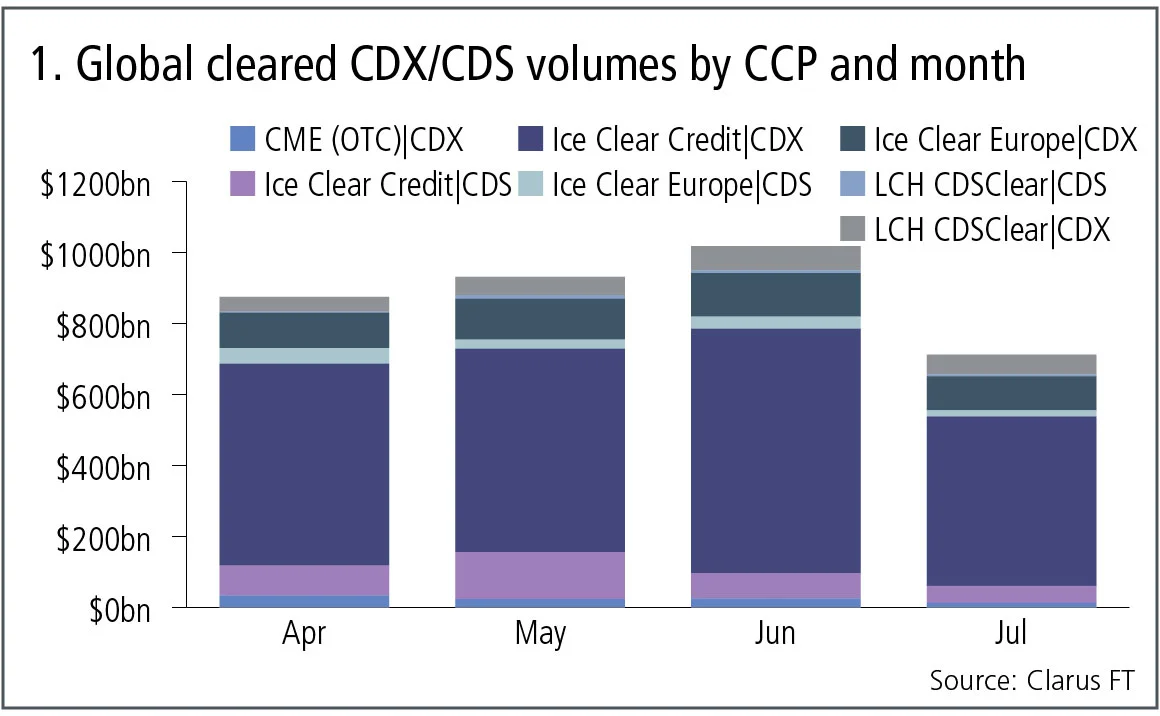

Cumulative volume of $3.5 trillion gross notional in global cleared credit derivatives over the April-July period peaked in June, with Ice capturing more than 90% of the business. This is a smaller market than the interest rate swap market, which was the main subject of my previous articles, but it is still significant in terms of volumes.

Global cleared volumes

Eighty-six per cent of global monthly cleared volumes was represented by credit default swap index (CDX). Let’s start with a chart breaking out CDX and single-name credit default swaps (CDS) by clearing house.

Figure 1 shows:

- Cumulative volume of $3.5 trillion gross notional in the past four months, of which the majority is CDS index ($3 trillion), and monthly volume ranging from $700 billion to $1 trillion.

- June 2017 was the highest month and July the lowest in the four-month period.

- Ice Clear Credit is by far the largest clearing house and CDX the largest product at Ice, with volume between $475–687 billion a month.

- Single-name CDS volumes at Ice Clear Credit are $48–132 billion a month.

- Ice Clear Credit represents 75% of the cumulative volume over the four-month period.

- Ice Clear Europe is the next largest and represents 16% of the cumulative volume, with monthly CDX volume of $96–123 billion and CDS volume of $18–45 billion.

- The combined share of the two Ice entities is 91% of cumulative volume.

- LCH CDSClear is the next largest with 7% market share, with CDX monthly volumes of $42–70 billion and CDS volumes of $4–11 billion.

- CME has 3% market share with CDX monthly volumes of $13–33 billion and no CDS volumes.

While these figures are much smaller than interest rate swaps where monthly volumes are $20–30 trillion, they are substantial in that almost $1 trillion gross notional is transacted and cleared each month.

Product types

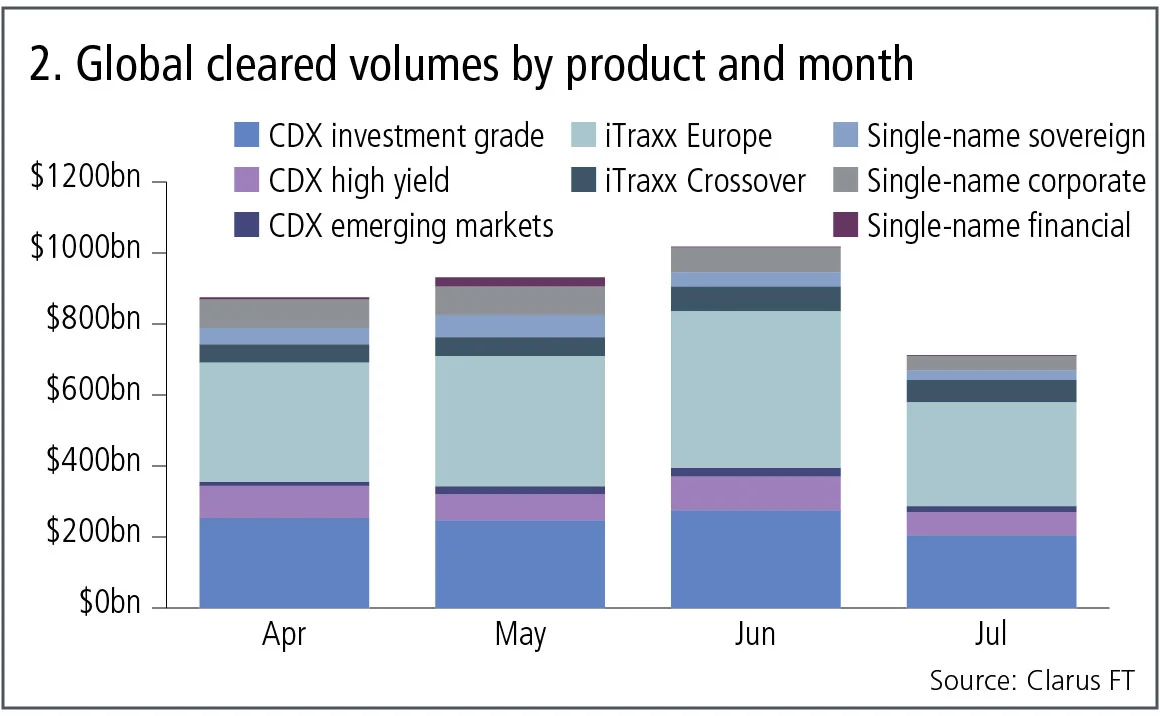

Now let’s look at the same figures, but split by product type to see which types of contracts are the most traded.

Figure 2 shows:

- iTraxx Europe is the largest product and represents 41% of the overall volume in this period with monthly volumes between $330–440 billion.

- CDX investment grade is the next largest product and represents 28% of the overall volume in this period with monthly volumes between $200–275 billion.

- CDX high-yield follows with a 9% share and monthly volumes of $65–95 billion.

- Single-name on corporates has 8% and monthly volumes of $40–80 billion, showing how much the single-name market is cleared, compared with the index market.

- Single-name on sovereigns represents 5% and single-name on financials represents 1% of the volume over this period.

- CDX emerging markets is 2% of the volume with $11–25 billion a month.

Swap execution facilities

Swap execution facilities (Sefs) are trading venues mandated for a subset of the cleared CDS index products executed by US-regulated market participants. They are required to publish daily volumes. However, single-name CDS do not fall under this regime, as they are regulated by the Securities and Exchange Commission, not the Commodity Futures Trading Commission.

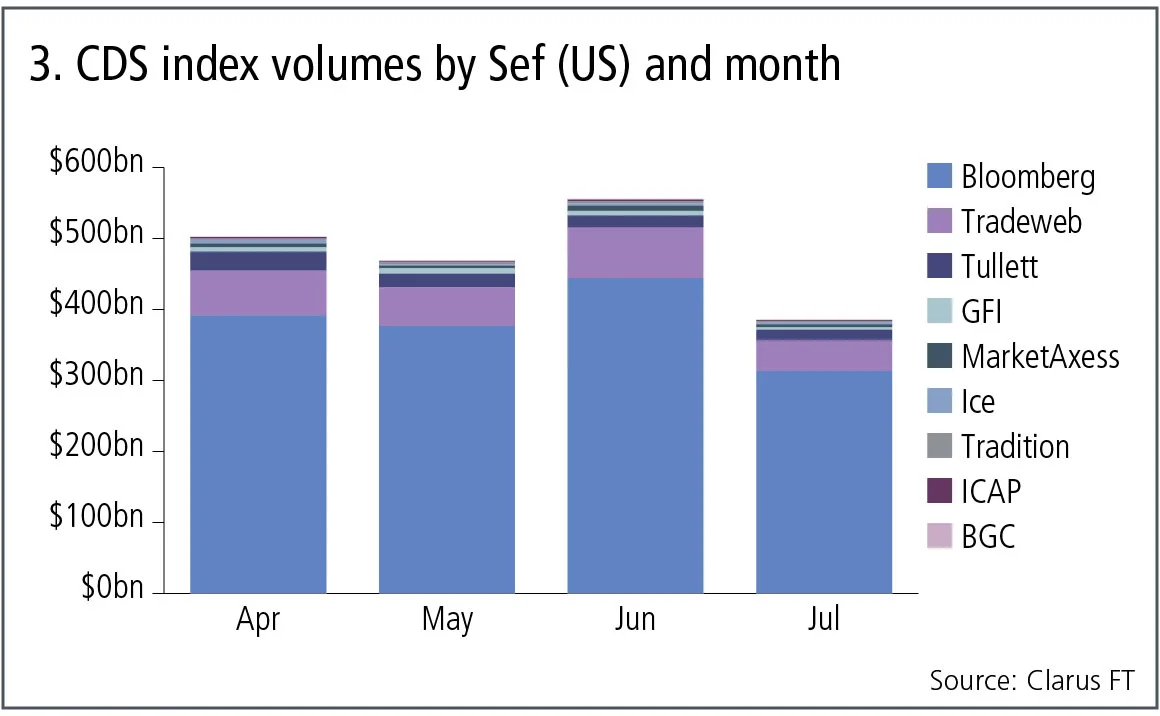

Let’s look at monthly volumes over the same period for CDS index products.

Figure 3 shows:

- Cumulative gross notional of $1.9 trillion over the four-month period, compared with the $3 trillion we saw in global cleared volumes, so representing 60% of the overall market.

- Bloomberg is by far the largest Sef, with 80% market share and monthly volumes between $300–450 billion.

- Tradeweb is the next largest with 12% share and monthly volumes between $40–70 billion.

- Tullett has a 4% share with monthly volumes between $15–30 billion.

- The remaining Sefs each have a 1% or smaller share.

Bloomberg’s dominance of trading of CDX mirrors the dominance of Ice in clearing of this asset class.

Option products

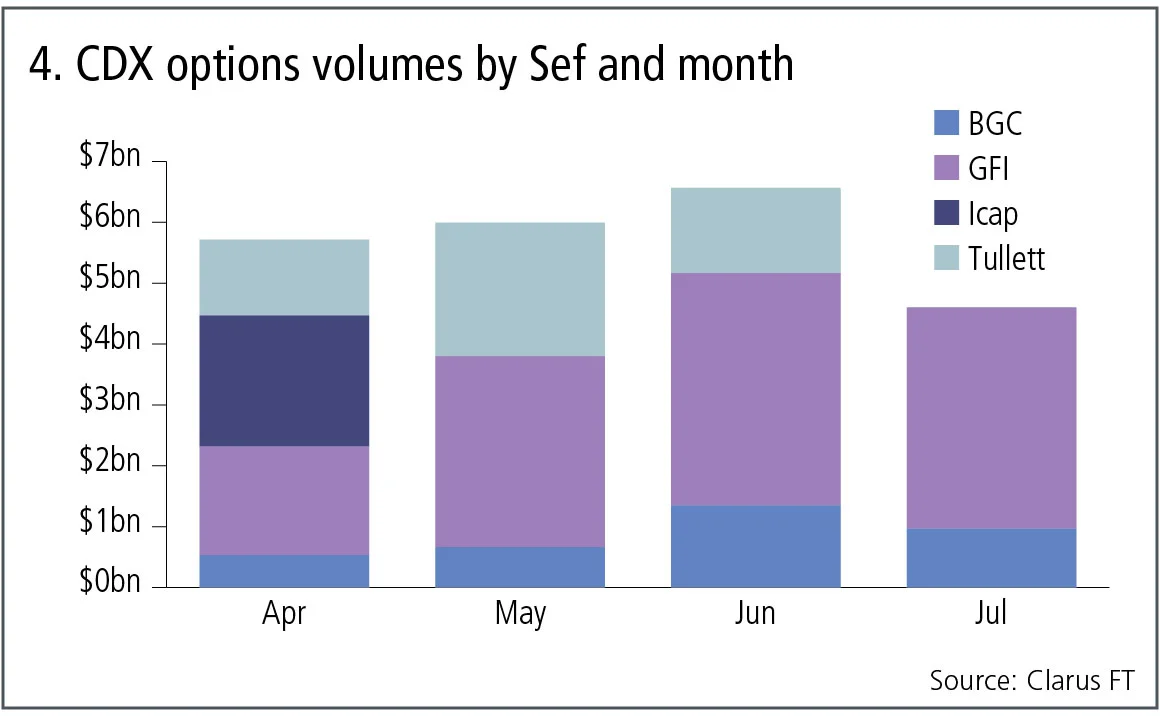

In addition to the above cleared products, there are two types of bilateral (uncleared) products that are commonly traded; options on indexes and tranches in indexes. Let’s look at the Sef reported volumes of options.

Figure 4 shows:

- Cumulative gross notional of $23 billion over the four-month period, compared with the $1.9 trillion in CDS index.

- GFI is the largest Sef with a 54% share and monthly volumes of $2–4 billion.

- Tullett is the next largest with a 21% share, followed by BGC with 15% and Icap with 9%.

So this not a huge market, but one that is active with transactions on most business days. Tranche index, however, shows very thin trading on Sefs with only $450 million reported in the four-month period, of which $380 million was at GFI.

Trade executions

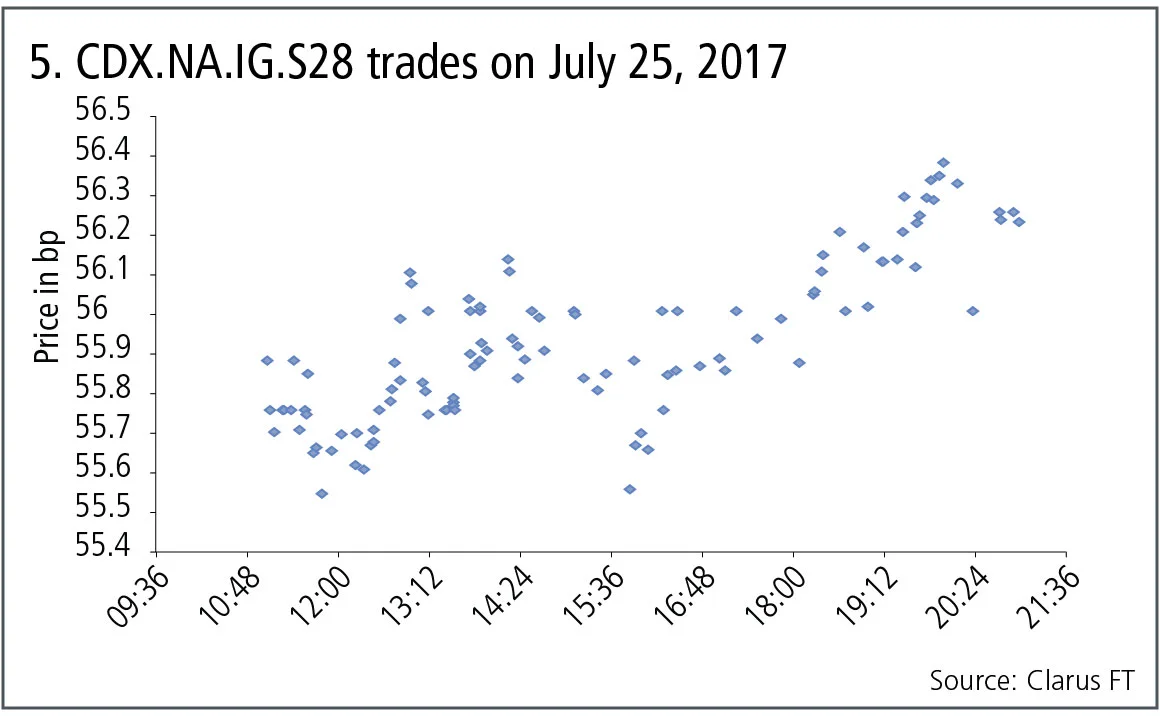

A final chart before we end. Using swap data repository data we can isolate the prices of trades for a specific contract on a given business day. Let’s do so for CDX North American Investment Grade S28 (CDX.NA.IG.S28).

Figure 5 shows:

- The prices and times of trades executed between 11:00 universal time (UTC) and 21:00 UTC.

- 107 trades in total.

- Prices starting at 55.75 basis points and rising over the day to close at 56.25bp.

- Reasonable price volatility over the course of the trading day.

Amir Khwaja is chief executive of Clarus Financial Technology.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら コメント

責任あるAIは、原則と同様に利益についても考慮すべき

ある企業が、ガバナンスを損なうことなく、融資処理時間を短縮し、不正検知を改善した方法

オペリスクデータ:NSEにおける低遅延、高コスト

また、ブラムバット氏の詐欺事件がブラックロックを直撃、JPモルガンは疑わしい取引の売却に遅れ。ORXニュースのデータより

クオンツキャスト・マスターズ・シリーズ:ナム・キフン(モナシュ大学)

メルボルン拠点のプログラムが年金基金業界に目を向ける

バーゼルIIIの最終局面が銀行の事業構成をどのように再構築するか

資本リスク戦略担当者は、B3Eがポートフォリオの重点分野と顧客戦略に影響を与えると述べています。

ソースコードへのアクセスがDora準拠において極めて重要である理由

EUにおいてDoraが普及するにつれ、ソースコードへのアクセスはますます重要になってきていますと、Adaptiveのケビン・コヴィントン氏は述べています。

クオンツキャスト・マスターズ・シリーズ:ペッター・コルム(クーラント研究所)

ニューヨーク大学のプログラムは、ほぼ専ら金融業界のエリート実務家の方々によって指導されております。

CVA資本コスト – 霧の中のゴリラ

2020年の米国銀行における信用リスク加重の動向は、バーゼルIII最終段階の影響を示唆しています。

NMRFフレームワークは、「使用テスト」を満たしているでしょうか?

モデル化不可能なリスクファクターはリスク感応度に影響を与え、また実用面や較正上の困難を伴うと、二人のリスク専門家は主張しています。