AIG hit by $230 million settlement over MedPartners

Megan van Ooyen from SAS rounds up the top five op risk losses for August

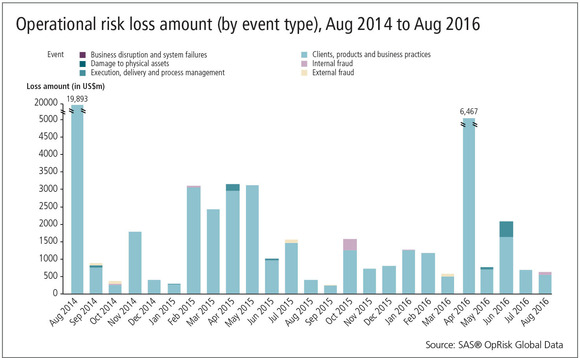

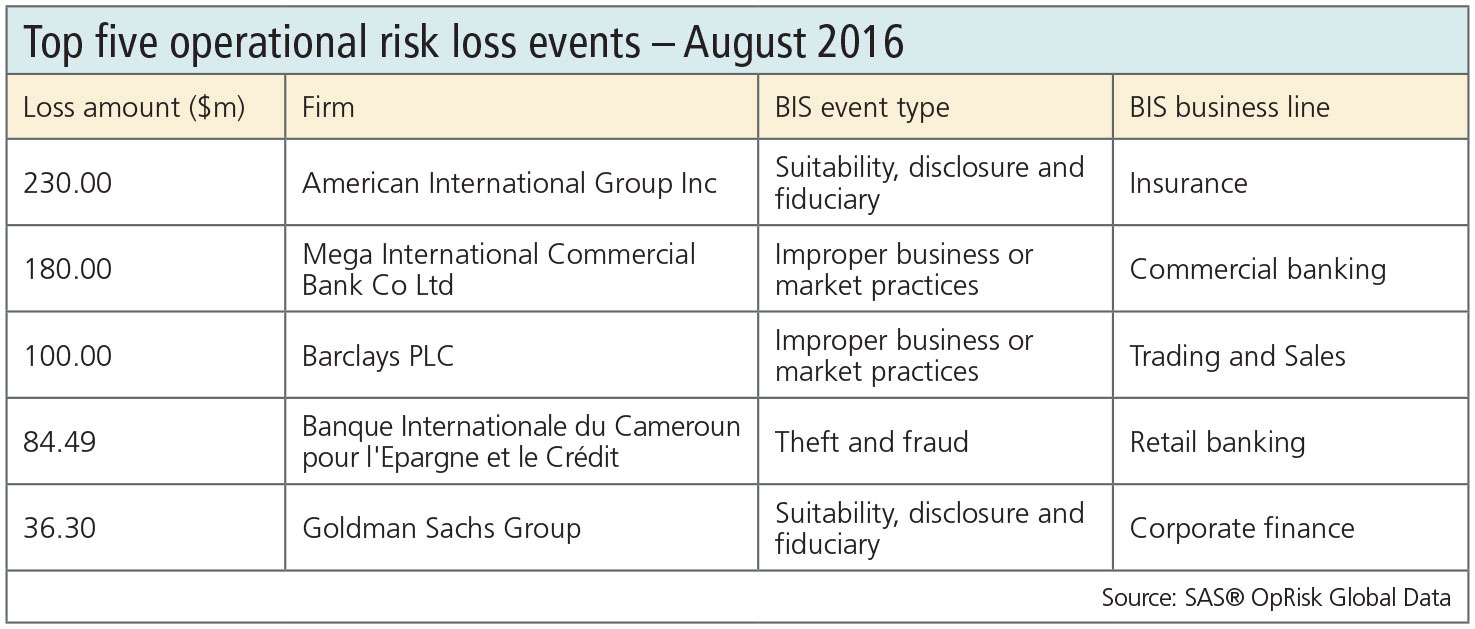

In August, financial services firms suffered some nasty operational risk losses as a result of problems such as market manipulation, misconduct and poor anti-money laundering (AML) compliance.

But the largest loss stemmed from a class action lawsuit against insurance giant AIG.

In the late 1990s, MedPartners, a physician practice management company that now operates as CVS Health, touted its fast-growth strategy, but a failed merger in 1998 called those claims into question. Fearing shareholder retaliation, MedPartners shored up its defences with an unlimited excess coverage policy from AIG.

As expected, disgruntled shareholders filed securities fraud lawsuits accusing the company of publishing false and misleading statements. The consolidated class action lawsuit sought $750 million in damages, but MedPartners claimed it was on the verge of bankruptcy. Shareholders knew the company had a directors and officers insurance limit of $50 million, so they decided to take what they could get and settled for $56 million in 1999.

Neither MedPartners nor AIG mentioned the unlimited excess coverage policy.

Click here to enlarge, or tap image on app

Inevitably, shareholders learned of the policy. They filed a second lawsuit in 2003 accusing AIG and MedPartners of fraud. The companies argued MedPartners had disclosed the policy in December 1998. It was not their fault, they reasoned, if the shareholders' lawyers had misunderstood the carefully worded press release.

The prospect of a trial motivated both parties to seek a resolution in early 2016. The judge approved a combined settlement of $310 million – including $230 million from AIG – on August 15.

Last month's second largest op risk loss occurred at Mega International Commercial Bank, which settled a dispute with the New York Department of Financial Services (DFS) for $180 million. The settlement follows a DFS examination of Mega Bank's New York branch in 2015, which found serious and systemic AML compliance problems.

According to the regulator, the compliance structure of Mega Bank's New York branch was a mess. Senior compliance officers also served as operational officers – a conflict of interest between their business and compliance obligations. Furthermore, many of those officers, including its Bank Secrecy Act/AML compliance officer and chief compliance officer, had little training in US regulations. The problem was compounded by language barriers, unclear transaction monitoring and reporting policies, and out-of-date surveillance monitoring criteria.

The AML deficiencies came to a head in Panama, where Mega Bank operated two branches. Reports link certain bank customers with Mossack Fonseca, the now-infamous law firm accused of aiding and abetting money laundering and tax evasion. Despite numerous red flags – and contrary to its own internal policies – Mega Bank allegedly never performed adequate due diligence on billions of dollars in transactions processed between New York and Panama.

The DFS presented its findings to Mega Bank in February 2016. Although the bank dismissed the regulator's concerns and challenged much of the report, it agreed to settle. Meanwhile, Mega Bank faces further investigations in the US and Taiwan.

August's third biggest op risk loss is part of an ongoing saga: the Libor scandal.

In this chapter, the US states of New York and Connecticut led a multi-state enquiry into the affair. They alleged Barclays Bank and Barclays Capital knowingly colluded with other panel banks to manipulate US dollar Libor rates. This meant investors lost out, so the states accused Barclays of willfully defrauding government entities and non-profit institutions.

The UK bank has a history of co-operating with Libor investigations, and did so again in this case. The states continue to pursue other panel banks, so Barclays' $100 million payout sets the benchmark for future settlements.

The final two losses in August's top five list involve internal misconduct.

Megan van Ooyen

Megan van Ooyen

In Cameroon, authorities arrested four current and former employees of French bank BPCE's local subsidiary, BICEC. The former director-general, former director of accounting, and two others allegedly used various schemes to steal an estimated $84.49 million between 2003 and 2015. BICEC fired the director-general three months before the arrests, but withheld its reasons for doing so. The bank also declined to confirm any loss speculation and did not offer additional details regarding the means of fraud. It has, however, filed a lawsuit against unspecified individuals in an attempt to recover the stolen funds.

Back in the US, a $36.3 million penalty levied on Goldman Sachs by the US Federal Reserve Board rounds out this month's top five op risk losses.

The trouble began in May 2014 when Goldman Sachs hired Rohit Bansal, a former bank examiner at the Fed's New York office, and placed him on a team with Joseph Jiampetro. According to the Fed, Jiampetro turned a blind eye when Bansal reached out to Jason Gross, his former colleague at the Fed. Gross provided Bansal with memoranda and internal correspondence regarding a client's upcoming review, as well as documents describing the Fed's assessment framework and examination rating process.

Scott Romanoff, the partner supervising Jiampetro's team, became suspicious in September 2014 and reported his concerns to Goldman's investment banking compliance division. The firm subsequently sacked Bansal and Jiampetro.

The DFS investigated the incident and fined Goldman $50 million in October 2015, while the Fed concluded its own probe more recently. The central bank found that Goldman's employees obtained confidential regulatory information illegally and used it to solicit business for the firm. The Fed also cited Goldman for having inadequate policies, procedures, and training in place to ensure employees didn't obtain or use confidential supervisory information without authorisation.

コンテンツを印刷またはコピーできるのは、有料の購読契約を結んでいるユーザー、または法人購読契約の一員であるユーザーのみです。

これらのオプションやその他の購読特典を利用するには、info@risk.net にお問い合わせいただくか、こちらの購読オプションをご覧ください: http://subscriptions.risk.net/subscribe

現在、このコンテンツを印刷することはできません。詳しくはinfo@risk.netまでお問い合わせください。

現在、このコンテンツをコピーすることはできません。詳しくはinfo@risk.netまでお問い合わせください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(ポイント2.4)に記載されているように、印刷は1部のみです。

追加の権利を購入したい場合は、info@risk.netまで電子メールでご連絡ください。

Copyright インフォプロ・デジタル・リミテッド.無断複写・転載を禁じます。

このコンテンツは、当社の記事ツールを使用して共有することができます。当社の利用規約、https://www.infopro-digital.com/terms-and-conditions/subscriptions/(第2.4項)に概説されているように、認定ユーザーは、個人的な使用のために資料のコピーを1部のみ作成することができます。また、2.5項の制限にも従わなければなりません。

追加権利の購入をご希望の場合は、info@risk.netまで電子メールでご連絡ください。

詳細はこちら リスク管理

CROは気候リスクの負担を担っていますが、より大きな組織全体の状況は不透明である

専任チームの規模は大きく異なりますが、その責任はリスク管理部門、サステナビリティ部門、および事業部門の間で共有されています。

ISITCのポール・フラム氏が欧州におけるT+1への懸念について語る

決済業務の移管に先立ち、取引処理部門の責任者は予算制約、テスト、および業務上のリスクに対する懸念を理由として挙げています。

Climate Risk Benchmarking: explore the data

View interactive charts from Risk.net’s 43-bank study, covering climate governance, physical and transition risks, stress-testing, technology, and regulation

「モデルは全く間違っていない」:気候リスクをめぐる論争

Risk.netの最新ベンチマーク調査によりますと、銀行は数十年にわたるエクスポージャーに直面している一方で、政治的な逆風、限られたリソース、データ不足といった課題にも取り組まざるを得ない状況にあります。

意外なことに、サイバー保険の保険料が2025年に低下した

攻撃の頻度と深刻さが増しているにもかかわらず、保険会社間の競争により保険料は低下しています。

オペリスクデータ:カイザー社、病気の偽装により5億ドルの支払いを主導

また:融資不正取引が韓国系銀行を直撃;サクソバンクとサンタンデール銀行でAMLが機能せず。ORXニュースのデータより

市場がベーシス取引に関するFSBの懸念を共有せず

業界は、債務発行が増加する中、より厳しいヘアカット規制が市場の容量を制限する可能性があると警告しています。

CGBレポ清算が香港に導入される予定…が、まだその時ではない

市場は、規制当局が義務化を検討する前に、インフラ整備に少なくとも5年を要すると見込んでおります。