Lorenzo Migliorato

Lorenzo is a senior data journalist on the Risk Quantum desk at Risk.net. He has previously covered consumer credit, financial regulation, equities and the high-yield markets. He graduated in philosophy at Sapienza University of Rome and in journalism at Cardiff University.

Follow Lorenzo

Articles by Lorenzo Migliorato

Liquidity valuation adjustment costs JPM $235m

Tweak to derivatives book weighs on the bank’s fixed income revenues

Barclays’ risk pare-back sees market RWAs fall £3bn

The majority of market risk is now assessed under the regulator-set standardised approach

EU banks’ derivatives exposures jumped 36% in H1

Top banks added €235bn since December, amid switch to SA-CCR and a new leverage ratio template

Regulatory feedback adds $23bn to Goldman’s RWAs

The revision to the bank's standardised RWAs brought it closer to hit the so-called Collins floor

Early SA-CCR adoption to lop 120bp off Morgan Stanley’s CET1 ratio

The planned switch is set to increase the bank’s RWAs by between $35bn and $45bn

JP Morgan’s VAR falls to lowest since 2018

Gauge of trading risk drops 20% quarter on quarter, driven by commodities and equity desks

IMA to retain large role in setting market risk capital post-FRTB

Gyrations over 2020 mean a bigger share of market risk requirements could be underpinned by internal models post-reform

Basel III heralds 41% op risk jump for EU banks

Capital requirements set to rise almost 88% for those G-Sibs that don’t currently use the AMA

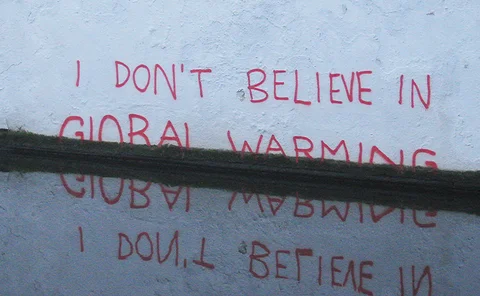

Climate risk: the writing is on the wall

For the EU financial sector, climate risk is inescapable, but it could be tamed

Basel III output floor set to bind 25% of large banks

Risk-based capital requirements would constrain the largest share of international lenders

European banks set for 17.6% capital hike under Basel III

Output floor expected to push Tier 1 capital requirements up 7.3% alone, latest BCBS monitoring report shows

Default risk set to rise from climate inaction – ECB

‘Hothouse world’ scenario could see average probability of default increase significantly more than under both orderly or belated transition

Interest rate ETD volumes up 40% from 2020 nadir

Shorter-dated contracts push total open interest higher

Level 3 assets at global systemic banks down 36% since 2014

Hard-to-value holdings down sharply over the past six years, but pandemic threw spanner in the works at some banks

Majority of US G-Sibs’ assets attract sub-100% risk-weighting

Risk Quantum analysis shows top US banks retrenched to lower-risk assets through the pandemic

EU banks eye debt issuance as central bank funding winds down

The projected increase would not be sufficient to replace TLTROs maturing in 2023, EBA report finds

State Street to become world’s largest custodian

Brown Brothers Harriman Investor Services acquisition means Boston-based bank will leapfrog BNY Mellon and JP Morgan

Deutsche sees equity RWAs jump 29% on new EU rules

CRR II requires banks to calculate exposure they would incur to honour guaranteed returns on investment products

Internal model revamp adds €3.2bn to Commerz’s CCR RWAs in Q2

IMM update drove most of 37.8% increase in total CCR RWAs

BoE floor could double capital charges on HSBC’s UK home loans

New rules could forcibly push up residential mortgage portfolio’s 5% risk density

Cleared portfolios surge at EU G-Sibs

Systemic banks post highest share of cleared trades in seven years, as IM phases five and six approach

Deutsche takes €17.7bn RWA add-on in final Trim hit

Leveraged loan portfolio among targets of ECB’s remedies

Crédit Agricole grew OTC derivatives notionals 17% in 2020

Bank pulls ahead of SocGen as third-largest European derivatives bank but risks incurring a higher G-Sib score