This article was paid for by a contributing third party.More Information.

Managing a high-inflation environment with clearing

Over the past two years, geopolitical events, macroeconomic forces and market disruptions have created significant challenges for the investment community. With the outlook for the remainder of 2023 still highly uncertain, how does clearing help market participants manage inflation?

A global inflationary environment greeted the world as it emerged from the lockdowns of the Covid-19 pandemic. The Ukraine/Russia conflict, rising energy prices and significant supply chain disruptions have sparked an inflationary cycle that has proven stubbornly persistent. The monetary policy response has been swift, with central banks – most notably the US Federal Reserve, Bank of England (BoE) and European Central Bank (ECB) – rolling out aggressive rate hikes.

However, market disruptions over the past 24 months, including the September 2022 UK mini-budget and financial sector fallout from the failures of Silicon Valley Bank and Credit Suisse, have increased volatility and uncertainty. This has raised questions about the optimal interest rate level, leaving many wondering whether interest rate cuts could happen sooner than expected, and what the inflationary ramifications of such a move would be.

In response, there has been increased appetite from the investment community for products to better hedge inflation risk. Inflation-linked swaps, which track an inflation index, are one such instrument that has gained popularity.

There have been interesting dynamics at play in the cleared world of inflation-linked swaps throughout this period. Uncleared margin rules (UMR) set a framework that prescribes the posting of initial margin (IM) for bilateral swaps, including inflation-linked swaps, where previously the posting of IM was routinely required only for cleared swaps. The phase-in of UMR has levelled off margin requirements between bilateral and cleared inflation swaps, contributing to a broadening of the customer base looking to clear their new and existing inflation swap positions.

The benefits of clearing inflation swaps

By their nature, inflation swaps tend to be long-dated. Since they also pay the lifetime inflation return as a terminal lump sum, they can be highly capital-intensive because of the credit exposure this generates. Clearing these swaps allows users to unlock this capital, and offers portfolio diversification for increased margin efficiencies by providing potential margin offsets against a cleared interest rate swap portfolio.

Additionally, the clearing of inflation swaps can further enable increased compression opportunities when compared with non-cleared positions, due to the standardisation of valuation that comes from facing one central counterparty (CCP) rather than multiple, and the trades’ standardised maturity profiles, which are particularly pronounced in EUR and GBP. In 2022, more than $5.5 trillion of inflation notional was compressed – a substantial figure compared with the total new inflation notional of $9.3 trillion.

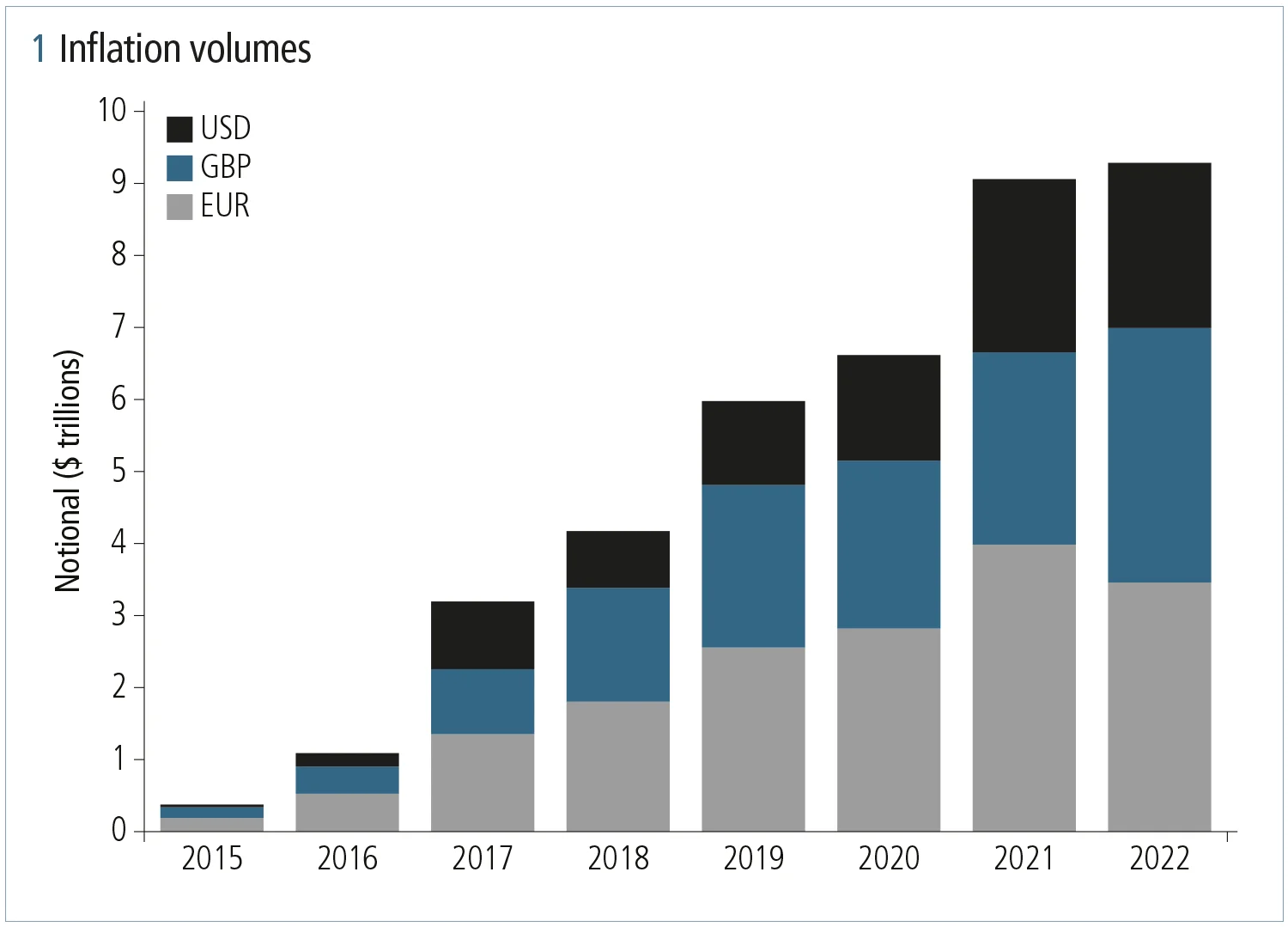

Looking across all products, market volatility and changes in interest rates drove record cleared volumes in 2022 at LCH SwapClear, with more than 8 million trades registered – an all-time high for the service – and more than $1 quadrillion of notional. Similarly, inflation swaps have undergone a step change over the past two years, hitting a record $9.3 trillion of notional registered in 2022, up from $6.6 trillion in 2020, and surpassing $10 trillion of outstanding notional for the first time.

EUR, GBP and USD have all seen heightened volumes, with spikes in activity in early 2021, as ‘reflation’ began making global headlines; in early 2022, as the Ukraine/Russia conflict commenced; and at the beginning of 2023 against a backdrop of uncertainty around the trajectory of interest rate hikes from the Fed, ECB and BoE.

Alongside increased inflation clearing activity from existing participants of the LCH service, there has been a jump in the number of SwapClear members and clients new to clearing the product. Since the start of 2022, eight members and 60 clients have cleared inflation swaps at SwapClear for the first time. As of the first quarter of 2023, inflation swaps were being cleared at SwapClear by 38 members, and by more than 200 clients using the clearing services of 15 clearing broker entities.

While zero-coupon inflation swaps clearing is now offered in three currencies (EUR, GBP and USD), there is a strong worldwide distribution among investors. The use of inflation swaps by SwapClear’s client base spans 24 countries and five continents, with investment sectors such as hedge funds, asset managers, central banks and pension funds all strongly represented.

LCH product offering

LCH was the first CCP to begin clearing inflation swaps in 2015, allowing swaps investors to leverage SwapClear’s proven risk framework, including the same margin and default management models as over-the-counter rate products. The LCH SwapClear margin calculator tool enables users to approximate margin obligations on existing inflation and interest rate swap positions, allowing thorough cost-benefit analyses to be conducted.

Inflation clearing at LCH encompasses the Euro Harmonised Index of Consumer Prices excluding Tobacco and UK Retail Price Index to a maximum tenor of 50 years, alongside the France Consumer Price Index excluding Tobacco and US Consumer Price Index to a maximum tenor of 30 years. As well as zero-coupon inflation swaps clearing, LCH also offers inflation-linked asset swaps clearing (standard coupon inflation swaps). Where previously market participants were only able to clear their inflation-linked asset swaps by structuring them as a series of zero-coupon tickets, inflation-linked asset swaps clearing has simplified the process for the sell-side and buy-side communities.

The inflation and interest rate outlooks appear poised to remain highly uncertain through 2023.

If you are interested in learning more about inflation clearing at LCH, contact LCH SwapClear’s specialist sales team or visit LCH SwapClear for further information.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net