This article was paid for by a contributing third party.More Information.

FX Smart Clearing at LCH ForexClear: solving SA-CCR capital challenges

LCH ForexClear explores how, with the standardised approach to counterparty credit risk (SA-CCR) increasing the capital requirements of banks’ foreign exchange portfolios, its FX Smart Clearing solution can reduce capital burden and achieve additional savings for members

Foreign exchange’s SA‑CCR challenge

As noted in a previous LCH ForexClear article, the introduction of the SA‑CCR has led to a significant increase in the capital requirements of banks’ FX portfolios. This sudden increase has led to pricing changes for those most impacted, with market participants seeking products and tools to ease the pain of transitioning to the SA‑CCR.

Clearing FX trades at LCH ForexClear is one such avenue that can be used to materially reduce capital burden and, following increased demand from its membership, the service has made progress on delivering on its FX Smart Clearing initiative. This allows third-party optimisation providers, acting on behalf of LCH ForexClear members, to select FX forwards and swaps for clearing to optimise financial resources – specifically, capital and margin requirements.

Following the initial proof of concept (PoC) LCH ForexClear conducted in July 2021 with 17 banking groups, the next phase of the programme was recently completed by Quantile, a multilateral optimisation provider, in partnership with LCH ForexClear. This was a milestone on the FX Smart Clearing journey.

The aim of the PoC was to prove that additional savings could be achieved by selectively clearing FX forwards and swaps using the expertise of a recognised optimisation provider. The run included data from 21 entities, and the results generated a compelling case for FX Smart Clearing, with an average reduction in capital utilisation of approximately 50%.

What is FX Smart Clearing?

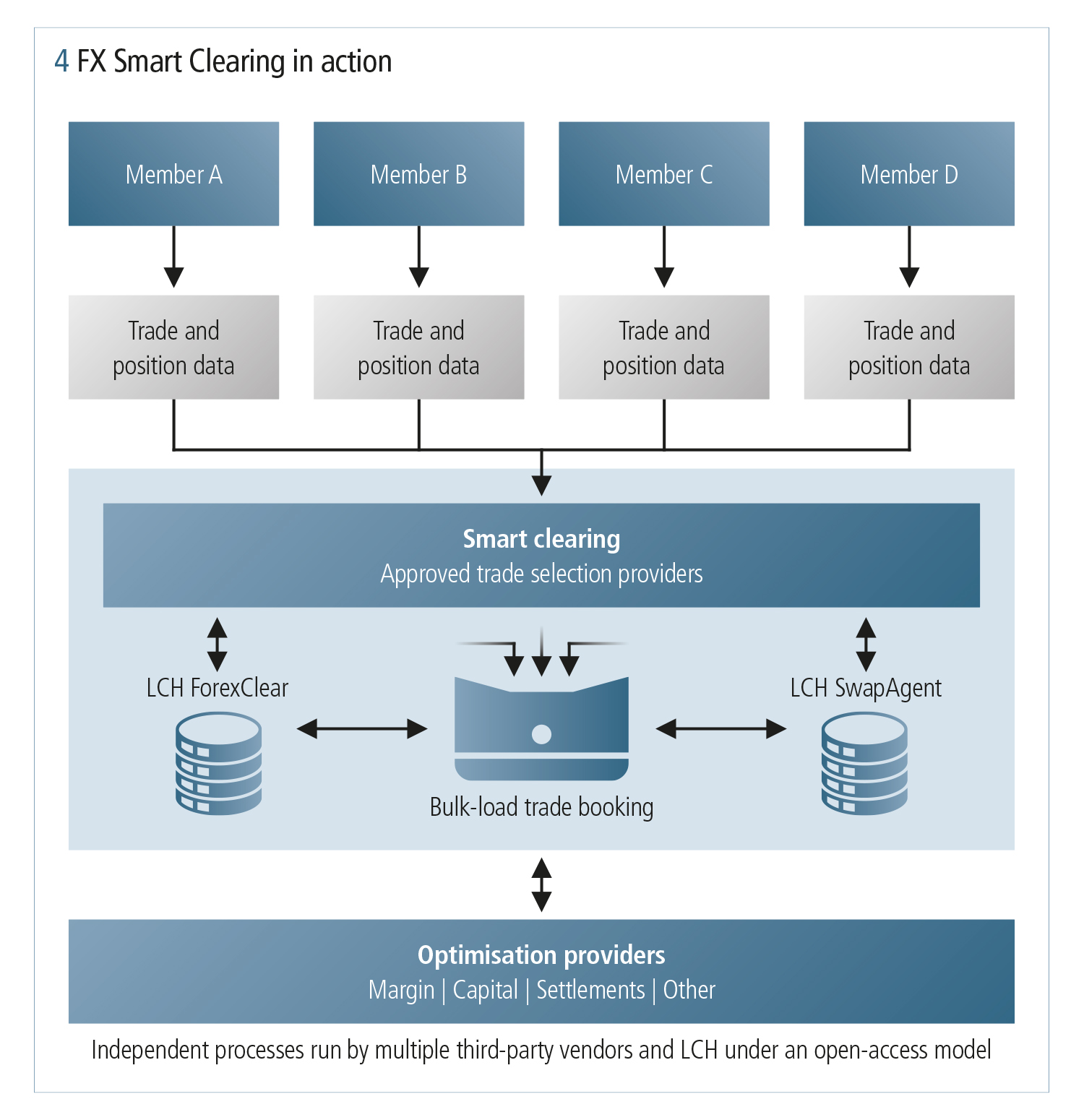

FX Smart Clearing allows members to connect to a third-party optimisation provider to share trade and other financial information, while the optimisation provider connects to LCH ForexClear to consume the existing cleared portfolio. The optimisation provider – or approved trade selection provider – then assesses the desired financial resource optimisation target for members, using selective clearing for each; solves complex optimisation problems to minimise financial resource requirements; and submits the resulting trade packages to LCH ForexClear to clear on behalf of its members.

Unlike non-deliverable forwards (NDFs) and FX options, deliverable FX forwards and swaps do not incur initial margin (IM) in the bilateral world, whereas all products cleared incur IM at the central counterparty (CCP). Consequently, these products must be cleared in a ‘smart’ way, maintaining the balance between capital benefits and the cost of margin. Thus, entire FX portfolios are not cleared, but ‘optimised’ portfolios are selected for clearing based on each member’s specific aims around margin and capital.

A key facet of the FX Smart Clearing project is an enhanced trade registration process at LCH ForexClear, allowing multilateral registration of large packages. This ensures an all-or-nothing scenario for all participants and allows them to benefit from optimised pre‑funding requirements.

The importance of a clearing node

The LCH ForexClear node was a vital component of the recent PoC run, allowing materially increased capital efficiencies, predominantly as a result of the following:

Multilateral netting

A single CCP offers the greatest netting benefits, reducing SA‑CCR exposure while keeping net risk-neutral. Multilateral netting benefits are considerable and provide a direct reduction in SA‑CCR exposures.

Settled-to-market (STM) benefits

Trades that are cleared can then be treated as STM, which reduces SA‑CCR exposure by 53% via a reduction in the maturity factor of every trade.

Reduced counterparty risk weight

Cleared positions save over 90% in risk-weighted asset capital requirements. Bilateral exposures are calculated using a counterparty risk-weight minimum of 20%, whereas positions versus an authorised CCP are treated with a counterparty risk weight of 2%.

Other value-add services

Following clearing of the selected packages, all trades will face a single CCP and will be managed under the CCP rule book, replacing a host of differing bilateral credit support annexes. Consequently, the ability to perform additional value-add optimisation services – risky compression, settlement ladder optimisation and notional reduction for global systemically important banks, for example – will increase dramatically.

The delivery of portfolio margining between LCH ForexClear’s deliverable and non‑deliverable segments, scheduled in February 2023 subject to regulatory review, allows it to continue adding value to the optimisation network. With portfolio margining, IM on deliverable FX forwards and swaps can be offset with eligible existing cleared emerging market NDFs, increasing the exposures that can be cleared and allowing LCH ForexClear members to achieve even greater capital and operational benefits.

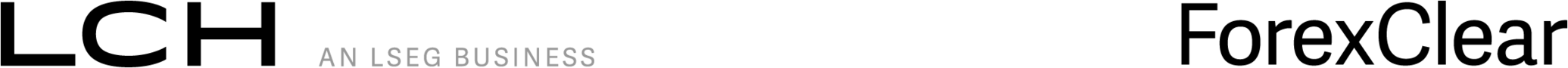

Similarly, as LCH ForexClear’s FX Options service continues to grow, so does its ability to clear large exposures that offset existing cleared positions. Again, this greatly increases the benefits of the cleared node within the optimisation ecosystem.

Quantile PoC run: results

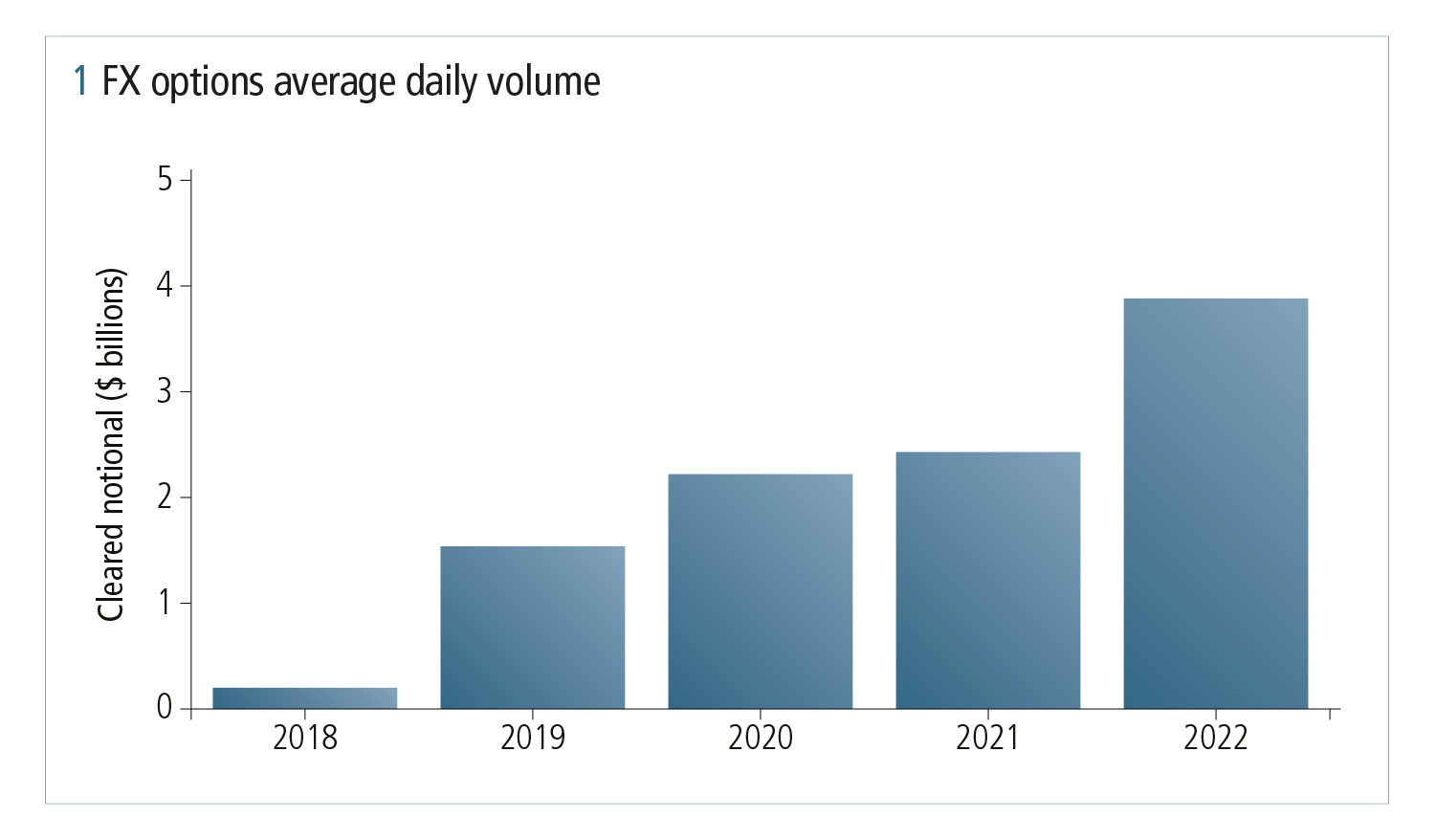

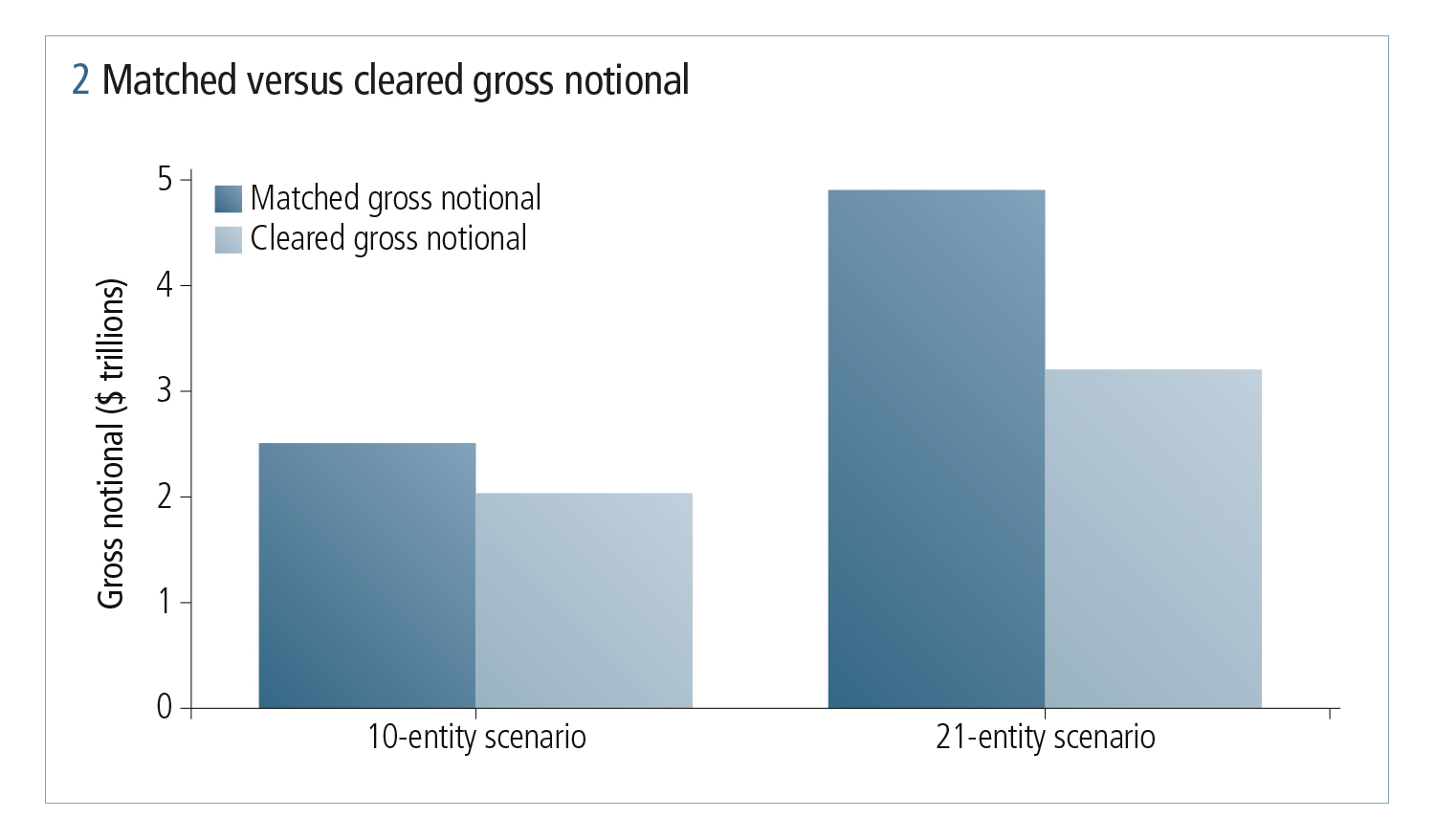

In November 2022, LCH ForexClear partnered with Quantile to deliver the first FX Smart Clearing PoC with a third party. Ten participants submitted data across 21 legal entities, which allowed mirroring of non-submitting entities to run two scenarios – the first with 10 entities and the second with 21 – aimed at SA‑CCR capital reduction while maintaining or limiting the impact of IM.

Each participant submitted FX forward and swap trade data, along with SA‑CCR position files and constraints, such as a max IM increase constraint.

The total gross notional submitted to LCH ForexClear was $2.04 trillion in the 10-entity scenario and $3.2 trillion with 21 entities. Clearing these trades would result in an average capital reduction of 38% (10 entities) and 50% (21 entities), with a substantial reduction in effective notional and annualised capital cost savings.

Next steps and future enhancements

Increased connectivity

Following the success of the most recent PoC run with Quantile, LCH ForexClear will liaise with market participants to ensure follow-up runs, with increased participation taking place in the first quarter of 2023. In keeping with its open-access principles, LCH ForexClear will also connect with other third-party optimisation vendors.

Live executed run

LCH ForexClear, in partnership with Quantile, aims to execute its first live FX Smart Clearing test run in the first half of 2023, during which time live trades will be novated – the starting point on the road to full-scale FX Smart Clearing execution as participation is expected to grow throughout 2023.

Enhanced currency pair offering

LCH ForexClear’s product road map includes an extension of its currency pair offering in 2023, subject to regulatory approval or review, allowing greater risk to be submitted to an FX Smart Clearing run and achieving greater optimisation results for members.

LCH SwapAgent

FX Smart Clearing ensures optimal packages are submitted to clearing. By its very nature, there are certain residual risk positions that would not or should not be submitted to LCH ForexClear. The FX Smart Clearing offering will expand to include an LCH SwapAgent node, ensuring these residual positions can still benefit from the 53% efficiency gained by STM treatment if submitted through SwapAgent, the LCH Group service that simplifies the processing, margining and settlement of non-cleared derivatives. However, eligible members can elect to connect to one or both services with their optimisation provider.

Learn more

Find out more about the benefits of FX Smart Clearing at LCH ForexClear by contacting forexclearclientservices@lch.com

Full service information can be found at www.lch.com/services/forexclear

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net