This article was paid for by a contributing third party.More Information.

Addressing SA-CCR capital challenges with FX clearing

Since the implementation of the standardised approach to counterparty credit risk (SA-CCR) in June 2021, the foreign exchange industry has struggled to cope with the sharp increases in capital requirements for FX products. James Shanahan, director, ForexClear Quantitative Research and Development, explains how clearing can help market participants reduce their SA-CCR capital footprint

FX is the market that has, arguably, been the most affected by the adoption of the SA-CCR in the calculation of risk-weighted asset (RWA)/leverage ratio capital requirements.

The SA-CCR replaces the current exposure methodology (CEM) as the standardised calculation of capital requirements, marking the transition to a more risk-sensitive approach to estimating counterparty credit risk. Under CEM, the estimated trade exposure/potential future exposure calculation was a function of the trade maturity, favourable to the short-dated nature of FX. Unlike CEM, the SA-CCR is based on the true risk of counterparty exposures. This transition from a maturity-based calculation to a risk-based calculation is the driver for sharp increases in banks’ capital requirements for FX products.

As adoption of the SA-CCR has increased globally (in the European Union since June 2021, and in the US and UK since January 2022), the landmark shift to the SA-CCR has caused pain for financial institutions worldwide, and banks’ increasing capital requirements have driven unprecedented demand for products to reduce RWA/leverage ratio capital requirements.

Following lengthy discussions with our customers, LCH ForexClear is developing an innovative solution to help ease these SA-CCR pains: FX Smart Clearing, which will provide the ability to clear in an optimised way. FX Smart Clearing is currently in its pilot phase and is scheduled to go live in 2023, subject to regulatory review.

How clearing reduces SA-CCR costs

Along with the array of operational efficiencies achieved through clearing, the risk management expertise provided by a qualified central counterparty (QCCP)1 has led to regulations offering substantial capital benefits for any positions cleared. Entities that clear their FX products can often expect to reduce their capital footprint in multiple ways, primarily via three methods:

1. Multilateral netting

Clearing offers netting benefits that may be maximised via the use of a single central counterparty, reducing the SA-CCR exposure while keeping the net risk neutral. Multilateral netting benefits can be considerable and can provide a direct reduction in SA-CCR exposures. Cleared trades can also benefit from multilateral netting as previous bilateral positions against multiple counterparties are collapsed to a single counterparty. Any offsetting positions are naturally reduced – driving SA-CCR/capital reductions without any change in risk.

2. Settled-to-market (STM) benefits

Trades that are cleared can then be treated as STM, which can reduce the SA-CCR exposure by up to 53%, based on LCH estimates, via a reduction in trade maturity factor.

3. Reduced counterparty risk weight

Cleared positions can receive a saving of more than 90% in RWA capital requirements. Bilateral exposures are calculated using a counterparty risk weight that is a minimum of 20%, whereas positions versus a QCCP are treated with a counterparty risk weight of 2%.

Smart Clearing: the future

FX forwards and swaps account for a large chunk of the SA-CCR exposures that drive increasing FX capital requirements. Unlike non-deliverable forwards and FX options, FX forwards and swaps do not incur initial margin in the bilateral space (whereas all products cleared incur initial margin at the central counterparty (CCP)). Subsequently, these products must be cleared in a ‘smart’ way to maintain the balance between capital benefits and cost of margin.

To ensure the margin costs of a cleared portfolio can be outweighed by the capital benefits, LCH ForexClear is launching a novel programme that offers market participants a new way to clear – in an optimised fashion.

Following a successful proof of concept in the second half of 2021 and a successful trade-booking trial run in the first quarter of 2022, LCH ForexClear has begun a period of collaboration with its membership and third-party optimisation providers to prepare for the launch of Smart Clearing later this year. By offering direct connectivity for approved trade selection providers (ATSPs) and an enhanced trade-booking model, LCH ForexClear clearing members can benefit from the expertise of third-party optimisation providers, as well as the capital and multitude of operational efficiencies gained from clearing FX.

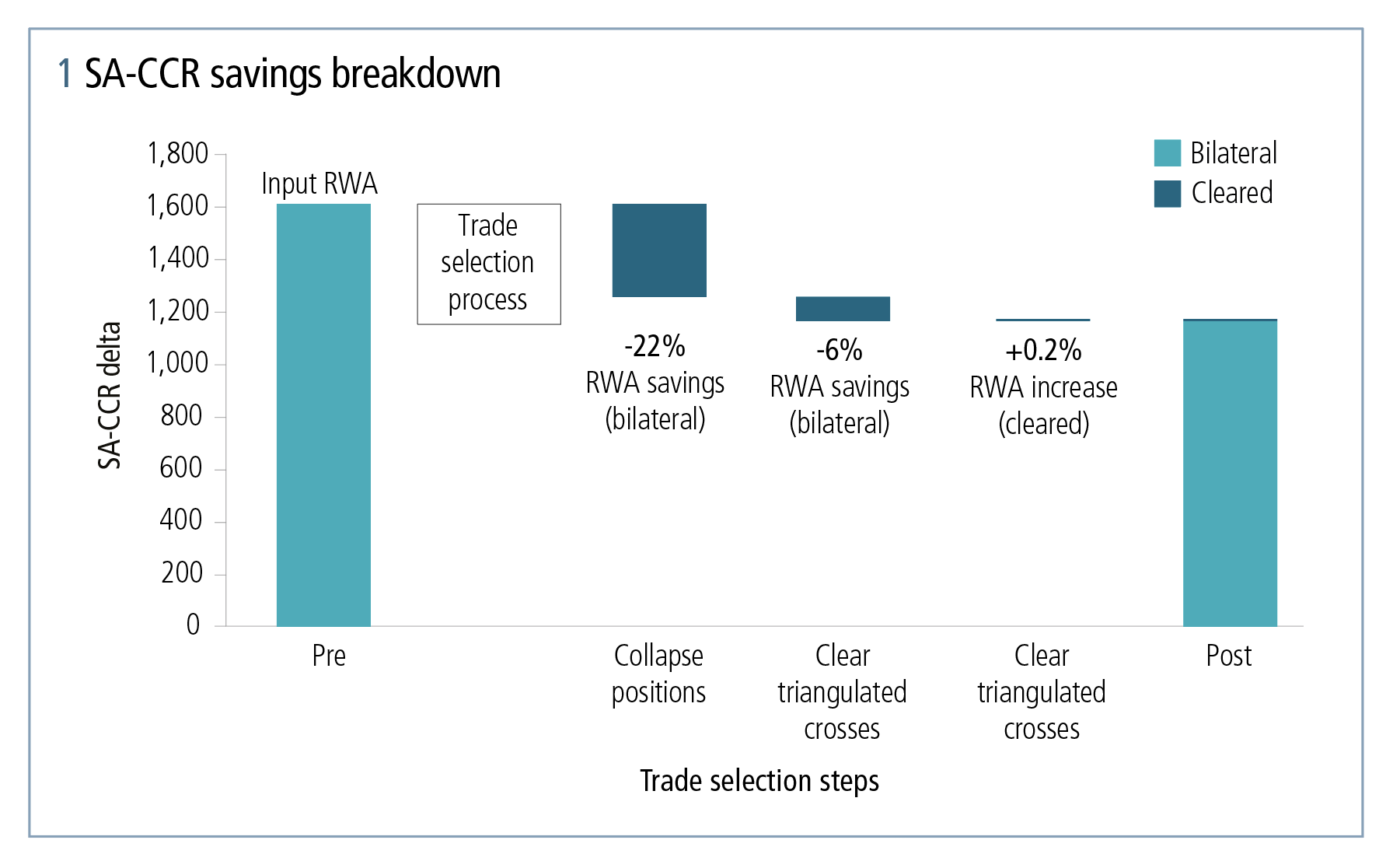

LCH proof of concept

LCH ForexClear performed a proof of concept in 2021 to demonstrate the potential advantages of selectively clearing FX forwards and swaps. Seventeen banking groups participated in this proof of concept, in which $1.6 trillion of SA-CCR delta in eight currency pairs was submitted, resulting in a reduction of $449 billion (or 28%) and providing LevX/RWA cost savings of $125million/$42 million across all participants.

Enhancements to LCH ForexClear’s product offering, as well as the introduction of the expertise of ATSPs, will further increase the potential for savings via FX Smart Clearing. Examples of LCH ForexClear’s planned initiatives include, subject to regulatory review or approval:

- 2023: FX Smart Clearing go-live

- 2023: portfolio margining between deliverable and non-deliverable trades

- 2023: increased eligible currency pair scope

Notes

1. In accordance with the Basel Committee on Banking Supervision standards, for the purposes of calculating banks’ capital requirements for exposures to CCPs, a QCCP is an entity licensed to operate as a CCP and prudentially supervised in a jurisdiction where the relevant regulator/overseer has implemented domestic regulations that implement the Committee on Payments and Market Infrastructures and International Organization of Securities Commissions Principles for Financial Market Infrastructures. As a result, financial institutions using QCCPs benefit from lower capital requirements for exposures to CCPs.

All clearing services are provided in accordance with the terms of the LCH rulebook. The contents of this article are for illustrative purposes only. All results will depend on individual ForexClear users’ individual circumstances. ForexClear users should seek their own advice regarding the use of LCH Limited’s clearing services.

Further reading

This article covers the topics from the recent thought leadership article LCH ForexClear: addressing SA-CCR capital challenges

LCH ForexClear is here to partner with the market on the recent UMR changes. Contact LCH ForexClear’s specialist sales team or visit LCH ForexClear for further information or requesting portfolio analysis.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net