This article was paid for by a contributing third party.More Information.

FX forwards and swaps

LCH’s Kah Yang Chong, head of foreign exchange Emea product, and James Shanahan, head of FX quantitative analytics, discuss whether clearing of FX forwards and swaps – so far limited by requirements under uncleared margin rules (UMR) – will provide the efficiencies market participants need

Market landscape

The financial marketplace continues to evolve and change in response to regulatory and technological advancements. The electronification of trading systems in the past decade, improving real-time data and risk monitoring, and new regulations such as UMR and Basel III capital framework are changing the way liquidity providers and banks approach their execution strategies.

The largest segment of the FX market – FX forwards and swaps – is increasingly becoming a focus area for these firms, which are looking to improve balance sheet impact and optimise counterparty risk exposure. According to the Bank for International Settlements’ Triennial central bank survey, this market represents 63% of the FX market daily turnover, at $4.2 trillion – with more recent surveys suggesting a marked increase since 2019.

To date, FX clearing has been driven predominantly by the introduction of UMR in 2016, which requires, inter alia, the posting of two-way initial margin (IM) between counterparties for uncleared, in-scope positions. This has led to the adoption of clearing for non-deliverable forwards (NDFs) and FX options (FXOs), as clearing provides netting across counterparties in addition to a stable margin model, which leads to margin efficiency. Cleared trades also benefit from a reduction in counterparty credit risk and clearing simplifies trading documentation, which could provide greater access to more counterparties for execution. However, FX forwards and swaps are not in-scope for the IM requirements under UMR, and thus clearing of these products has been limited to date. But interest is now growing.

Impact of SA-CCR regulations

According to the latest Basel III monitoring report, the introduction of full Basel III standards – which include a standardised approach to counterparty credit risk (SA-CCR) – is expected to increase the Tier 1 minimum required capital by 3% for Group 1 banks.SA-CCR is currently binding in the European Union and will be in force for the rest of the Group of 20 economies from January 1, 2022.

In 2020, Risk.net examined the potential benefits of clearing FX swaps and identified a possible 90% reduction in regulatory capital versus bilateral positions. This is mainly driven by the SA-CCR capital framework, which provides capital relief to central counterparty (CCP) exposures by allowing a lower margin period of risk and offering settled-to-market benefits, reflecting the safeguards and transparent rulebook governing trades at a CCP. Given the size of the FX forwards and swaps markets, achieving significant balance sheet savings by repositioning exposures towards a CCP versus maintaining bilateral positions is a real possibility.

However, since FX forwards and swaps are not in-scope for the IM requirements under UMR,1 and therefore the margin savings that have worked so well from clearing NDFs and FXOs do not have the same effect as clearing FX forwards and swaps, the key question remains: how do banks set themselves up to maximise the potential regulatory capital benefits of clearing while optimising the new margin cost associated with clearing FX forwards and swaps?

FX clearing at LCH

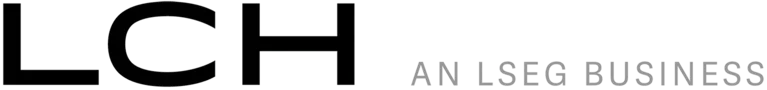

Launched in 2012, LCH’s ForexClear service offers clearing of NDFs, FXOs, non-deliverable FXOs and linear FX products (FX spot, forwards and swaps) across certain emerging market and G20 currency pairs. ForexClear volumes grew substantially when UMR first came into effect in 2016, and today the service comprises an ecosystem of 35 members actively clearing approximately $80 billion of FX transactions daily.

Volumes are expected to grow further as phases five and six of UMR approach in 2021 and 2022, respectively. And, as the clearing ecosystem grows stronger, a network effect that amplifies the benefits of clearing is created.

Membership of LCH’s deliverable FX clearing service for FX options and linear FX products is expected to increase by 50% by the end of 2021. As the service continues to grow, portfolio margining and settlement netting offered between cleared FX options and linear FX products can provide a potential home for clearing FX forwards and swaps.

Clearing proof-of-concept for FX forwards and swaps

LCH has always worked closely with its clearing members and partners to understand existing problems and to design solutions in a collaborative way; LCH is taking the same innovative approach to the challenge of FX forwards and swaps.

In the second half of 2020, LCH began exploring possible solutions to facilitate the clearing of FX forwards and swaps with a group of clearing members. A key finding was that, through multilateral netting and specific capital benefits applicable against a CCP transaction, it may be possible to find opportunities to clear selectively to maximise capital benefits while controlling margin impact.

Although clearing provides capital benefits, each institution working in its own silo would lead to a suboptimal solution because of the lack of information around their counterparties’ exposures. To facilitate a more efficient solution, LCH undertook an analysis-only proof-of-concept in the second quarter of 2021, using its position as a trusted party to perform optimised trade selection at a global level.

Being able to take a bird’s-eye view of bilateral exposures enabled LCH to ensure all participants benefit from a reduction in bilateral net notional (achieved by repositioning net and gross notional in clearing) while maintaining low IM at the CCP.

Crucially, the LCH solution for reducing bilateral net notional does not require the generation of new trades. The reduction of bilateral net notional is achieved via the clearing of existing bilateral trades, which ensures there is no detrimental impact to gross notional metrics, as well as providing operational simplicity and efficiencies.

LCH’s proof-of-concept

Seventeen banking groups signed up for LCH’s FX forwards and swaps proof-of-concept, which included strong participation from the global banks and several regional banks in Europe, North America and Asia.

Each bank provided its open trades against those of the other participants, with various constraints. LCH then matched submitted trades as input into its optimisation engine. Using its status as an independent party, LCH was able to agree the following consensus view on the target metrics of the optimisation run with all participants:

1. Achieve bilateral net notional reduction

2. Maintain low IM at the CCP – a maximum $50 million IM was set for the purpose of the exercise and for simplicity; better results could be achieved by allowing this parameter to be more flexible

3. Select trades for clearing that have a greater opportunity for gross notional compression post-clearing.

Not only does the LCH solution allow for the rebalancing of existing bilateral positions (and thereby allow participants to obtain the benefits of multilateral netting), but optimised clearing also leverages the capital relief applied to CCPs to clear directional risk, allowing participants to achieve further capital savings.

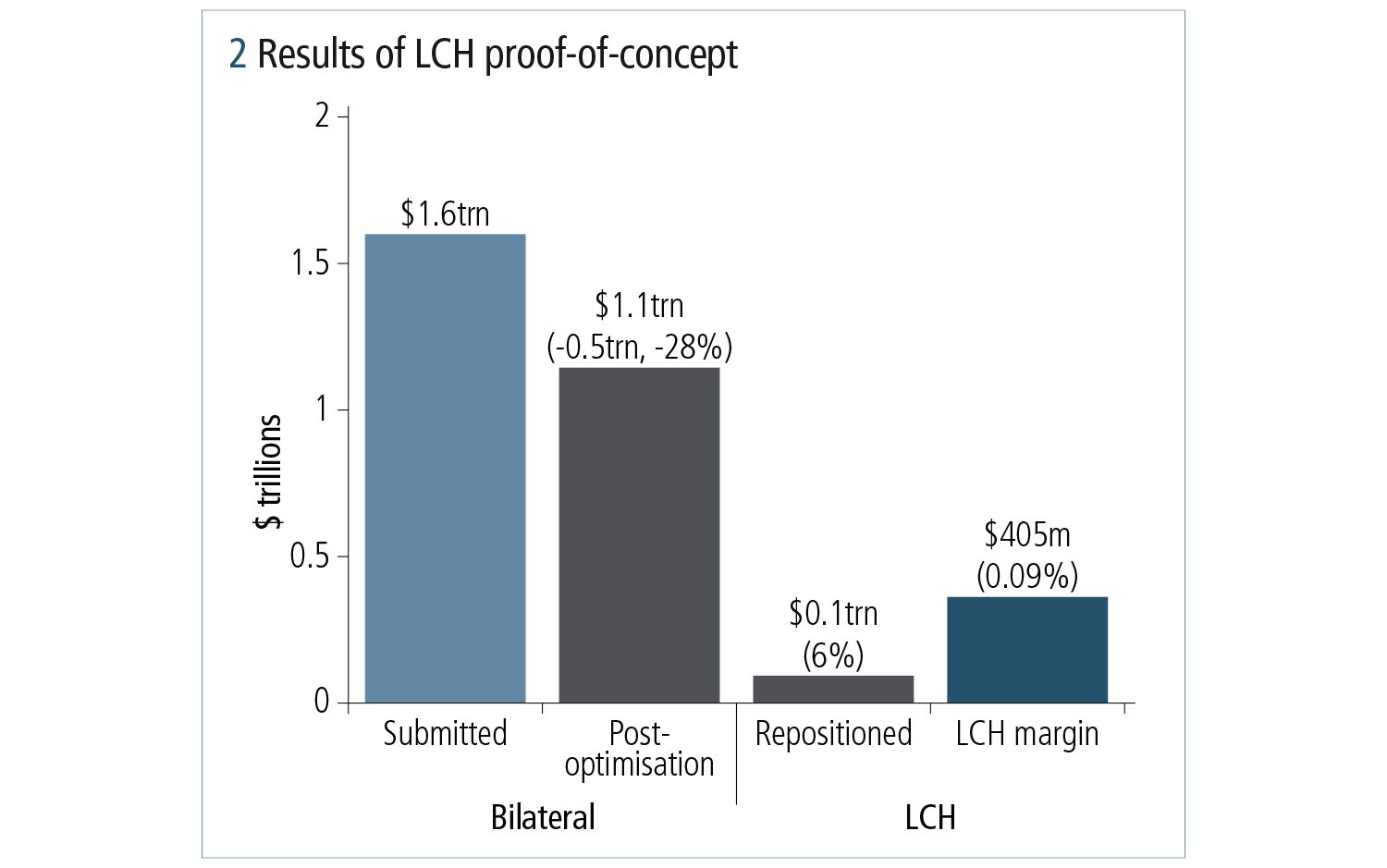

More than 250,000 trades were submitted to the LCH proof-of-concept, with an optimised subset of 45% of submitted trades suggested for clearing. By selecting an optimised subset of existing trades for clearing, LCH was able to demonstrate an analysis that showed substantial reductions in bilateral net notional for the participating banks. In total, net notional was reduced by 28%, with 6% repositioned at LCH, attracting low total margin at the CCP.

The trades selected for clearing represented $6.2 trillion in gross notional, which participants could subsequently reduce by 44% by leveraging LCH’s risk-free compression. Compression provides an additional benefit to clearing deliverable FX forwards and swaps by providing regulatory capital relief to certain LCH members.

These results demonstrated by LCH were well received by the participants, many of whom were excited by the ability to reduce bilateral positions to such a large extent while maintaining low IM at the CCP.

What’s next?

The objective of the proof-of-concept was to demonstrate that clearing of FX forwards and swaps can bring capital benefits while managing margin impact.

LCH will be working closely with the participants in H2 2021 to formalise the analysis into a live run. This will involve designing end-to-end workflows and refining the trade selection and margin calculation algorithm to seek the optimal value for delivering the biggest benefits to participants.

This may extend to other capital metrics, such as the Comprehensive Capital Analysis and Review, and designing a solution that is strategic to the evolution of the FX market – an ecosystem with automation and simplicity at its core, and as close to real-time trade execution as possible.

During this period of design, the architecture of the FX forwards and swaps clearing will be agreed.2 This will present a great opportunity for market participants to get involved or to stay up to date on the latest developments, and we encourage interested parties to get in touch with us to discuss this.

Notes

1. As an exception, counterparties to an uncleared FX forward or swap are required to collect or post variation margin, depending on the type of such counterparties. See Commission Delegated Regulation (EU) 2016/2251 and Commission Delegated Regulation (EU) 2021/236.

2. A final proposal on the solution will be subject to internal and external review/approval.

Sponsored content

Copyright Infopro Digital Limited. All rights reserved.

As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (point 2.4), printing is limited to a single copy.

If you would like to purchase additional rights please email info@risk.net

Copyright Infopro Digital Limited. All rights reserved.

You may share this content using our article tools. As outlined in our terms and conditions, https://www.infopro-digital.com/terms-and-conditions/subscriptions/ (clause 2.4), an Authorised User may only make one copy of the materials for their own personal use. You must also comply with the restrictions in clause 2.5.

If you would like to purchase additional rights please email info@risk.net