Infrastructure

UBS takes $3.4 billion hit

UBS will report losses of Sfr4 billion ($3.4 billion) in its fixed income, rates and currencies division for the third quarter ending September 30. The write-downs were due to legacy positions from Dillon Read Capital Management, an internal hedge fund…

Quants' tail of woe

Liquidations of large quantitative equity portfolios prompted widespread misfiring of hitherto robust quant models. Historically unusual returns volatility and multi-billion-dollar mark-to-market losses ensued. Leading hedge fund managers talk to Jayne…

Capitol mortgage ideas

Government-sponsored Entities

The risk of one

Fund Derivatives

The OTC ambassador

Isda's deputy chief executive, George Handjinicolaou, talks to Alexander Campbell

Building through selling

Real estate

Modelling South African swap spreads

Sponsored Statement

Algorithmic investment strategies

Sponsored Statement

Italian unease

Italy

Carry on trading

Structured products

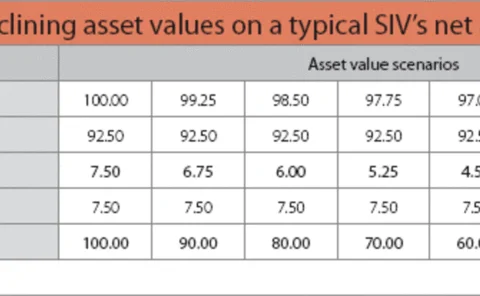

Leaking like a SIV

Structured Finance

US Treasury tells derivatives managers to improve Risk practices

Daily news headlines

Subprime bill deemed “a constructive step”

Daily news headlines

Elsip for Asia

RBS has launched equity-linked structured investor products (Elsip) under its newly built structured investor products programme in Hong Kong, which allows the bank to issue its own branded products through local distributors.

Dealers gain licences to trade HK property derivatives

Five dealers have secured licences to trade residential property derivatives based on the University of Hong Kong real estate index series (HKU-REIS). The firms – Deutsche Bank, Goldman Sachs, Lehman Brothers, Merrill Lynch and Morgan Stanley - join ABN…

Carbon-trading log ready by November

The Kyoto Protocol’s international carbon-trading market is set for expansion, with the introduction of a worldwide transaction log by the end of the year. The International Transaction Log (ITL) will link the carbon registries for each Kyoto nation…

L & G hitches up return rates on Capital Guaranteed Bond

Legal & General has increased the minimum return on its Capital Guaranteed Bond 4. The structured product, launched earlier this year, now offers either 50% of FTSE 100 growth or a return of 30% gross (4.47% AER), whichever is greater, with no cap.

Bank of England and ECB act to boost markets

The Bank of England (BOE) and the European Central Bank (ECB) both left interest rates unchanged, but eased liquidity supply as the credit squeeze continued today.

US regulators encourage loss-mitigation strategies

Six US regulatory agencies have called for more loss-mitigation strategies to prevent homeowner defaults on mortgages. In a joint statement released yesterday they said that all regulated financial institutions that service mortgage loans should take…

Perfect partner?

information technology

Which way is up? - measuring performance

academic paper

A new coal agreement

The ISDA Coal Annex allows market participants to combine physical coal trades and coal derivatives under a single trading agreement. Lauren Teigland-Hunt says this development should improve liquidity in the global coal market